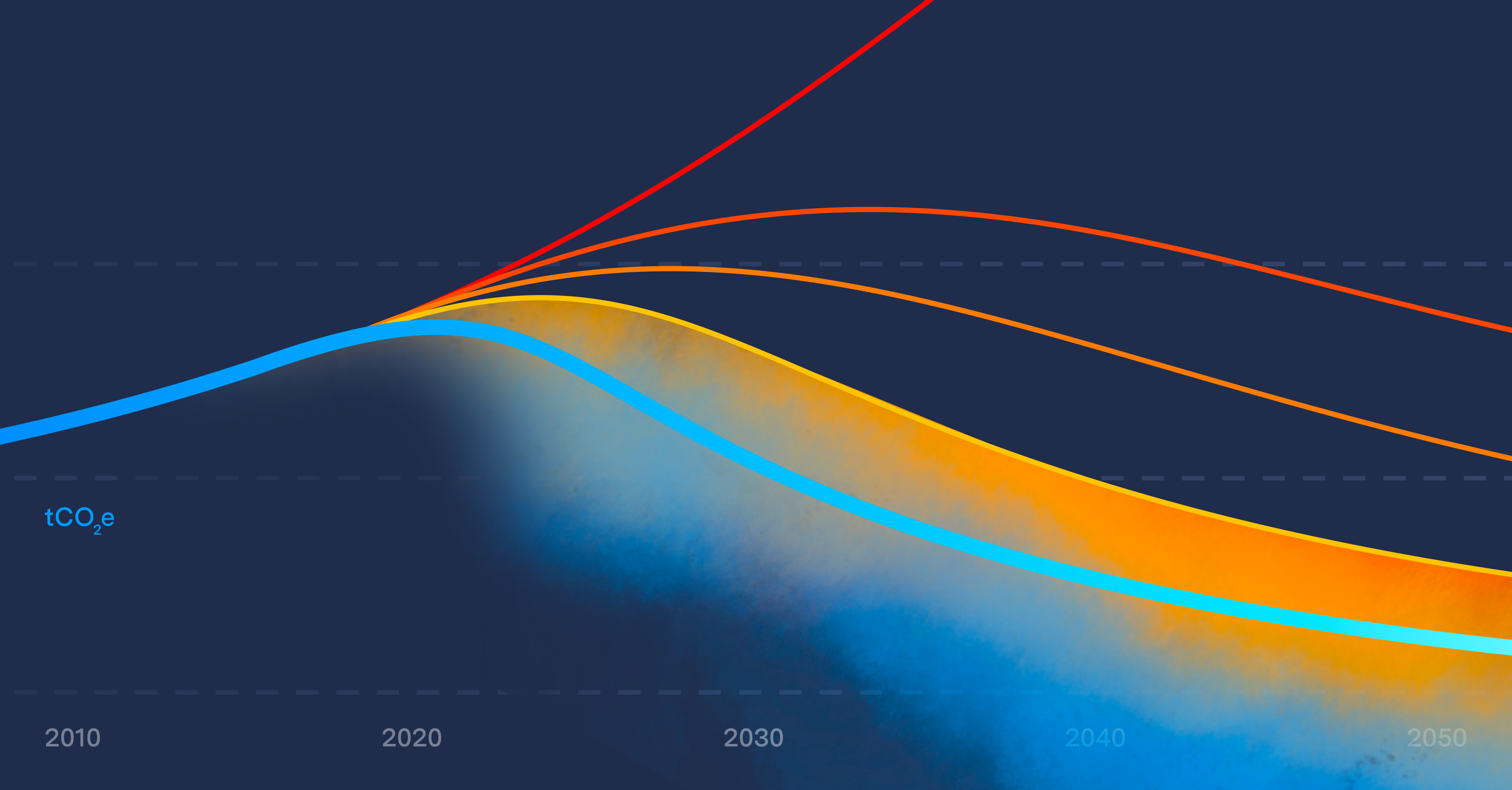

The stakes are being raised on corporate reporting as a new wave of mandatory disclosures come into effect. The Corporate Sustainability Reporting Directive (CSRD), the International Sustainability Standards Board (ISSB) standards, California disclosure laws, and regulations in dozens of other countries have made sustainability reporting subject to the same standards, controls, and accountability as financial reporting. Finance leaders must lead this work to drive compliance and rigor on sustainability data, make thoughtful investments to deliver results, and robustly meet assurance obligations. An ESG controller—a role virtually unheard of two years ago—is now in place at more than half of Fortune 100 companies.

To meet this moment, we have formed a CFO Advisory Board, which will provide guidance to Watershed and our community of customers. The founding members include:

Michelle Collins is a former Deloitte Partner with a distinguished finance career. She served as Vice Chair of Deloitte's US Board of Directors and held key leadership roles across global audit and advisory services. During her career, she guided Fortune 500 companies in the automotive, manufacturing, and consumer sectors through complex financial reporting and risk management challenges. Her expertise spans enterprise risk management, SEC compliance, and business transformation, complemented by her service on the Value Reporting Foundation's Board advancing ESG initiatives.

Luisa Gómez Bravo currently serves as Chief Financial Officer at BBVA reporting to the CEO. She is also a member of the Executive Committee of the BBVA Group. Ms. Gómez Bravo joined BBVA in 1998, and has since then held several senior management positions in the Group including COO of Wholesale Banking, Global Head of Asset Management, COO and Head of Transformation in Spain and Portugal, Global Head of Investor Relations, Global Head of Investment & Cost Management, and Global Head of Corporate & Investment Banking. Before joining BBVA, Luisa Gómez Bravo worked at Salomon Brothers and Lehman Brothers in London.

Panos Kakoullis is a seasoned executive with over 35 years of experience in professional services and public and private companies. Most recently he was the Chief Financial Officer at Rolls-Royce Holdings with a focus on driving transformation and sustainable growth. Prior to that he spent 30 years at Deloitte advising businesses in a range of industries including TMT, retail, and manufacturing, and also led the Global Audit & Assurance business. Panos now has a portfolio of interests advising PE and VC-backed businesses and is an executive coach.

Graeme Pitkethly was Chief Financial Officer and a board member of Unilever PLC from 2015 until 2024. Graeme is a trustee of the Leverhulme Trust, Vice Chair and Senior Independent Director of Pearson, and a non-executive director of Sandoz. He chairs the audit committees of Pearson and Sandoz and is motivated by increasing affordable access at scale. Prior to becoming Group CFO Graeme led Unilever’s UK and Ireland business, and previously held various financial and commercial roles, including CFO of Global Markets, Head of M&A, Group Treasurer, and CFO of Unilever Indonesia.

In the coming months, we’ll be hosting a series of roundtables for finance leaders (CFOs, controllers, board members) and the members of our CFO Advisory Board—off the record conversations about what’s working, what’s not, and how to get ready for the first year of mandatory sustainability disclosure. Reach out to us at cfo@watershed.com if you’d like to join.