Today, we announced $100M in new Series C funding, valuing Watershed at $1.8B. The round was led by Greenoaks, and included Kleiner Perkins, Sequoia, and other existing investors.

Our mission is to accelerate the climate economy. Today, that mission feels both more urgent and more achievable than ever: 2023 was a record year for global temperatures, but also for investment in clean energy. More than two-thirds of global Fortune 500 companies have made significant climate pledges, and more than 10,000 companies are now required to file sustainability disclosures under the EU’s Corporate Sustainability Reporting Directive (CSRD). It’s time to turn that potential energy into the kinetic energy of real decarbonization.

“2023 was a record year for global temperatures, but also for investment in clean energy.”

Our work to power corporate climate action has picked up speed over the last year. Our customer base now spans every region and industry, and includes leading companies like General Mills, Suncorp, Medline, BBVA, Paramount, Spotify, Klarna, 4 of the top 6 US banks, and 6 of the top 10 private equity firms. We’re helping financial institutions like Carlyle decarbonize their portfolios, brands like Coyuchi and YETI make strategic decisions about materials and suppliers, and professional services companies like Aon meet their net zero goals faster.

The bar for climate work is rising fast, and we’ve been hard at work building the tools companies need to be effective. Last April, we acquired CEDA, the world’s leading multi-region emissions database, to arm companies with more actionable carbon data. We launched Watershed Disclosures to streamline global sustainability reporting, and expanded the Watershed Marketplace, enabling companies to fund high-impact clean power and sustainable aviation fuel. We established partnerships with KPMG, Accenture, ERM, PCAF, and more. We also convened a Policy Advisory Board and a Science Advisory Board to incorporate the latest climate science and policy expertise into every aspect of our platform.

Looking ahead, we’ll remain laser-focused on building the products companies need to succeed in the new climate economy. In particular, we’ll continue growing our team and supporting customers in the UK and Europe—the frontier for the coming wave of climate compliance, starting with the CSRD.

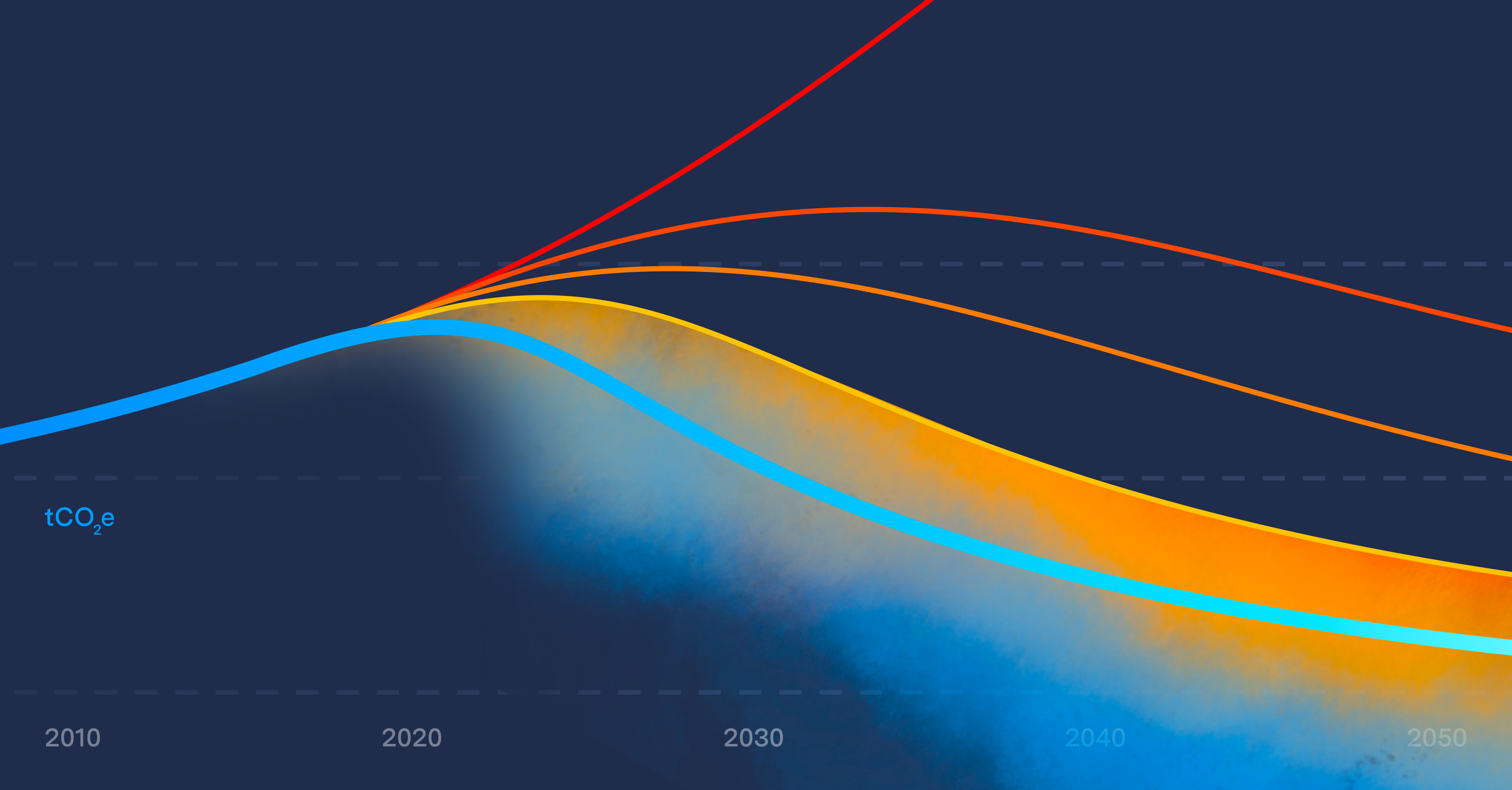

Most importantly, we’ll work with our customers to unlock decarbonization at scale. Two years ago, when we announced our Series B funding, our customers were managing an estimated 20 million tonnes of carbon dioxide equivalent (CO2e). That number is now 479 million tonnes—more than the total annual emissions of France. Day-in, day-out, we’re focused on supporting companies as they cut those emissions to zero.

We’re just getting started on this mission—and we hope you’ll join us.