Since receiving their banking license in 2017, Monzo's approach to giving customers a modern and fully-functional bank in their smartphone has gained the faith of over 5 million customers and counting. Their core insight was simple: people want more transparency and control over their finances—from simpler and more avoidable fees, advance warnings about increased bills, and rich context on spending patterns and goal progress.

But there was one area of transparency that both customers and employees wanted to understand on a deeper level: climate impact. While the financial sector was showy with glossy pamphlets and strong promises, there was a widespread lack of real data. What was driving the most emissions? What actions would really move the needle? And just how much carbon was hiding in the industry’s shared blind spots?

Just one year into their Watershed partnership, Monzo now has a much deeper understanding of the carbon within their business—and how to remove it.

Early wins, early surprises

While most companies know the right early steps to take—from offsetting corporate travel to shopping for renewable energy for their offices—Monzo realised that you can't really root out carbon if you don't know where it's hiding.

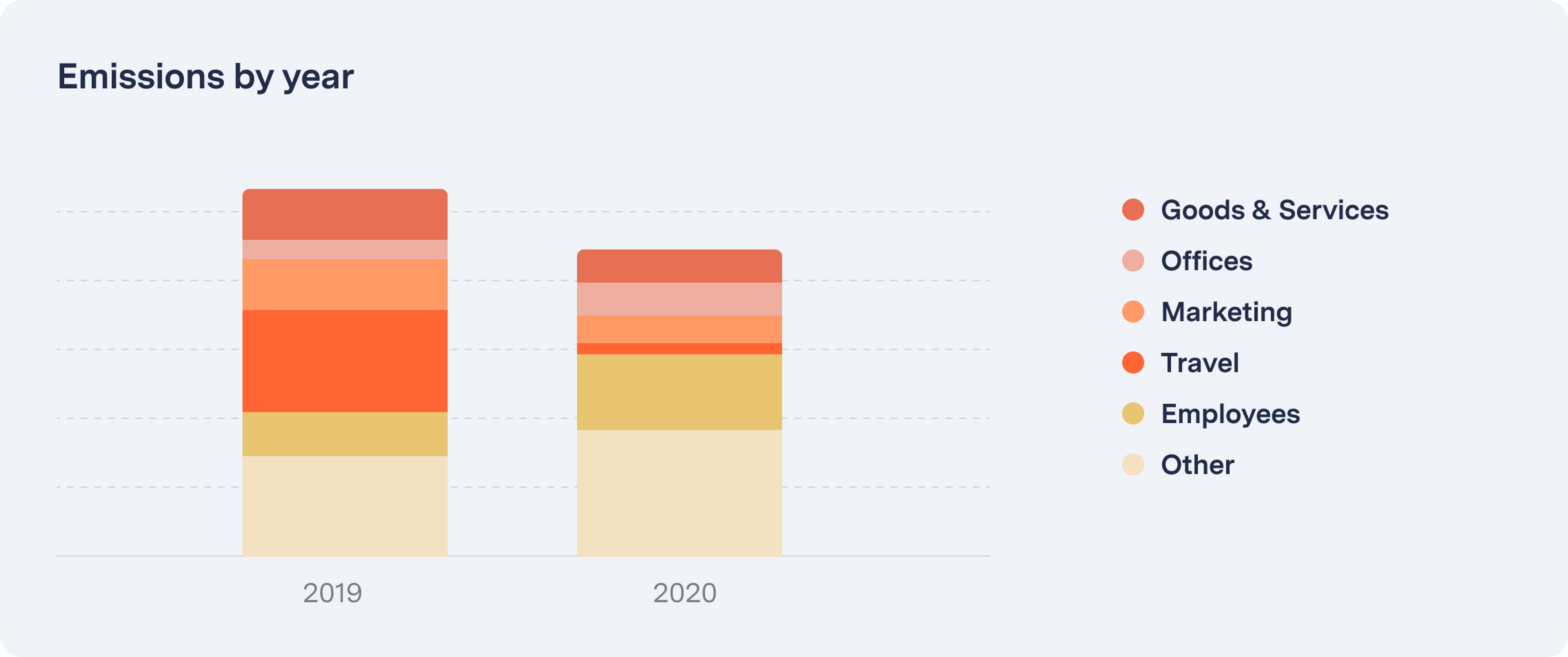

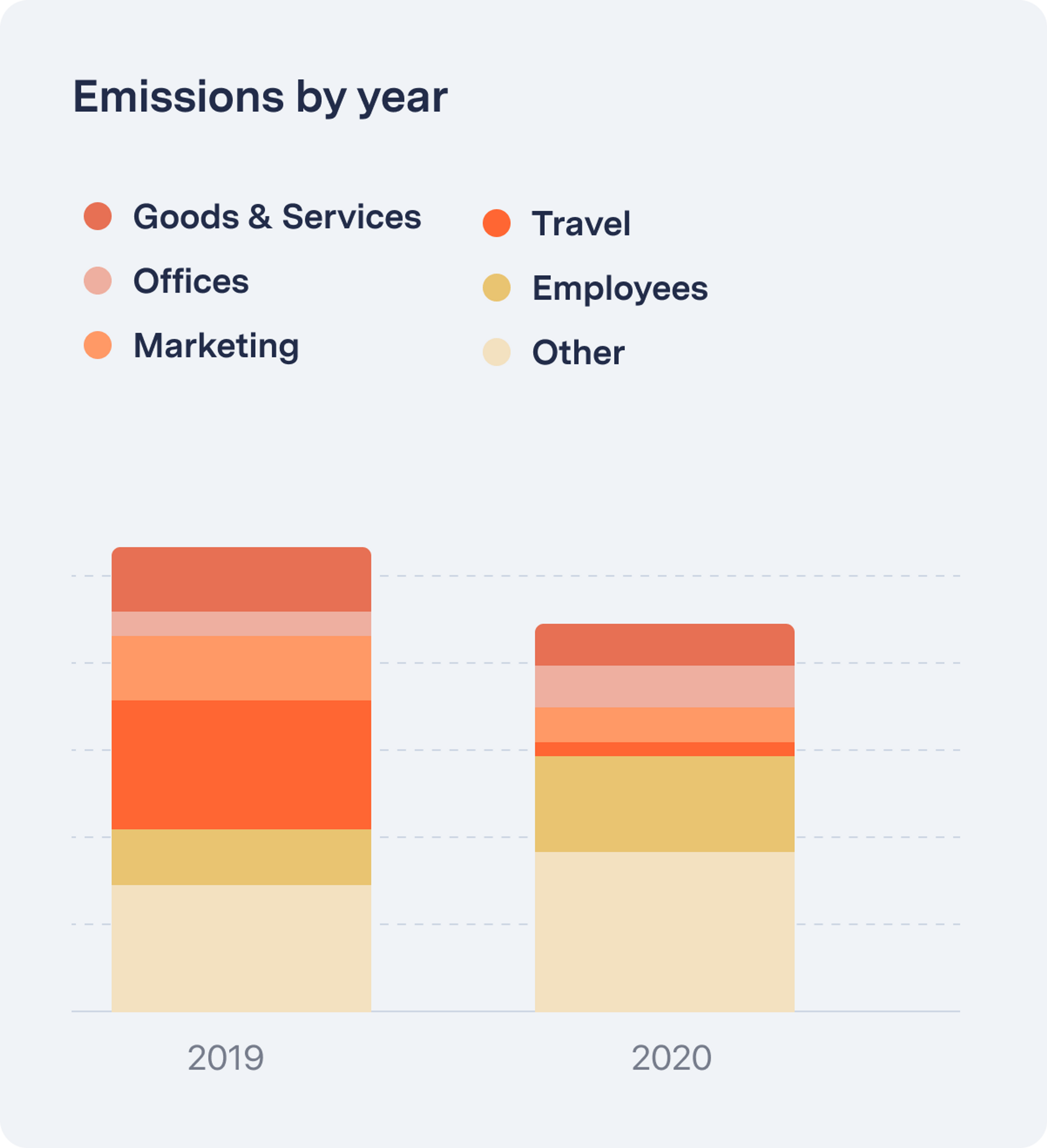

Setting up on Watershed allowed them to have a detailed and accurate sense of emissions across their full value chain for the first time.

