Financial institutions are a major lever for fighting the climate crisis, and regulators in the US, EU, and UK have drafted aggressive new rules calling the industry to stronger action. While 273 of the world’s major asset managers now have net-zero targets, few feel confident that they’re on track to meet either those goals or the avalanche of new disclosure requirements.

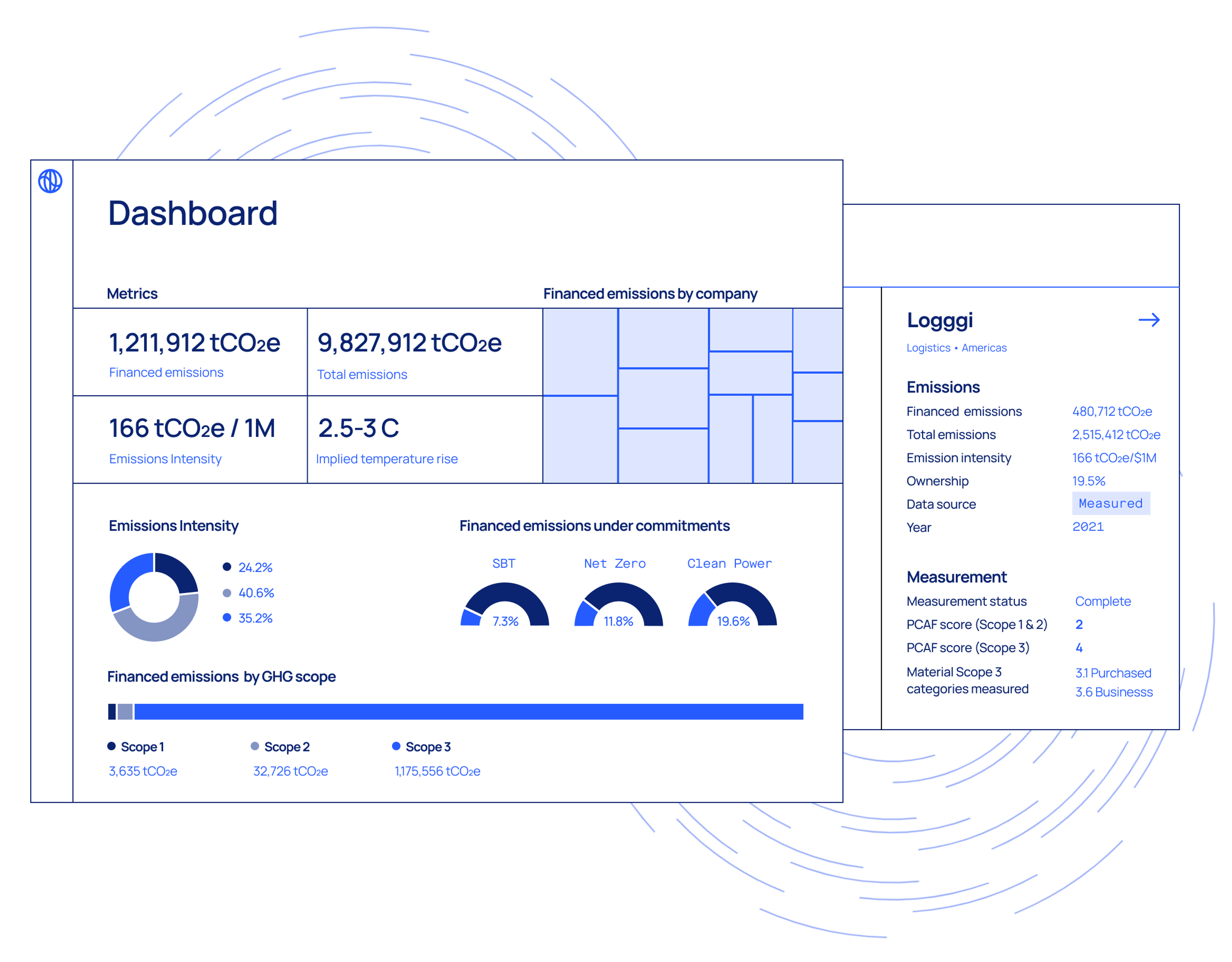

Based on feedback from our initial corporate work with some of the world’s premier investors—like Tiger Global, Fortress, and Baillie Gifford—we’ve built Watershed Finance, a new all-in-one toolbox that provides a comprehensive view of all the carbon within portfolio companies and outlines real pathways to drive emissions to net zero.

