This update brings more climate disclosure news out of Sacramento and Brussels.

In California, CARB—the regulator in charge of implementing California’s climate disclosure laws—released new guidance for SB 261 and SB 253 compliance. Meanwhile, the Ninth Circuit Court of Appeals has temporarily paused implementation of SB 261, the climate risk disclosure law, pending a hearing on January 9, 2026.

In Brussels, the European Parliament adopted its position on the Omnibus Directive, clearing the path for trilogue negotiations that will shape CSRD and CS3D reforms through 2026.

Below, we break down what companies need to know.

California: Outputs from CARB’s third implementation workshop

CARB—the regulator implementing California’s climate disclosure laws—held its third public workshop on November 18, 2025, delivering the clearest guidance yet on how companies should prepare to comply with SB 253 and SB 261. Alongside slides of the workshop, CARB also provided an updated FAQ and a finalized Climate-Related Financial Risk Report Checklist. Together, these updates give companies a more concrete view of what to expect in 2026.

Key updates (read our full guide here)

For SB 253 (scope 1-3 emissions disclosure), updates include:

- Updated timeline: A first-year reporting deadline of August 10, 2026

- First year flexibility: Companies required to “give what [they] have on hand” in the first year, with limited assurance not required

- Reporting template optional: Companies can use CARB’s template if helpful, or provide any report that includes scope 1 and 2 emissions in the first year

- Clarity on which year’s data to use: Companies with FY ending Jan 1–Feb 1, 2026 report FY26 data; companies closing after Feb 1 report FY25 data

For SB 261 (climate risk disclosure), updates include:

- A finalized Climate Risk Report Checklist

- Expanded report FAQ

- Clarified submission process: Companies must post their risk reports on their company website by the deadline (originally January 1, 2026, though currently stayed until the court reviews the case on January 9, 2026—see more below), and post a link to a public docket hosted by CARB

Other updates included:

- Updated definitions of “revenue,” “doing business,” and “parent/subsidiary”

- Clarity on which fiscal year data to use

- Expanded proposed exemptions, including for non-profit and charitable organizations and companies whose only California presence is teleworking employees

- Clarified fee structure

Read our full guide to the workshop and the latest updates here.

What’s next? CARB will release the Notice of Proposed Rulemaking (NPRM) for the initial regulation in the coming weeks, with a Board vote planned for Q1 2026.

CARB also opened a consultation for scope 3 measurement, inviting feedback on which scope 3 categories companies use most, or are most useful for customers and investors, ahead of scope 3 disclosure deadlines in 2027.

Key takeaway: In-scope companies should proceed with preparing their SB 261 reports ahead of the January deadline, and begin collecting data for SB 253’s August deadline. Watershed can help; reach out for questions, measurement, report preparation, and more.

California: SB 261 implementation temporarily paused

The Ninth Circuit Court of Appeals has temporarily paused enforcement of California’s climate risk disclosure law, SB 261, while it reviews a legal challenge by the US Chamber of Commerce. This does not decide the case but delays implementation until the court’s review, with a hearing set for January 9, 2026. SB 253 is not paused, with first reports due August 10, 2026.

We covered what this means for companies in a live webinar with Ropes & Gray’s Michael Littenberg. You can watch that recording here.

Key takeaway: Companies should continue to prepare for SB 261 and SB 253 compliance.

European Parliament adopts Omnibus position; trilogue begins

After weeks of negotiations, the European Parliament adopted its formal position on the sustainability Omnibus, the legislative package revising the CSRD and CSDDD. The vote follows a failed compromise last month, when a centrist agreement brokered by the EPP and center-left parties collapsed in a secret ballot. This week, the EPP rebuilt a majority by securing support from two right-leaning groups (ECR and PfE), allowing the Parliament to finalize its stance ahead of trilogue negotiations.

What’s in the Parliament’s position?

