The upcoming Securities and Exchange Commission (SEC)’s climate disclosure rule in the US and the recently-finalized Corporate Sustainability Reporting Directive (CSRD) in Europe both require mandatory carbon footprint disclosures from most large companies. Under these regulations, footprint data will be disclosed alongside financial statements, and must be treated with the same level of rigor.

Under the SEC rule as it’s currently written, large public filers will be required to provide—with attestation—limited assurance on the accuracy and completeness of their scope 1 and 2 emissions starting in 2024, followed by reasonable assurance in 2026 and beyond. Assurance is an assessment of the quality from a third-party auditor, and attestation refers to the auditor’s sign-off on the assurance findings.

Here, “limited” and “reasonable” follow the same distinction used in financial accounting and are a matter of depth: limited assurance tests a small sample, while reasonable assurance goes deep across the data review process. CSRD disclosures will also require auditing.

As we move toward more standardized and mandatory reporting on climate, high-quality carbon accounting is critical to business success. Companies will need to treat climate data with the same precision as financial data.

Successfully doing this starts with implementing strong internal controls: measures that ensure data accuracy, completeness, validity, and security. It also requires quality data governance—an overall management framework for climate data and the measurement process.

This guide is our blueprint for navigating the challenges many organizations face when they take this on, with a focus on how companies can maintain audit-ready rigor throughout the emissions measurement process.

