In 2023, the ISSB released climate-related reporting standards based largely on the original TCFD recommendations, and in 2024, ISSB will take over monitoring responsibility for TCFD reporting. ISSB’s standards, known as IFRS 1 and IFRS 2, build largely upon TCFD’s original recommendations for reporting climate-related data and information.

TCFD Reporting

What every organisation should know about TCFD reporting

In the new era of corporate responsibility, organisations around the world are being held to account for sustainability—and not just for promises and goals, but for concrete and measurable action towards those goals. Standards created by the Task Force on Climate-related Financial Disclosures (TCFD) have become the global baseline for sustainability reporting, and understanding them is critical for any company seeking to remain competitive in today’s economy.

What is TCFD?

The Task Force on Climate-related Financial Disclosures, or TCFD, was created by the Financial Stability Board, an international UN-style body for global financial policy, to create a framework for climate-related financial disclosures. TCFD released their standard in 2017: a set of 11 questions spread across four major "pillars" that guide filers to ensure their disclosures go far enough. Though intended for voluntary filing, TCFD's standard was widely adopted by the first wave of national and regional mandatory disclosure programs.

Essentially, the FSB recognized that climate-related risks (such as sea level rise or the cost of transitioning off of fossil fuels) have financial implications—so investors, lenders, and insurers would need clear, reliable data on those risks in order to make informed funding decisions. The Task Force includes 31 members from across the G20.

Why is TCFD important?

The framework developed by the TCFD has since become the baseline for many climate disclosure requirements around the world. As more companies move toward reporting comprehensive, audit-grade sustainability data—whether due to regulatory mandate or shareholder and customer demand—TCFD provides a helpful framework for ensuring you have the right data, in the right formats, for successful disclosure.

What does TCFD include?

