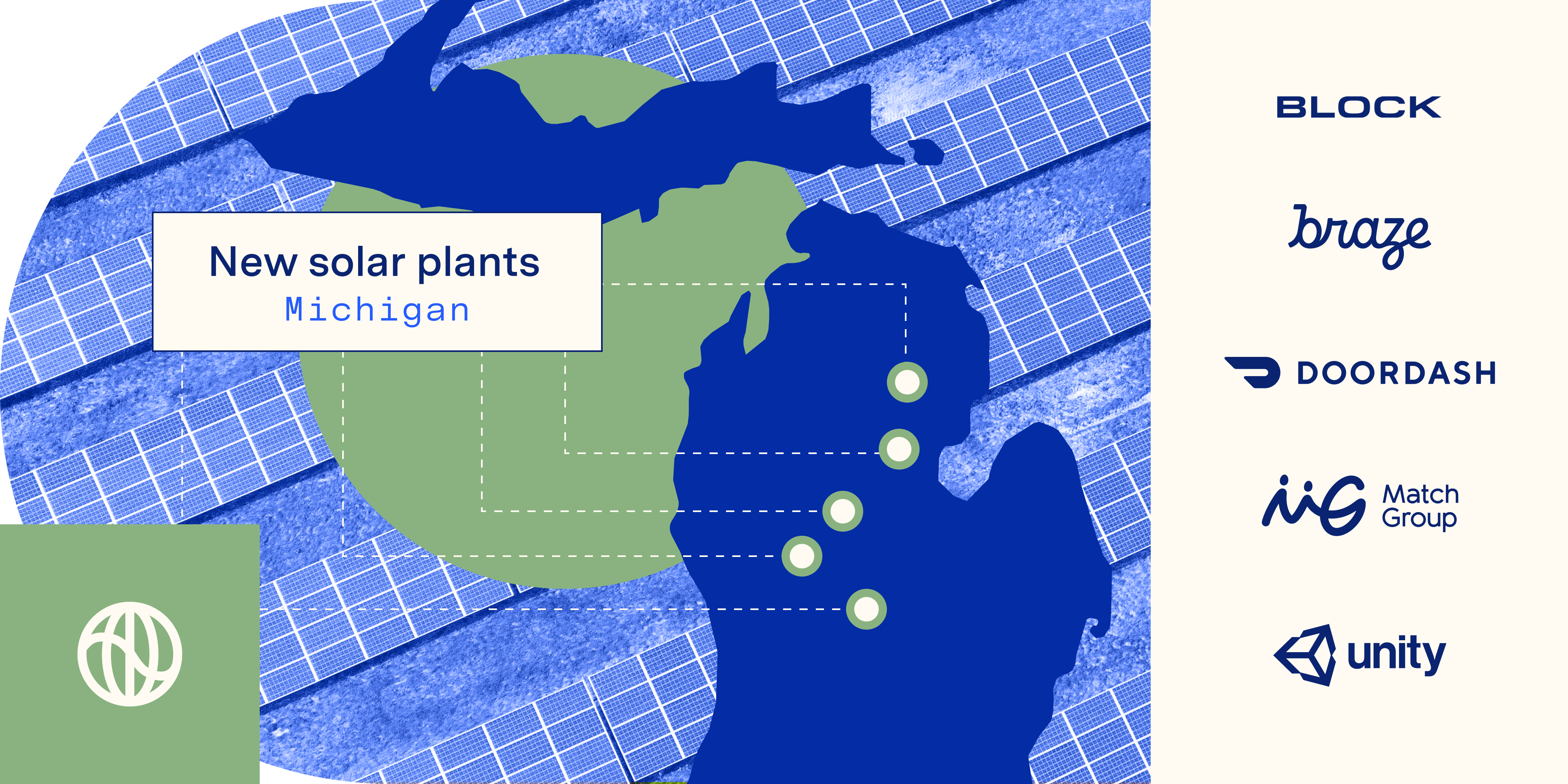

Eight Watershed customers—including Block, Braze, DoorDash, Match Group, and Unity—announced they have helped fund five new solar plants across the state of Michigan via a fixed-price Virtual Power Purchase Agreement (VPPA). The state recently made its own Healthy Climate Plan announcement, passing a bill committing to a goal of 100% renewable energy by 2040.

The solar project announcement represents three converging trends:

- legislative action driving ambitious energy and climate goals,

- companies wanting to see real-world impact from their decarbonization efforts,

- and novel financing models like the Watershed fixed-price VPPA making it easy for companies to support new clean power projects.