About Watershed

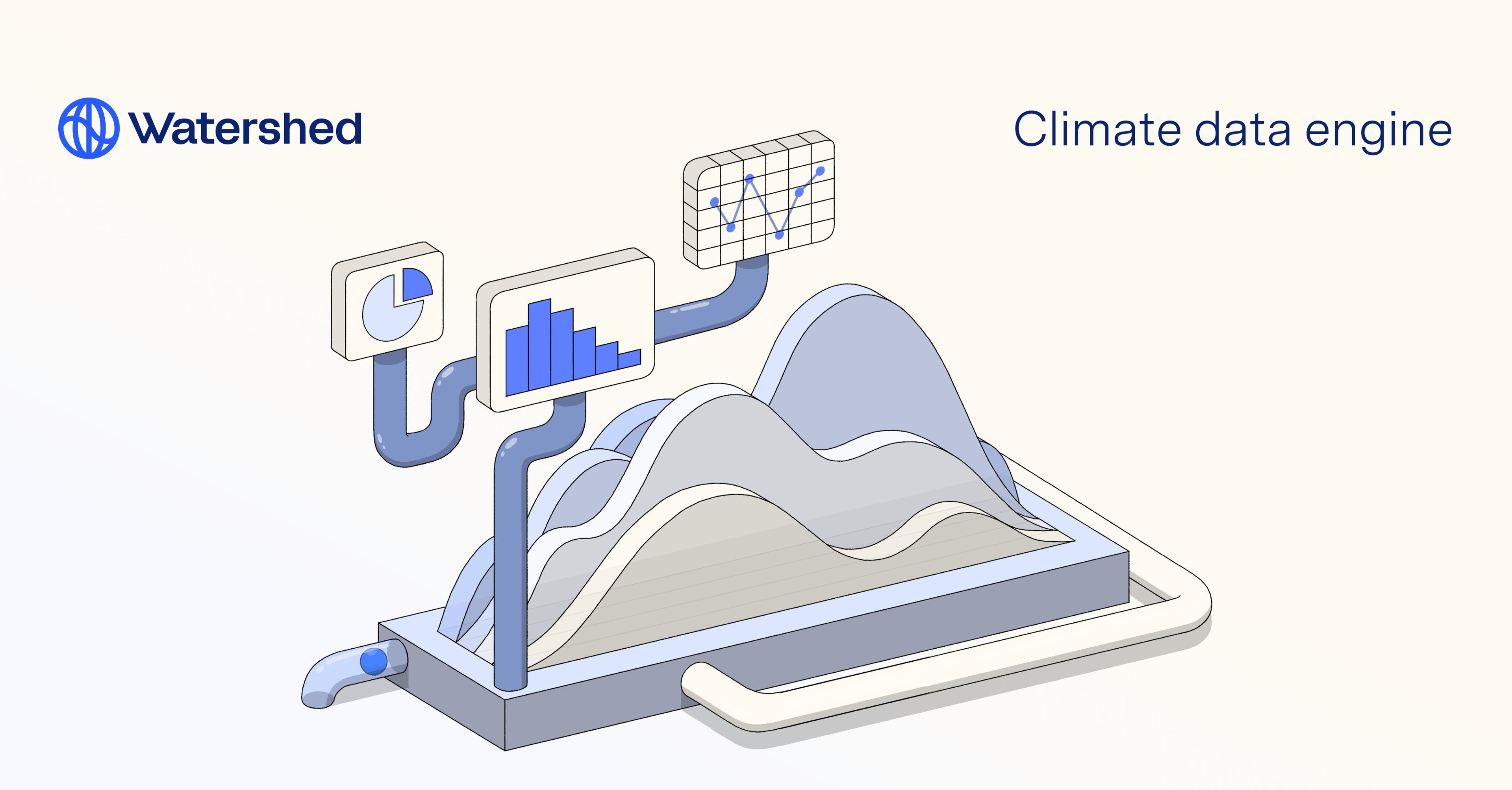

Watershed gives leading companies the tools and expertise they need to get to net zero faster—helping them measure their emissions, decarbonize their supply chains, deploy clean power, support carbon removal, and report on their progress.

Our customers manage 26M tCO2e—equivalent to six times the carbon footprint of San Francisco. The financial firms we work with manage over $14T in assets.

A growing imperative

As regulatory focus on carbon emissions grows, companies and investors face an increasing imperative to act: the SEC is now pushing for both company-level and fund-level emissions disclosure, governments in the EU/UK have already approved comprehensive carbon legislation, and green activism is increasing within both employee ranks and the financial industry itself.