Challenge 1: Complex data sources

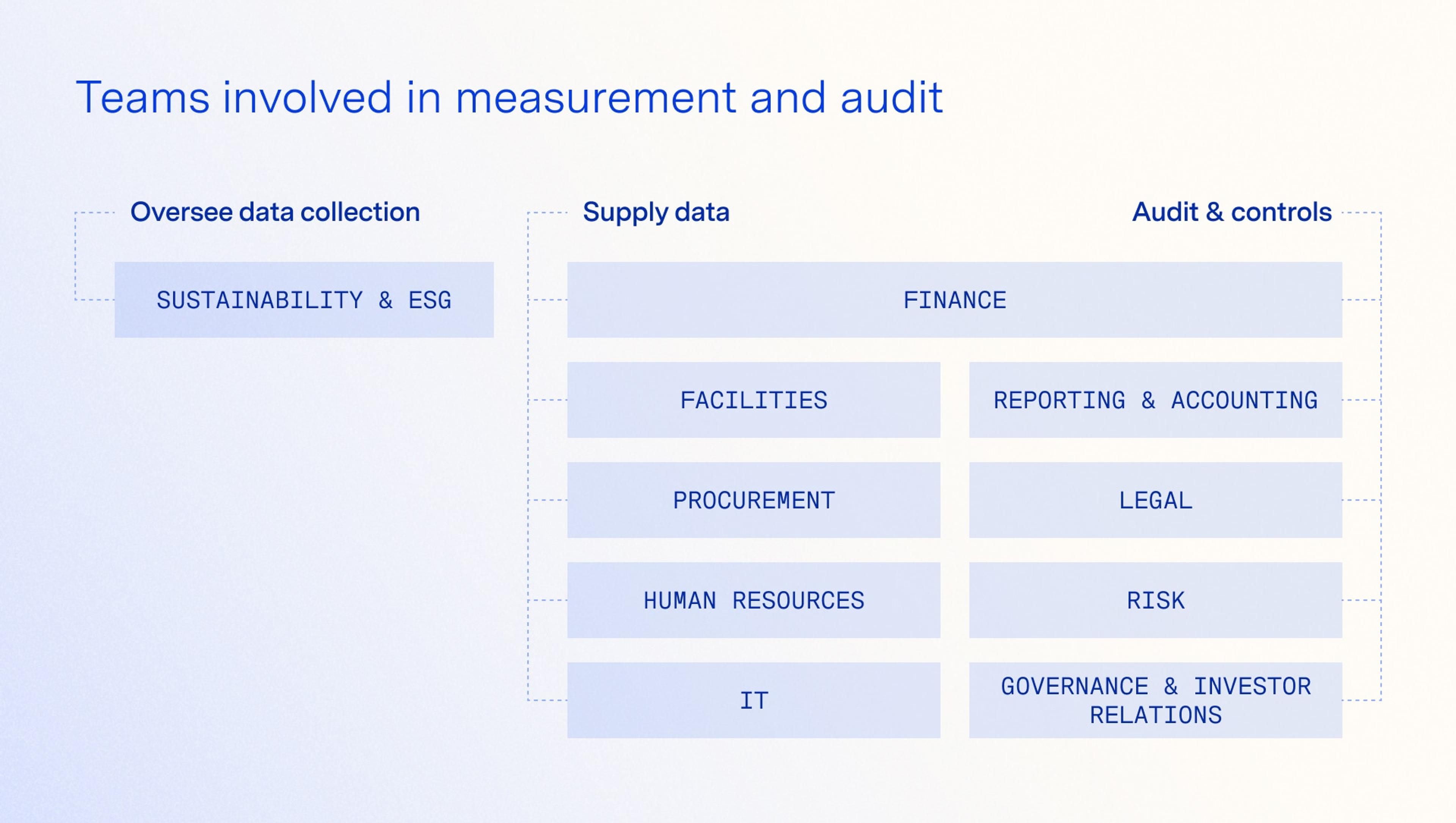

Carbon accounting relies on a multitude of data sources from teams across a company, including facilities, human resources, and finance. Some of these sources require manual data collection, which can make setting up control systems a difficult task.

There are three common ways to collect data from multiple sources:

- CSV exports provide a more straightforward data import option, but are prone to formatting inconsistencies and lack an export paper trail between systems, leading to gaps in control.

- Manually collected data is time-consuming and labor-intensive, but can be unavoidable for unique datasets like utility bills. Like with CSV exports, a comprehensive audit trail is often missing, making it difficult to create robust process controls.

- Integration—a way to give direct access to your data and automate updates going forward—offers end-to-end control and reduced risk of errors. It can be more complex to set up, but using a software platform reduces the set-up barrier, allowing your business to benefit from more control, accuracy, and traceability in data collection.

Challenge 2: Implementing and testing internal controls

Companies must establish a systematic process for implementing and testing internal controls over carbon accounting, focusing on four key components:

- Risk assessment: Identify the key risks associated with the carbon accounting process, such as data inaccuracies, estimation uncertainties, and non-compliance with regulatory requirements.

- Control design: Design and implement control activities to mitigate the identified risks. These could include automated data checks, reconciliation procedures, review and approval workflows, and segregation of duties.

- Control testing: Regularly test the effectiveness of the internal controls, including walkthroughs, inspections, and inquiry-based procedures. This helps organizations identify potential weaknesses and areas for improvement.

- Monitor and report: Establish a continuous monitoring process to track the performance of the internal controls, and report the results to relevant stakeholders, such as the audit committee and senior management.

Challenge 3: Meeting tough external audit deadlines

The reporting deadlines for carbon accounting, as set by the SEC and CSRD, will determine the timeline for external audits of an organization's carbon footprint. Some helpful strategies to have your reports ready and data audited in time include:

- Synchronizing your carbon accounting processes with your financial reporting cycles.

- Setting earlier deadlines for collecting and validating carbon emissions data. This allows sufficient time for internal audit and control testing.

- Aligning with your financial auditor today to get a sense of their future capacity for additional verification, given demand for auditors will increase as more regulations require verification and attestation.

How to meet these challenges and prepare your climate program for audits:

Implement climate software with enterprise-grade features

Powerful enterprise-grade features can make or break the integrity of your data, your governance processes, and stakeholder collaboration. Look for these features:

- Intuitive design with collaboration features and fine-grained access controls: Users can easily upload data onto the platform and include any unique context needed to process it.

- Ingest data from your system of record: Direct integration enables you to remove manual data export from your measurement process to greatly reduce the chance of human error.

- Audit trails: Detailed logs of all data uploads, transformations, and assumptions to provide full transparency for your internal and external auditors.

- Anomaly detection: Automatic detection of data anomalies to validate ingested data and ensure accuracy, plus the ability to review data with subject matter experts and approve it before incorporating it into your measurement.

Prepare for what’s next

While preparing for audit and disclosure can be daunting, a holistic approach will enable you to take the next step: climate action. A comprehensive platform will produce a measurement that’s granular and accurate enough to drive strategic business decisions.

By addressing the challenges of data complexity, meeting the growing demand for rigor, fostering cross-functional collaboration, and carefully planning the implementation and testing of internal controls, you can position your business for success in this new era of carbon accounting.

In doing so, you’ll address regulatory requirements in tandem with advancing efforts to reduce greenhouse gas emissions and mitigate climate change. If Watershed can help you take these steps, get in touch.