What is ISSB?

The International Sustainability Standards Board (ISSB) is an international standards-setting body backed by economic cooperation forums, including the G7, G20, and the International Organization of Securities Commissions (IOSCO). ISSB was created by the International Financial Reporting Standards Foundation (IFRS), the nonprofit responsible for developing modern global accounting standards, and ISSB’s mandate is to develop a global baseline of sustainability disclosure standards, starting with climate-focused disclosures.

Why was ISSB developed?

Prior to the establishment of ISSB, global climate and sustainability reporting was inconsistent, fragmented and costly. While the TCFD reporting framework served as a useful reporting baseline for many companies, investors, companies, and international policymakers needed a common set of disclosure rules that made information easily comparable and useful for decision-making.

In June 2023, ISSB released its first two reporting standards, known as IFRS S1 and IFRS S2, making it simpler for companies to report climate and sustainability information in their financial statements. The standards are efficient, consistent, comparable, and verifiable, and as a result, they make it easier for investors to evaluate a company’s climate and sustainability practices, as well as its strategic approach to the transition to net zero, and thus make better investment decisions. Alongside the dedicated climate reporting standard (S2), the ISSB is currently deciding which topic-specific standards to release next, such as biodiversity. Long term, the ISSB framework will have dedicated standards for all topics under the ESG umbrella.

Which companies are subject to ISSB reporting?

ISSB has been designed to be applicable to any company, but reporting requirements will depend on a company’s size, scope, and the jurisdiction(s) in which it operates. Currently, ISSB reporting is not mandatory; however, companies may choose to adopt the reporting in response to pressure from investors and the broader community. Companies have been free to voluntarily use the ISSB framework for reporting, from the start of 2024.

Sustainability disclosure regulations for some companies in countries including the UK, Singapore, Australia, Canada, and Japan will be based on ISSB standards. The precise way in which countries apply ISSB and the reporting deadlines for companies will vary, but these countries could require reporting as early as 2025. Typically the companies in scope are publicly traded, but in some cases (like the UK) the rules will also apply to larger private companies. Irrespective of precise reporting deadlines, it’s good practice to test-run reporting using the framework before your first year of required reporting, so many companies are already utilizing the framework this year.

The standards offer a helpful framework for companies to disclose on sustainability matters such as risks and opportunities. Adopting the standards makes sustainability reporting more transparent and consistent, boosting public confidence in your company’s climate and sustainability disclosures.

If you do business with a network of third parties, adopting ISSB standards can help you:

- Assess and vet third parties based on sustainability and climate factors

- Streamline data collection and ensure more consistent reporting across multiple jurisdictions