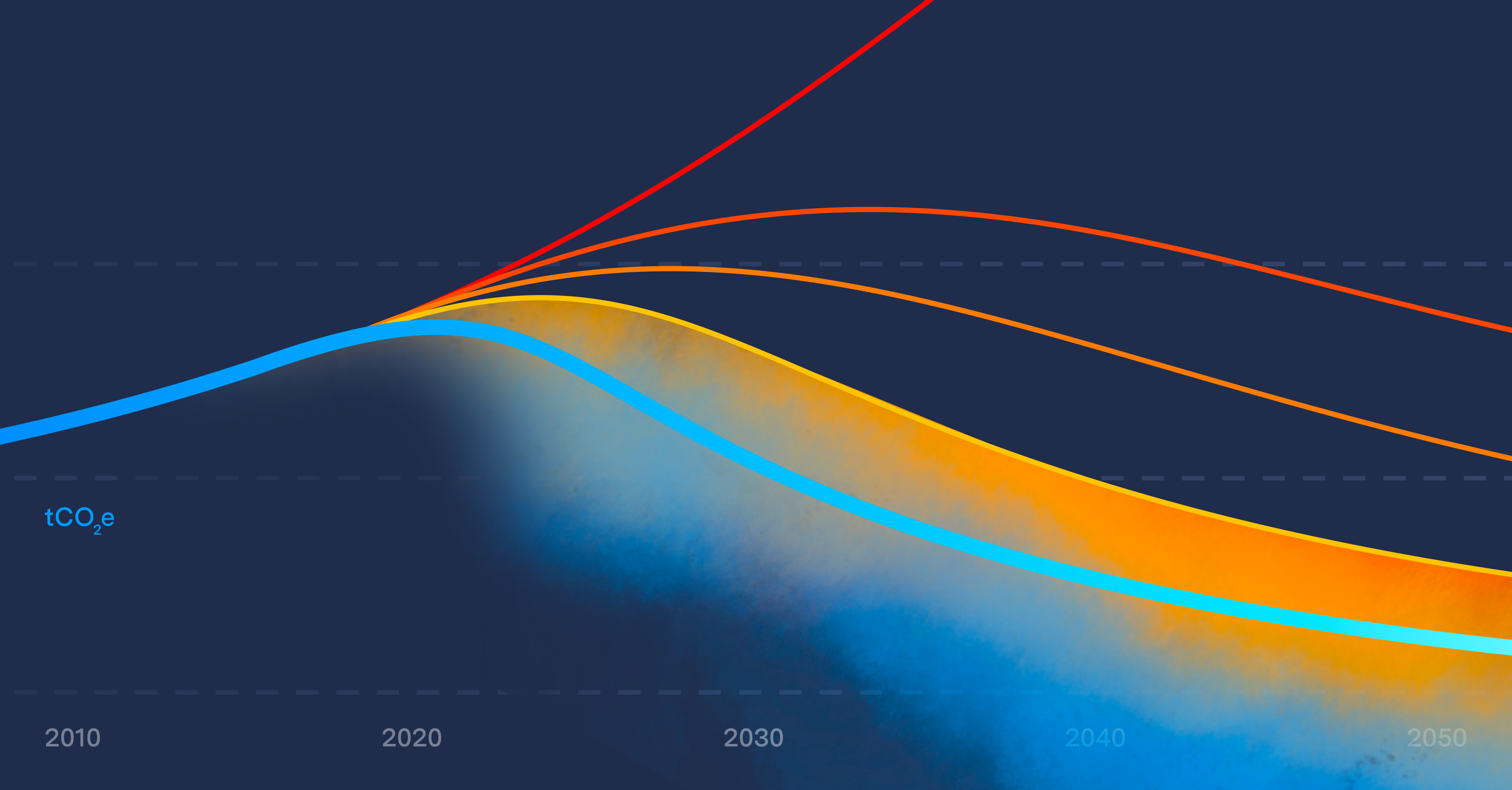

Global finance has responded with big-picture pledges. The Glasgow Financial Alliance for Net Zero (GFANZ) alone represents $130T in private assets committed to global decarbonization. But even GFANZ’s co-founder Mark Carney—who’s also a Watershed advisor—has been clear:

“While there’s been real progress, there are no style points for climate action. It’s a math problem. And we aren’t acting yet on the scale that’s needed.”