The new solar plants, totalling nearly 100MW, are expected to generate more than 110,000 MWh of clean energy a year for five Michigan communities, avoiding more than 52,000 tonnes of carbon dioxide annually. Participating companies will use the resulting Renewable Energy Certificates (RECs), proof of production of carbon-free electricity, to reduce their electricity-related emissions.

A step toward 100% carbon neutral Michigan by 2050

Michigan’s Healthy Climate Plan “lays out a pathway for Michigan to reach 100% carbon neutrality by 2050.” The plan includes recommendations around electric vehicles, public transit, environmental protections, decarbonizing homes and businesses—and decarbonizing the electric grid.

The five new solar plants funded through the Watershed-organized solar pool are a step toward the state’s goals of transforming its grid, which today is the 13th dirtiest grid in the United States. As of October 2023, less than 2% of Michigan’s electricity came from solar power, with only about 10% sourced from renewables in total. These solar projects will help establish supply chains and train local workers needed to deliver Michigan’s ambitious clean power targets.

The recently constructed projects are in Lowell, Mio, Sheridan Township, Tompkins Township, and Gladwin.

How collective action makes ambitious clean power projects possible

Using a VPPA to fund power projects isn’t a new concept. A typical VPPA, however, can be difficult for companies to participate in due to complexity and financial risk. A Watershed fixed-price VPPA, like the one funding these projects in Michigan, creates a shared model that fixes the price of the RECs and removes the need for the buyers to guarantee the electricity price.

In a typical VPPA, a renewable energy project enters a contract with a buyer (usually a business) to guarantee a certain amount of revenue for a fixed period of time. The upside for both? The developer can now secure financing for the project using this guaranteed revenue. The buyer receives the Renewable Energy Certificates (RECs), matched to the production of one unit of clean energy, which they use to reduce their reported electricity emissions.

Typical VPPAs include a complex financial product called a Contract for Difference. While the buyer does not receive electricity produced by the project, the buyer does guarantee a minimum price for the power, known as the “strike price”. If the market price of power goes above the “strike price” the buyer could reap a profit.

So why aren’t these types of agreements more popular? In 2021, only around 600 companies participated in either virtual or physical power purchasing agreements (VPPAs or PPAs, where in the latter, the buyer directly buys the electricity).

The answer lies in the potential downsides for the buyer and the product’s complexity. The financial risk if the market price of power goes below the agreed-upon strike price is often too high for any but the most profitable companies to bear. The length of commitment required, typically greater than 15 years, goes far beyond what most companies can sign up for. Companies are also typically required to demonstrate creditworthiness, or provide expensive letters of credit, to prove they can meet these long-term financial commitments.

Enter: the Watershed fixed-price VPPA.

The fixed-price RECs offer numerous advantages. Project developers still get the guaranteed revenue they need to secure financing. Companies can lock in high-quality carbon reductions, plan ahead due to the known costs, and sign on for only five years, much shorter than the usual PPA timeline.

Because Watershed’s flexible VPPA structure allows multiple businesses to share the cost and risk, it broadens access to this high-impact emissions reduction vehicle, which is typically only feasible for larger companies.

The fixed-price Virtual Power Purchase Agreement (VPPA) in action

The eight customers involved in the Michigan VPPA join others currently in progress, including a repowered wind farm in Howard County, Tex., fueled by Samsara, Stripe, TaskUs, and MongoDB; and a network of community solar projects in Illinois co-funded by Canva and its Canva Print suppliers.

The Canva and Canva Print VPPA is one of the first examples of a company and its suppliers partnering to support community solar through a fixed-price VPPA—and taking on their emissions collectively. Canva’s suppliers benefit from reduced emissions, and Canva can realize high-impact reductions in their scope 3 footprint.

"Scope 3 emissions are by far the biggest component of almost every company's carbon footprint. Reducing these emissions is the challenge that keeps most of our customers up at night,” said Matt Konieczny, Head of Clean Power at Watershed, of the Canva VPPA. “To date, very few companies have been able to drive meaningful reductions in their supply chain. These kinds of VPPAs are a rare exception.”

The lower price and distributed risk of the Watershed fixed-price VPPA means many different types of suppliers can enter these agreements, allowing organizations up and down the supply chain to reap the benefits of scope 3 reductions.

“By using a flexible and scalable approach, Canva has delivered an example others can follow,” said Konieczny.

These fixed-price agreements provide a unique opportunity: aligning forward-thinking companies, communities in need of clean infrastructure, and developers in need of stable financing to build the future of long-term clean power.