On September 24, the California Air Resources Board (CARB) published the list of entities it believes need to comply with California’s new climate disclosure laws, SB 253 and SB 261.

Check the list: Preliminary List of Reporting/Covered Entities

Compliance is based on two tests: whether the entity’s global revenue meets the statutory threshold (over $500M for SB 261; and over $1B for SB 253), and whether the entity is “doing business” in California.

On October 10th, CARB released a reporting template for SB 253. Details on the template can be found here. Note for Watershed customers: Watershed is integrating the template directly into its report builder for SB 253, so you'll have the latest CARB guidance incorporated.

Is the CARB list complete?

The list published is only a preliminary estimate. CARB indicated it relied on California tax code definitions of “doing business” (Revenue & Tax Code § 23101) and public revenue records to assemble this list, which can be outdated or incomplete.

As a result, the list should be seen as a helpful starting point rather than a final answer. Many companies that should be included are missing, and some that appear may not actually be in scope.

We noticed some surprising omissions—for example, major U.S. multinationals not currently named—while a number of smaller companies which appear to fall below the statutory thresholds are named. These anomalies reflect the limitations of the underlying data, and underline CARB’s point that the list is advisory only.

If you believe your company has been listed in error—or should be listed but is not—CARB has published a survey for companies to submit corrections. We strongly encourage regulated companies to weigh in directly, but we are also happy to note any comments and relay them to CARB.

What companies should do now

To prepare for compliance, companies should:

- Confirm your status. Review your corporate structure, revenue figures, and California footprint, then work with legal counsel to determine if you meet the thresholds—even if CARB hasn’t listed you yet. Note that CARB has also proposed limited exemptions (eg nonprofits or insurers). These carve-outs are still being finalized, but they underscore that inclusion on the list is not determinative.

- Determine your filing structure. CARB looks likely to allow parent companies to file consolidated reports on behalf of subsidiaries. This is an option rather than a requirement, but may simplify reporting for some. Note: even if reporting is consolidated, each captured entity will remain liable for filing fees.

- Mobilize your data owners. Kick off a coordinated data-gathering process across finance, ops, procurement, IT, and sustainability, assigning clear owners and deadlines for emissions and climate risk information.

- Get audit-ready. Limited assurance begins with your first SB 253 filing. Early preparation reduces the risk of gaps, errors, and penalties. (Note: SB 261 reports do not require assurance.)

“California is asking companies to assess the impact of climate-related risks on their business. Luckily, there are great tools for quickly assessing how exposed your assets might be to the shocks and stresses that we are already experiencing. Assessing your risks and opportunities and measuring your emissions can happen in weeks, not months, with the right tools and expertise.”

Nate Kimball, Sustainability Advisor at Watershed

How Watershed helps

One of the first decisions companies face is whether to build reporting on a technology platform or to patch it together manually. Manual approaches can get you through year one, but they come with costs: higher risk of errors, longer reporting cycles, and little ability to reuse work as requirements expand.

Watershed offers the best of both worlds: enterprise-grade software and unmatched advisory expertise. With Watershed, you get:

