Climate programs are fast becoming standard for companies. Investor pressure is building: BlackRock, the world’s largest asset manager, announced they expect every company to develop a plan for getting to net zero emissions. Climate disclosure is required for large companies in the UK and Europe. Talented employees want to work at companies that are acting on climate. And customers—both consumers and businesses—expect to buy from low-carbon companies.

This is good for business—and it’s critical for the planet. To avert catastrophic climate change, the world needs to halve global greenhouse gas emissions by 2030 and get to net zero by 2050. Companies like Apple, Microsoft, Google, and Square have set targets to get there faster, by 2030, to accelerate the climate solution.

So, where to start? Any company can launch a high-impact climate program in four steps:

- Measure your footprint comprehensively

- Reduce emissions as much as you can

- Get to zero

- Report on progress

Step 1: Measure your footprint—comprehensively.

The first step: figure out where your carbon comes from.

The Greenhouse Gas Protocol is the global standard for carbon accounting—the climate equivalent of GAAP. You’ll find hundreds of PDF pages on their website, but there are two things you really need to know:

The carbon equation

Business activities are your company’s daily actions that cause global warming: your buildings and data centers consume electricity, your employees drive to work, and you purchase products from other companies that emit carbon to produce them. To start measuring your footprint, you collect raw data about this activity—utility bills, purchase orders, travel records, cloud usage reports, and more.

Emissions factors measure how much carbon is emitted for each business activity. At Watershed, we’ve assembled a carbon database from thousands of academic studies, government databases, company reports, and regulatory disclosures. We know that growing a tomato emits 0.65 kg of CO2e, manufacturing a MacBook Pro emits 185, and using a kWh of electricity in Ohio emits 0.6. Our software matches each line item of business activity with the most accurate emissions factor.

Multiply the business activity by the emission factor and you get tonnes of carbon dioxide equivalent, or tCO2e, a measure of your business’s contribution to climate change.

A note on the “e” in tCO2e

Carbon dioxide is the most common greenhouse gas, but it’s not the only one. Methane from cows, nitrous oxide from fertilizers, hydrofluorocarbons from refrigeration, and dozens of other gases also cause global warming. Scientists convert these gases into measures equivalent to a tonne of carbon dioxide for consistent scorekeeping.

To put those numbers in context:

| Emissions | Activity |

|---|---|

| 1 tonne | Producing 35 pounds of beef |

| 18 tonnes | Average American’s carbon footprint for a year |

| 100 tonnes | Driving an average American passenger vehicle 248,139 miles |

| 100,000 tonnes | Annual carbon footprint of 5,500 Americans |

| 5.14 million tonnes | San Francisco’s emissions in 2018 |

| 25.1 million tonnes | Apple’s carbon emissions in 2019 |

Scopes

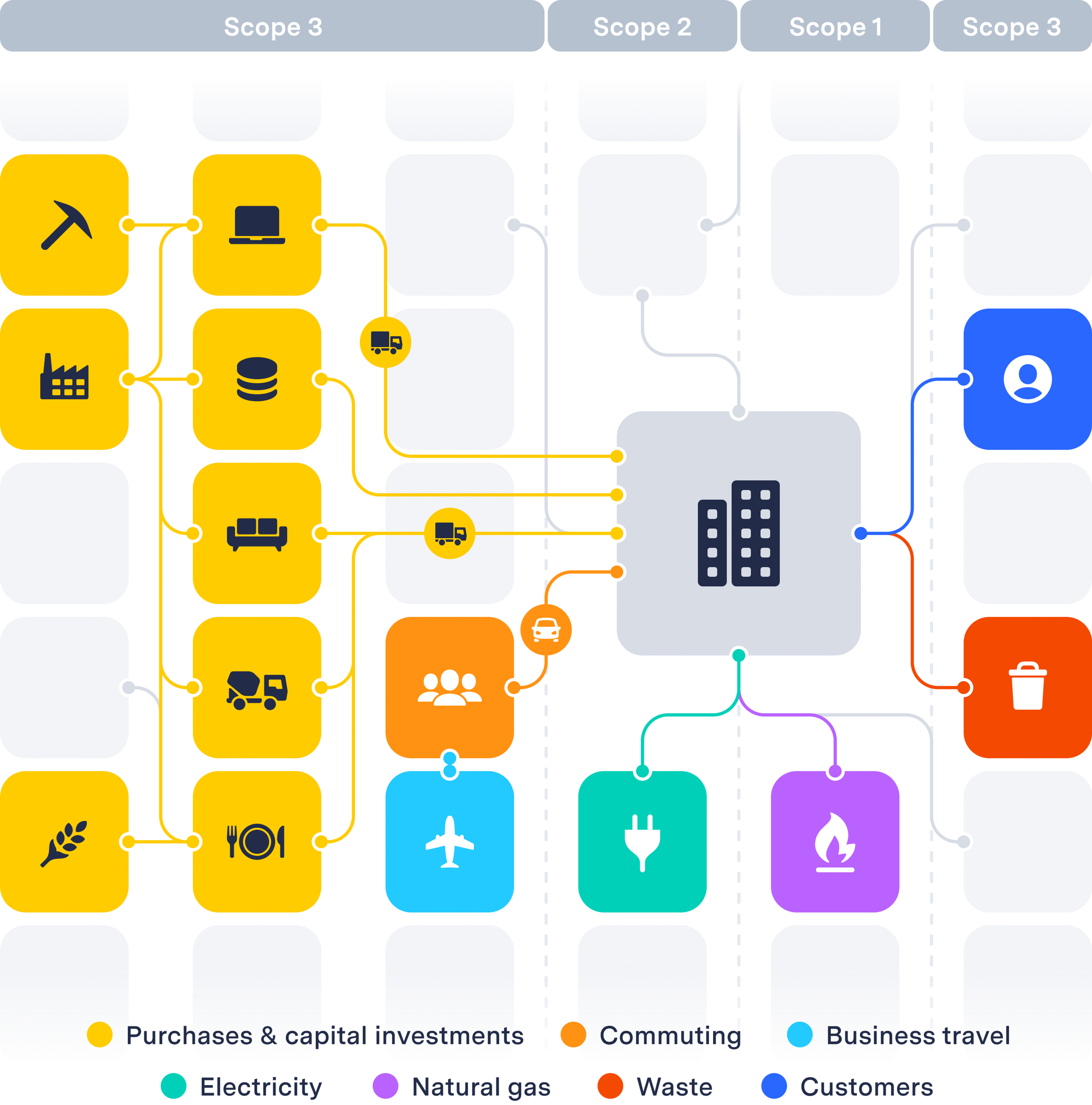

If the carbon equation defines how you count carbon, “scopes” define what you count. The Greenhouse Gas Protocol defines three different scopes, or categories, of emissions:

Scope 1

You own something—a car, a boiler, a smokestack—that directly emits greenhouse gases into the atmosphere. Examples: Burning natural gas to heat a building; driving a company-owned car that burns gasoline.

Scope 2

You purchase electricity, which generated greenhouse gases while being produced (e.g. at a coal or natural gas plant). Examples: Purchasing electricity for your office or warehouse from a local utility.

Scope 3

Everything else. Divided into “upstream” emissions (from the production and transportation of products and services you purchase) and “downstream” emissions (emissions from your customers when they use and dispose of your product).

Examples: Shopify considers the impact of transporting a product from a merchant to a consumer; Square measures the carbon emitted when merchants use electricity to power a Square Register; sweetgreen counts methane emitted producing cheese served in its salads.

Today, companies are expected to measure and report emissions comprehensively, across all three scopes, upstream, downstream, and in your own operations. For most, Scope 3 is the most important piece of the puzzle, because it can account for 80-90% of a company’s footprint. Carbon emitted producing or using your product is your carbon.

This is a profound shift in how companies act on their carbon footprint. It’s no longer enough to measure Scope 1 & 2, buy some offsets, and report those numbers in annual PDF. Companies are taking responsibility for their entire value chain, and driving deep reductions with suppliers and customers.

This can get complicated fast: your carbon footprint is buried in thousands of purchase orders, utility bills, corporate reports, and studies of changing electricity grids around the world. We’ve built Watershed to make it easy to collect data and transform it into a carbon assessment you can act on.