— Mark Carney

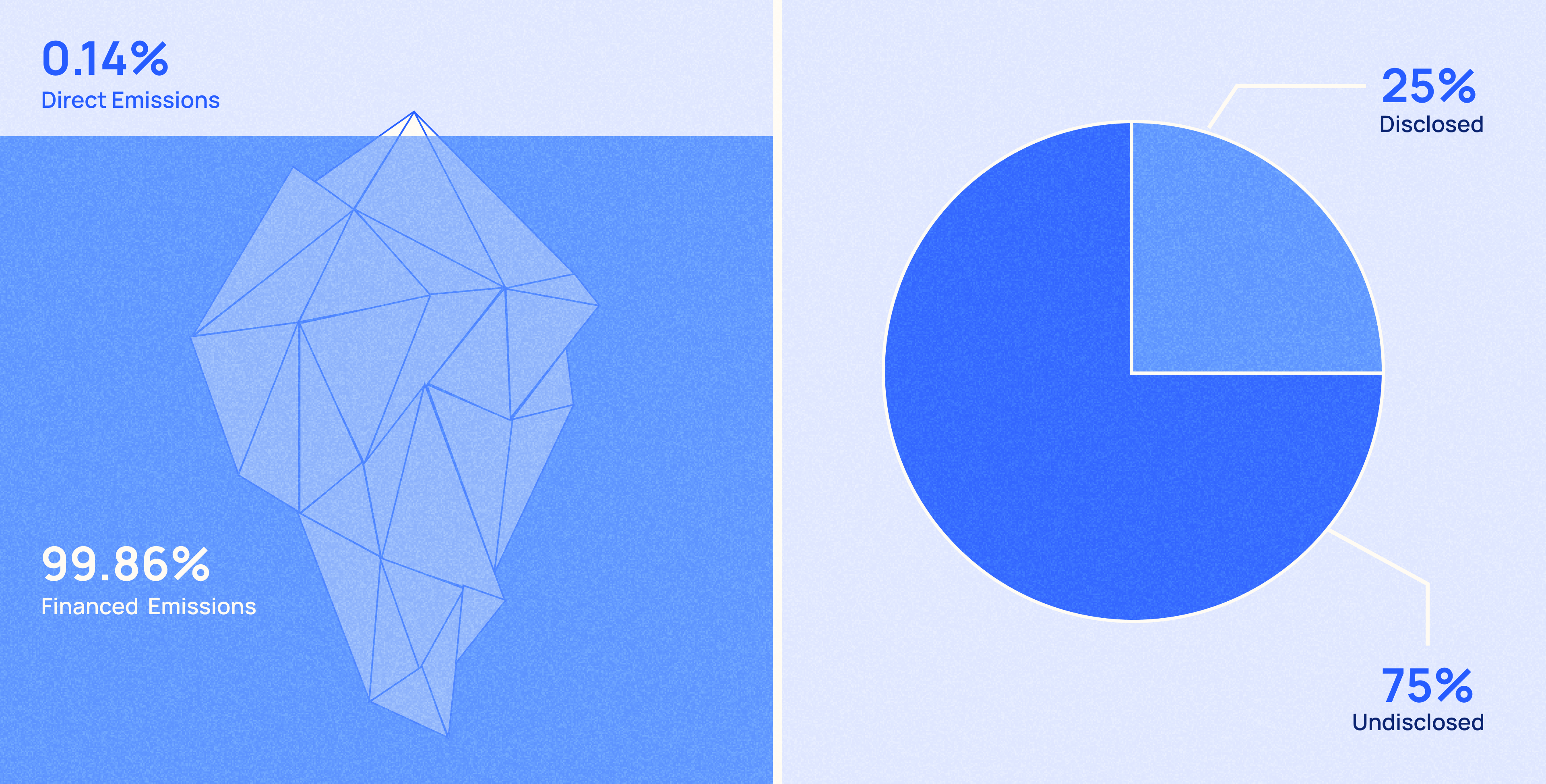

Not only do many net-zero pledges lack concrete pathways, but 75% of asset managers have yet to report the emissions associated with their investing, lending, and underwriting—which are typically 700x higher than their direct emissions.

But increased climate transparency isn’t only about hitting pledges, complying with regulation, future-proofing against stranded assets, or even fighting climate change itself: it’s also just good business. When financial institutions help their portfolio companies measure and reduce carbon emissions, opportunities emerge for both cost savings and new value creation.

X-ray your portfolio, fast

Watershed Finance is a platform for analyzing financed emissions in minutes, using data you already have. You can then identify hotspots, model transition scenarios, build portfolio decarbonization strategies, and generate audit-ready reports—with our network of in-house climate experts available to help you navigate the regulatory landscape. Portfolio companies can also use Watershed directly to launch their own high-impact climate programs and report back to investors.

Speed matters in this fight. To meet our Paris commitments and avoid the worst of climate change, we have just 90 months to cut global emissions by nearly half. If you think Watershed Finance could help accelerate your fund’s efforts, we’d love to chat.