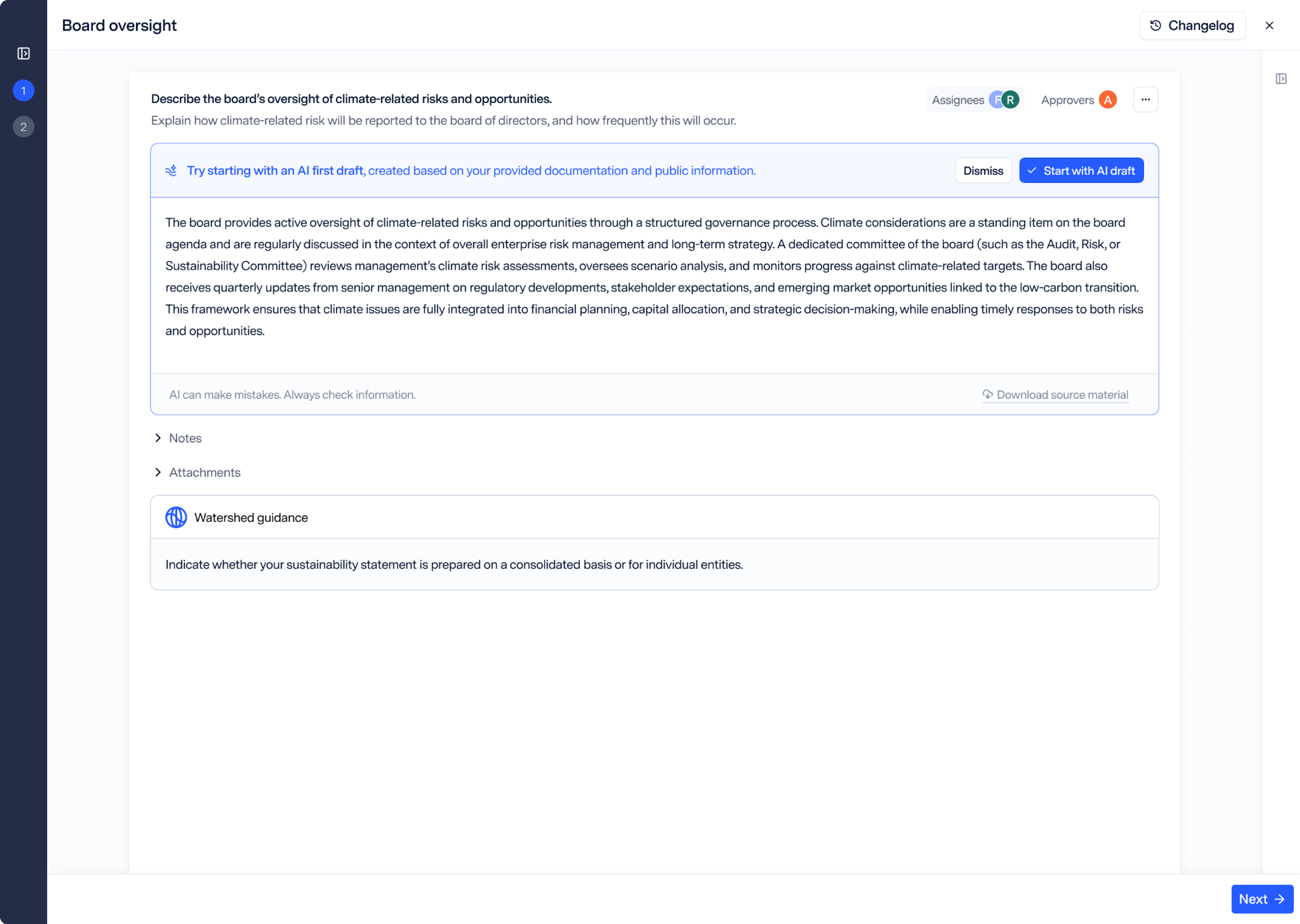

- Guided California report builder aligned with SB 253 and SB 261 requirements

- AI-accelerated drafting to speed up report preparation, with transparent, explainable outputs

- Audit-ready measurement with 150+ built-in error checks and a 100% audit pass rate

- Policy and assurance expertise from the team most trusted by companies reporting to California today

- Future-proof infrastructure — a secure, SOC-2 compliant system of record that scales to Scope 3, SEC, and CSRD reporting

With Watershed, companies don’t have to choose between rigor and speed. You get both: automation and hands-on support to solve for compliance quickly, and confidence you’re reporting trustworthy disclosures that will stand up to regulatory scrutiny. That’s why more companies trust Watershed for California reporting than any other platform.

If you meet the thresholds—or appear on CARB’s list—now is the time to act.

Talk with our team to see how Watershed can help you move quickly, stay compliant, and turn disclosure into a driver of resilience and growth.