Step 2: Reduce emissions

Every company needs to cut carbon—to keep up with business expectations and help the planet fight climate change. Expectations here are changing. Ten years ago, many companies measured their Scope 1 & 2 footprint, bought carbon offsets, and declared themselves carbon neutral. Today, companies are expected to measure comprehensively, including Scope 3, drive high-impact reductions, and only then think about offsets or carbon removal to get to zero.

The good news: it’s possible. Technology to decarbonize electricity, transportation, agriculture, and industry exists; in many cases, it’s cheaper than the alternative.

Each company’s path will be unique. Our customers use Watershed to execute on a reduction plan customized to their operations. That said, there are a few categories that are generally the highest impact:

Suppliers

For most companies, the vast majority of emissions come from the supply chain: the carbon emitted to produce and move the things you buy from other companies. Flexing your power as a purchaser is your highest-impact path to reducing emissions.

Start by doing an inventory of your vendors, focusing on the ones responsible for the most emissions: how many have climate targets? How ambitious are they? Tell them you care.

If you purchase physical products as part of a supply chain—like electronics or apparel—prioritize vendors who run their facilities with clean power. (Apple publishes a list of its suppliers that have made this commitment.)

When you make major new purchases, add carbon to the RFP. Ask vendors whether they’ve measured their carbon footprint and set targets for reducing it.

This work is fast becoming standard practice for sourcing and procurement teams:

- Software companies are prioritizing carbon in their partnerships with cloud providers like AWS, Google Cloud, and Microsoft Azure. Google Cloud already runs its data centers on 100% renewable energy. Microsoft and Amazon are fast behind; in the meantime, choosing a region that runs on a low-carbon electricity grid (like AWS’s us-west-2 in hydro-powered Oregon) can dramatically reduce emissions versus a dirty grid (like us-east-2 in coal-heavy Virginia).

- Many companies are making carbon disclosure a requirement for all vendors. Microsoft added it to its Supplier Code of Conduct, and we expect other companies to follow suit.

- Sweetgreen is working with top suppliers to measure their emissions. It turns out that different practices—fertilizer and irrigation for avocados, feed for poultry, and how dairy manure is handled—make a big difference. Sweetgreen will use this data to make sourcing decisions as part of its food ethos.

Watershed makes it easy to design your supply chain around carbon: analyze the carbon of your current suppliers, and track their progress towards their goals.

Clean power

Power your buildings with zero-carbon electricity, like solar and wind. These technologies are now the lowest-cost source of energy almost everywhere in the world. But we need to accelerate their deployment so the entire electricity grid is carbon-free.

Businesses can make this happen by choosing to buy clean power—by opting in to programs offered by local utilities (like CleanPowerSF), purchasing Renewable Energy Certificates (REC’s), participating in long-term Power Purchase Agreements (PPA’s) directly with developers of solar and wind projects, or installing solar panels on their roofs.

The right approach will depend on your company and your location. As you navigate your options, the key question is: are you adding new clean power to the grid? Or paying for clean power that would have been deployed anyway?

Low-carbon workplace

COVID has scrambled the workplace forever. As we emerge from the pandemic, every company will design a new model for work, with a new mix of shared office space, remote work, commuting, and business travel.

These decisions are a rare opportunity to reset our approach to work in a way that cuts carbon. But it’s more nuanced than meets the eye. Remote work doesn’t eliminate workplace emissions; it shifts them—from a central office to a network of millions of homes. Less commuting reduces emissions, but employees moving from cities to suburbs increases them.

Climate leaders are designing their new distributed workplaces to be zero carbon:

- Reduce commute. Encourage remote work and incentivize commuters to walk, bike, or take public transit.

- Clean power for remote workers. Support employees in upgrading to clean power for their homes, to ensure your distributed office runs on zero-carbon electricity.

- Reduce business travel. COVID has taught us that you don’t have to jump on a plane to work together. Air travel is responsible for 2% of global emissions, so locking in these learnings can have a huge impact. Set new guidelines for what travel is appropriate or charge a carbon price for flights.

- Low-carbon buildings. Building a building—materials, furnishings, construction, and remodeling—can emit more carbon than operating. When you move into a new space, use sustainable materials like CarbonCure cement.