- Collaborate with third parties to address their risks and opportunities

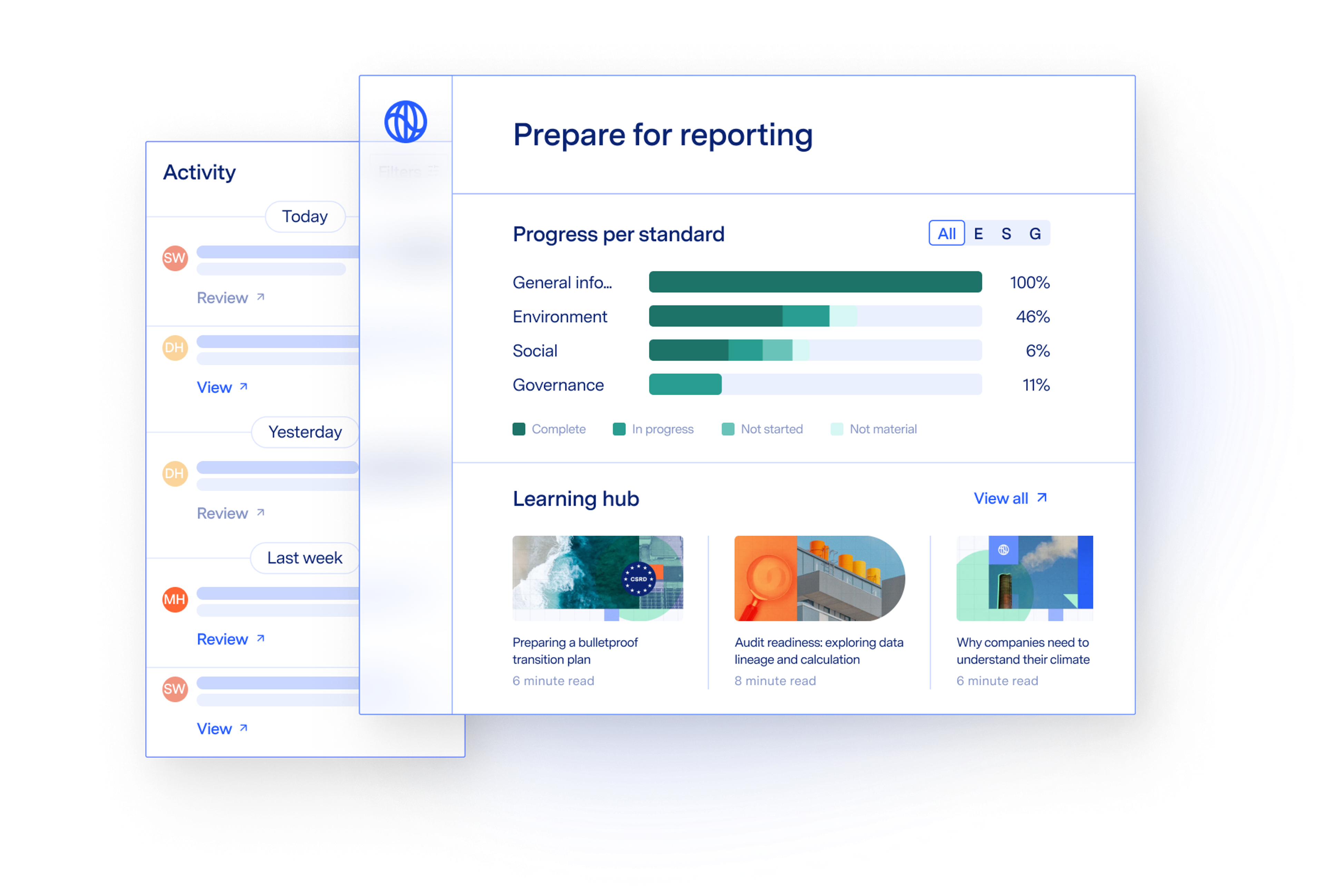

What will my company need to report under ISSB?

Companies that choose to use ISSB for their reporting now will need to report on the topics included under the first two standards: IFRS S1 (General Requirements for Disclosure of Sustainability-related Financial Information) and IRFS S2 (Climate-related Disclosures). In the first year a company applies ISSB standards, it can choose to report only on climate-related matters. In the company’s second year of reporting, it will need to report on all sustainability-related risks and opportunities.

IFRS S1 and IFRS S2 focus on similar disclosure topics, but their goals are different. IFRS S1 is focused on general sustainability disclosures, and IFRS S2 builds on these with climate-specific requirements. Both standards’ disclosure topics can be divided into four content areas: governance, strategy, risk management, and metrics and targets. These areas are consistent with the Task Force on Climate-Related Financial Disclosures (TCFD) framework, but the key topics differ. The TCFD has actually been absorbed by the ISSB, and while the TCFD is still available for companies to use, they should think of the ISSB framework as the new, higher quality baseline for reporting.

Key disclosure topics

|

Governance | Process and procedures to monitor and manage sustainability risks and the opportunities identified | Process and procedures to monitor and manage sustainability risks and the opportunities identified |

Strategy | Approach to sustainability risks and opportunities that could impact business models over the short, medium, and long term | Approach to climate-related risks and opportunities that could impact business models over the short, medium, and long term |

Risk management | Internal processes to identify, measure, and manage sustainability risks | Internal processes to identify, measure, and manage climate-related risks (both physical and transition risks) |

Metrics and targets | Assess, manage, and monitor sustainability risks and opportunities | Scope 1-3 GHG emissions Industry-based metrics or other established metrics to assess processes on targets |

ISSB reporting will be connected to a company’s financial statements, so companies will need processes and controls in place in order to provide sustainability reports at the same time and of the same quality as their financial statements.

How does ISSB relate to other disclosure frameworks?

ISSB builds on the following investor-focused reporting initiatives:

- Climate Disclosure Standards Board (CDSB)

- Task Force on Climate-Related Financial Disclosures (TCFD)

- Value Reporting Foundation's (VRF) integrated reporting framework

- Industry-based Sustainability Accounting Standards Board (SASB) standards

- World Economic Forum’s Stakeholder Capitalism Metrics

The goal is to create a global baseline of “sustainability-related financial disclosures” that focus on the information needs of investors and connect with information in a company’s financial statements.

Existing global standards and disclosure frameworks have one of three relationships with ISSB:

- They will formally consolidate with ISSB and will no longer exist independently.

This includes CDSB and the VRF (which SASB and the International Integrated Reporting Council (IIRC) merged into). - They will collaborate with ISSB to align climate-related disclosures.

This includes most national disclosure programs including CDP (formerly known as the Carbon Disclosure Project), which incorporated ISSB at the beginning of 2024. - They are the foundation for ISSB and will now exist as a stepping stone.

This mainly applies to TCFD. ISSB adopts TCFD’s four pillars focused on climate disclosure and will gradually apply them to other areas of sustainability like water, waste, and biodiversity—while also asking for additional data and analysis on climate items.

The big picture: ISSB is taking over from TCFD as the new global reporting baseline for companies. By merging TCFD (a general framework) with more industry specific frameworks such as SASB, it gives companies one, rather than many standards to report against, an evolution not a revolution.