The data contained a few surprises:

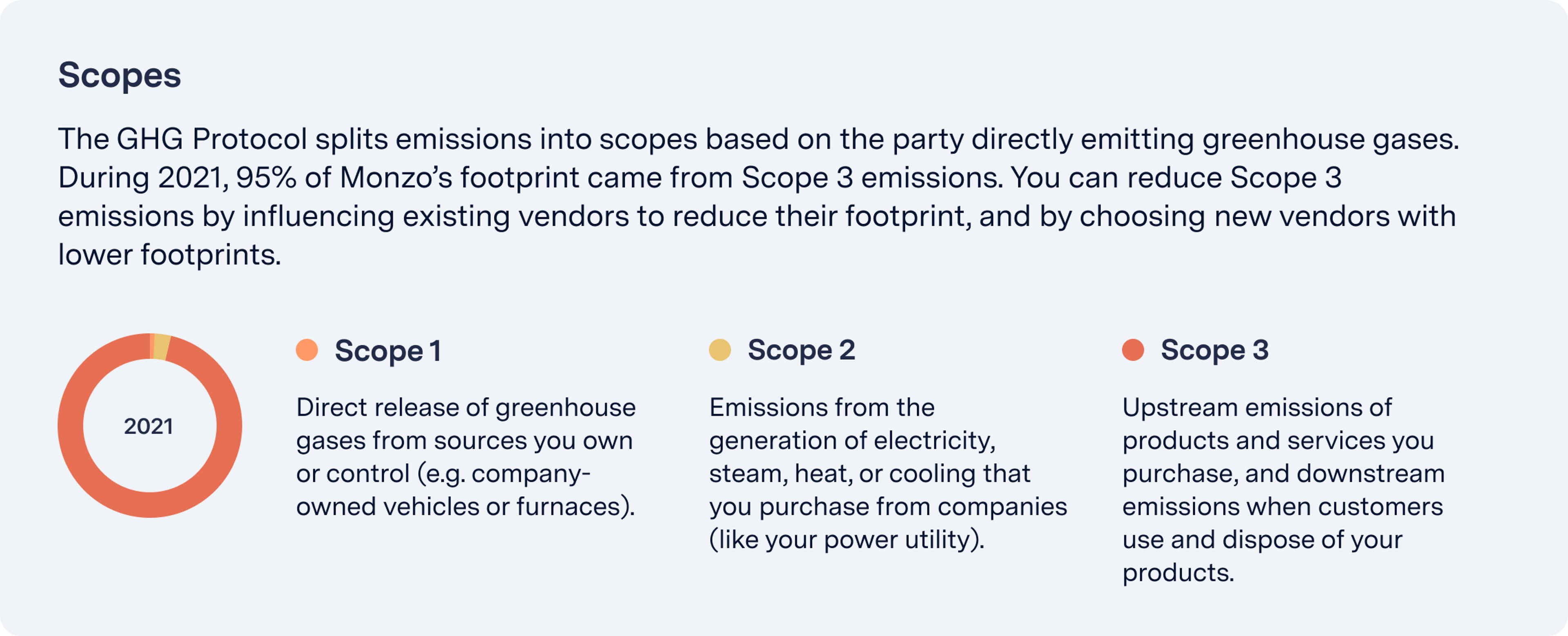

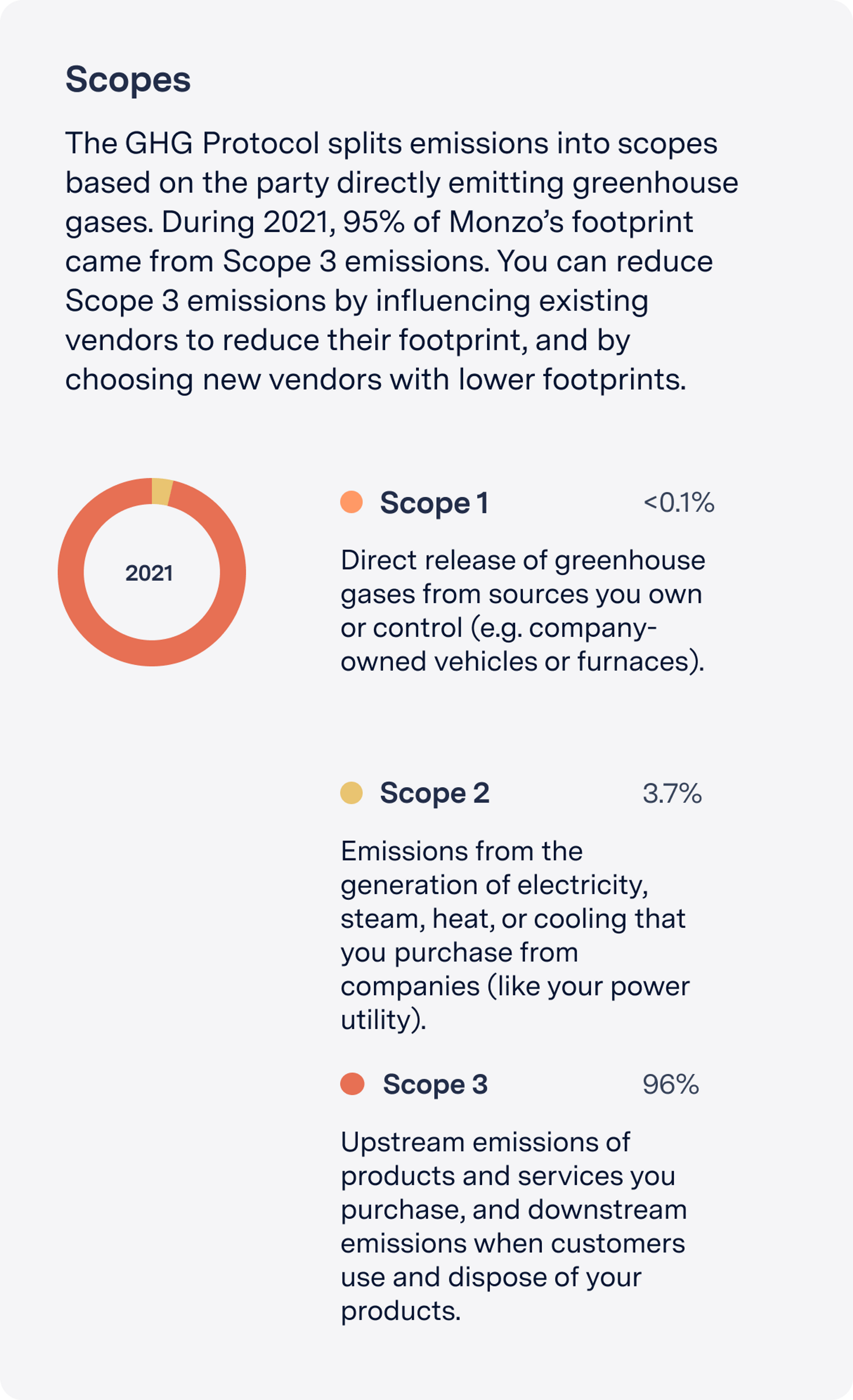

- Roughly 95% of the emissions induced by Monzo’s existence were hiding in their value chain outside of their normal carbon accounting (i.e., in Scope 3), being either upstream with suppliers or downstream with customers.

- Emissions from activities like processing payments, manufacturing and shipping cards, and engaging professional and legal services were much higher than expected.

- Understanding the quality and impact of purchased carbon credits was far more nuanced and complicated than first imagined—like the difference between carbon removals and carbon offsets.

But today:

“Climate is now something we can regularly talk about in meetings, including at executive and board levels. And we’re now able to train employees on the carbon impacts of our processes, and to engage suppliers with real insights in hand.”

But it’s not just about how Monzo can modify their business to cut emissions: it’s about giving customers that same power.

Passing it on

At first, Monzo just needed more precision and more confidence in their data. But with that in hand, what's the right way to then share those insights with customers?

They started with some simple commitments: to measure comprehensively, show the whole footprint, and—critically—to make sure the shared information is clear and accessible, so customers can meaningfully engage with the climate programme. Monzo also joined the UK's Tech Zero Taskforce.

With that in place, Monzo is now starting to ask a more advanced version of that question:

"How do we help customers understand and engage with the environmental impact of their spending and deposits? How do we empower customers to easily make powerful climate decisions in how they use our product?"

This is where the industry is going: giving consumers information alongside opportunities for meaningful, low-friction action—something Monzo is now putting its mind to.

Of course, it all starts with data. If Watershed can help, please get in touch.