Build climate into your product

Once you've reduced carbon within your operations and supply chain, think about your other spheres of influence. Many companies can accelerate decarbonization by designing their products in a way that helps customers cut carbon. Some examples:

- Square helps millions of Cash App customers purchase Bitcoin, and started the $10M Bitcoin Clean Energy Initiative to deploy renewable energy for Bitcoin mining.

- Stripe is encouraging millions of internet businesses to direct part of their revenue towards carbon removal.

- Shopify offset shipping emissions for millions of shipments on Black Friday and Cyber Monday.

Get to zero

After reducing emissions as much as possible, many companies choose to go a step further—to fund projects that eliminate whatever emissions remain. After all, the world’s goal is to get to zero emissions by 2050, and investors like BlackRock expect every company to have a plan for doing the same. There are two paths:

- Offsets. Fund traditional offset projects that pay others not to pollute. For example, you can pay landowners to prevent destruction of forests, or fertilizer plants to destroy nitrous oxide before it’s released.

- Carbon removal. To get to zero carbon, it’s not enough to prevent emissions. We need to remove the greenhouse gases that remain in the atmosphere. There are two paths: “natural” solutions that sequester carbon in trees and soils, and new technologies like direct air capture. The world needs both—now—but they’re expensive and small-scale today. Companies have a crucial role to play in creating predictable demand for these approaches.

Different companies use different labels to describe their carbon target. A note on the different targets and what they mean:

- Carbon neutral. Companies that commit to buy enough offsets to compensate for their carbon footprint are “carbon neutral.” These companies generally buy offsets that prevent emissions that otherwise would have happened, not remove carbon from the atmosphere.

- Net zero. Companies that set net zero targets commit to deeply reducing their footprint, then funding enough carbon removal for the emissions that remain. Companies generally pick a year in the future to achieve net zero: Amazon is aiming for 2040; Microsoft, Apple, and Square are getting there by 2030. This is an exciting new standard and is seen as more ambitious than carbon neutrality.

- Science Based Target. The Science Based Targets initiative (SBTi) is an independent organization that verifies corporate plans for carbon reduction. Companies that set an SBT commit to reducing their emissions in line with what science says is necessary for the entire world to get to net zero by 2050. (Reduction pathways vary depending on the size and sector of the company.) SBT runs a process to validate that plans are ambitious and credible.

Report on progress

Share your progress with employees, customers, and investors.

Share with employees. Tell your team about your targets and progress. Encourage them to get involved. Your company will only succeed in reducing emissions if many teams chip in—from building operations to procurement to engineering. Give them the data so they can own the solution.

Share what you’ve learned with other companies. Publish a regular report on your climate program. This can be a PDF on investor day or a tweet. Share what you’ve learned, hold yourself accountable, and encourage other companies to follow suit. The more detail the better.

The acronyms. There’s a burgeoning universe of climate standards and raters. The new standard for public companies is to publish a TCFD report and submit it to CDP every year.

Some tips on the acronyms that matter:

- GHG Protocol. the global standard for calculating a company’s carbon emissions.

- TCFD. Task Force on Climate-related Financial Disclosure. Standard for reporting your risk exposure to the impacts of climate change, carbon emissions, and plan for reducing emissions to investors. Fast becoming the de facto standard. The UK government will require TCFD reporting from large companies beginning in 2025.

- CDP. Clearinghouse for carbon disclosures from thousands of companies.

- SASB. A set of industry-specific standards for disclosing your sustainability impact to investors. These standards are broader than climate, covering topics from water to diversity. The core concept is “materiality”—what issues matter for your business?

- GRI. More than a dozen standards for disclosure on environmental, economic, and social issues. GRI 305 sets standards for reporting carbon emissions, based on the GHG Protocol guidelines. Particularly common for European companies.

- SBT. Science Based Targets. Encourages companies to set targets to reduce their emissions in line with what science tells us is required to achieve net zero carbon by 2050. Companies submit their carbon reduction plans to SBT for approval.

Conclusion

This is a turning point for corporate action on climate. Expectations from investors, customers, regulators, and employees means that it’s a smart business decision to launch a climate program. New tools are making it easy to take action that is genuinely impactful, fast: companies are launching industry-leading programs from scratch in weeks, not years. And, most importantly, this matters. The world has less than a decade to halve carbon emissions, and we need leadership from companies to get there.