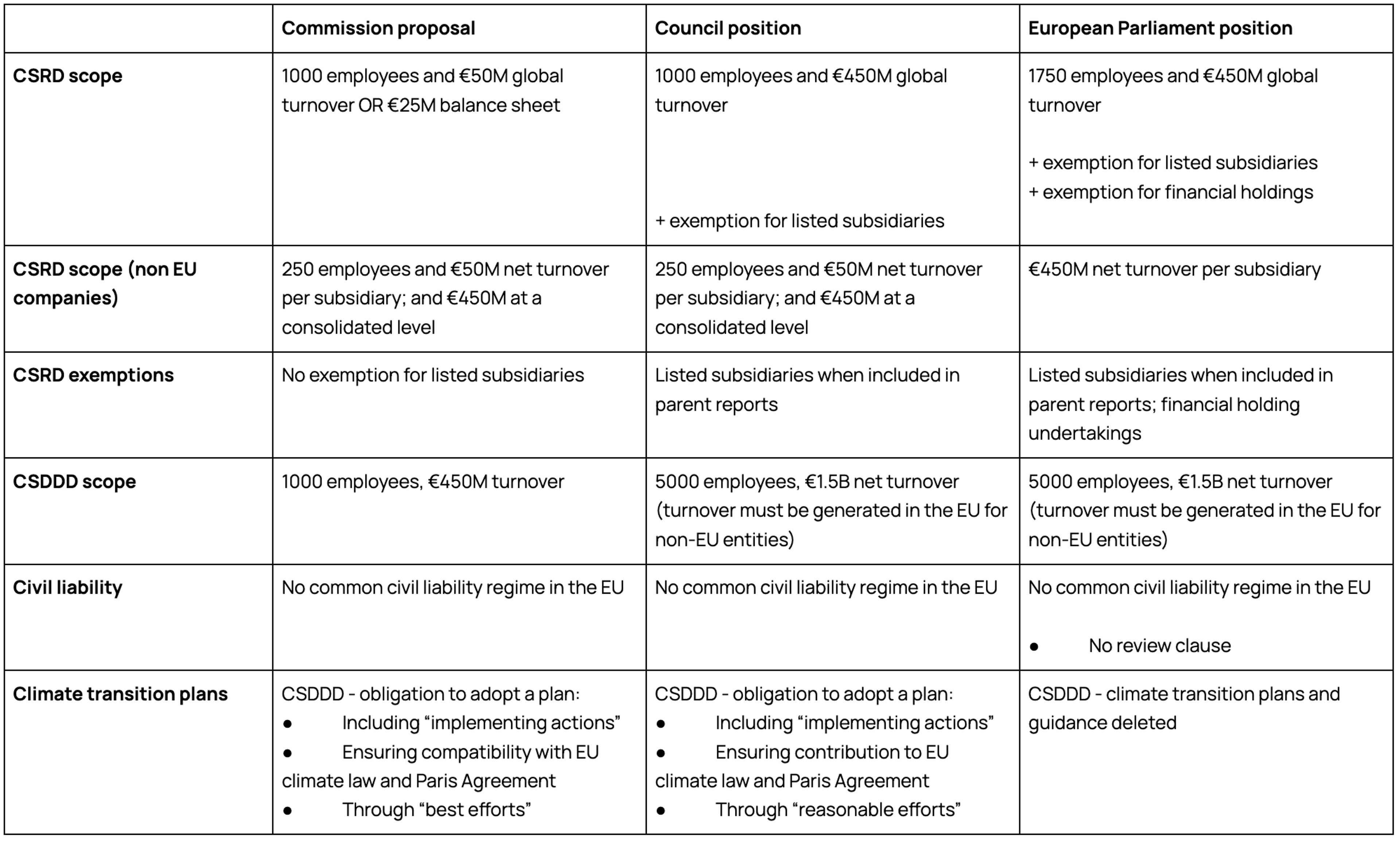

- CSRD scope: The Parliament supports applying CSRD to EU entities with more than 1,750 employees and €450 million turnover—aligned with the Council, but narrower than the Commission’s original proposal (1,000 employees and €50 million turnover).

- CS3D scope: The threshold for due diligence obligations is set at 5,000 employees and €1.5 billion turnover, again consistent with the Council’s proposal.

- Transition plans: In a significant shift, the proposal removed mandatory climate transition plan requirements from the due diligence directive, in contrast to the Council and Commission’s positions.

- Non-EU companies: The Parliament retained the 2029 timeline for standalone reporting by non-EU parent companies, with 2028 remaining the first year of reporting for in-scope subsidiaries.

With the Parliament’s position decided, here are the respective positions of each governing body ahead of negotiations:

What’s next? Trilogues between the Parliament, Council, and Commission started this week, with negotiators hoping for a political agreement before year-end.

Key takeaway: The direction is clear: simplification and narrower scope remain the dominant themes, but the final thresholds and transition plan requirements will be decided in the coming weeks.