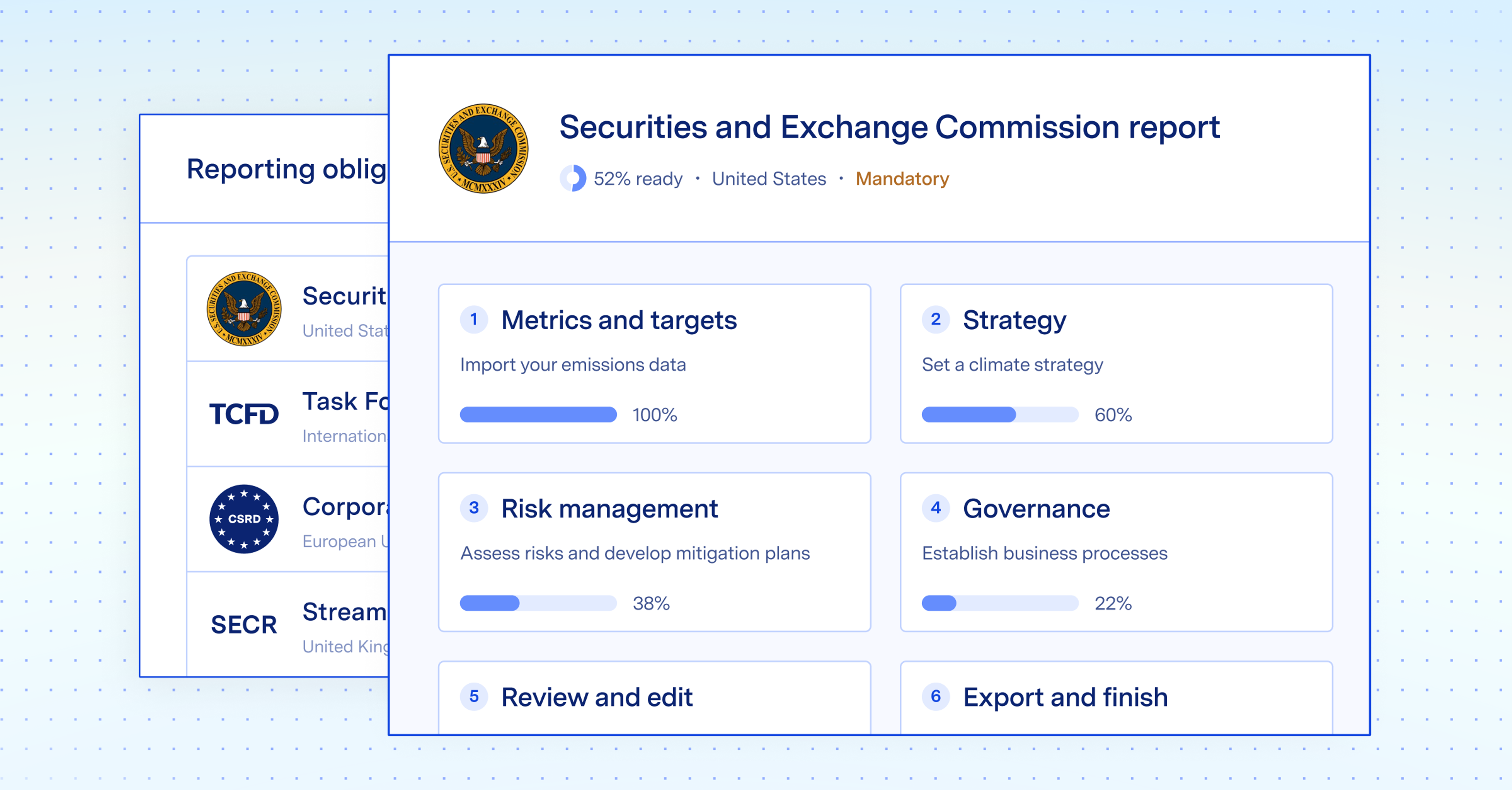

TCFD’s core framework includes four pillars and 11 disclosure questions that test the integration of climate issues within an organisation. Within each pillar is a set of key disclosure questions about emissions and climate strategy, with the “Metrics and Targets” pillar viewed as the cornerstone of the disclosure framework.

TCFD Pillar | Disclosure Questions | ||

|---|---|---|---|

Governance |

| ||

Strategy |

| ||

Risk management |

| ||

Metrics and Targets |

| ||

Why file TCFD-style disclosures?

Climate disclosures have many benefits—beyond the obvious need to remain compliant with regulation.

01

Higher acquisition price

Executives and investors surveyed showed willingness to pay a 5-10% acquisition price premium for companies with a positive record on ESG (McKinsey)

02

Better M&A success rate

53% of investors have cancelled M&A deals because of material findings in ESG due diligence (KPMG)

03

Consumer preference

Products marketed as sustainable grew 5X faster than those that weren’t between 2013 and 2019 (HBS).

04

Lower cost of capital

Companies with high ESG scores receive valuation premiums (5%+ on average) and discounted costs of capital (10% on average) versus peers with low ESG scores. (Morningstar, McKinsey)

05

Competitive advantage

2,250+ companies, representing one-third of the global economy, have committed to science-based targets that will require deep emissions reduction across their supply chains, leading to significant growth in the number of RFPs that require climate disclosures

06

Employee engagement

Companies with sustainability programs have 40% higher employee retention (Deloitte), and 55% better morale (HBR).

What are the TCFD requirements?

TCFD provides detailed guidance on the type and quality of data required to meet its standards for metrics and targets. Use this checklist as a starting point to gather the data you’ll need for TCFD-ready disclosures.

Category | Climate risks & opportunities | Greenhouse gas emissions | ||

|---|---|---|---|---|

TCFD guidance | Organisations should provide the key metrics used to measure and manage climate-related risks and opportunities, as well as metrics consistent with the cross-industry, climate-related metric categories. | Organisations should provide their Scope 1 and Scope 2 GHG emissions independent of a materiality assessment, and, if appropriate, Scope 3 GHG emissions and the related risks. All organisations should consider disclosing Scope 3 GHG emissions. | ||

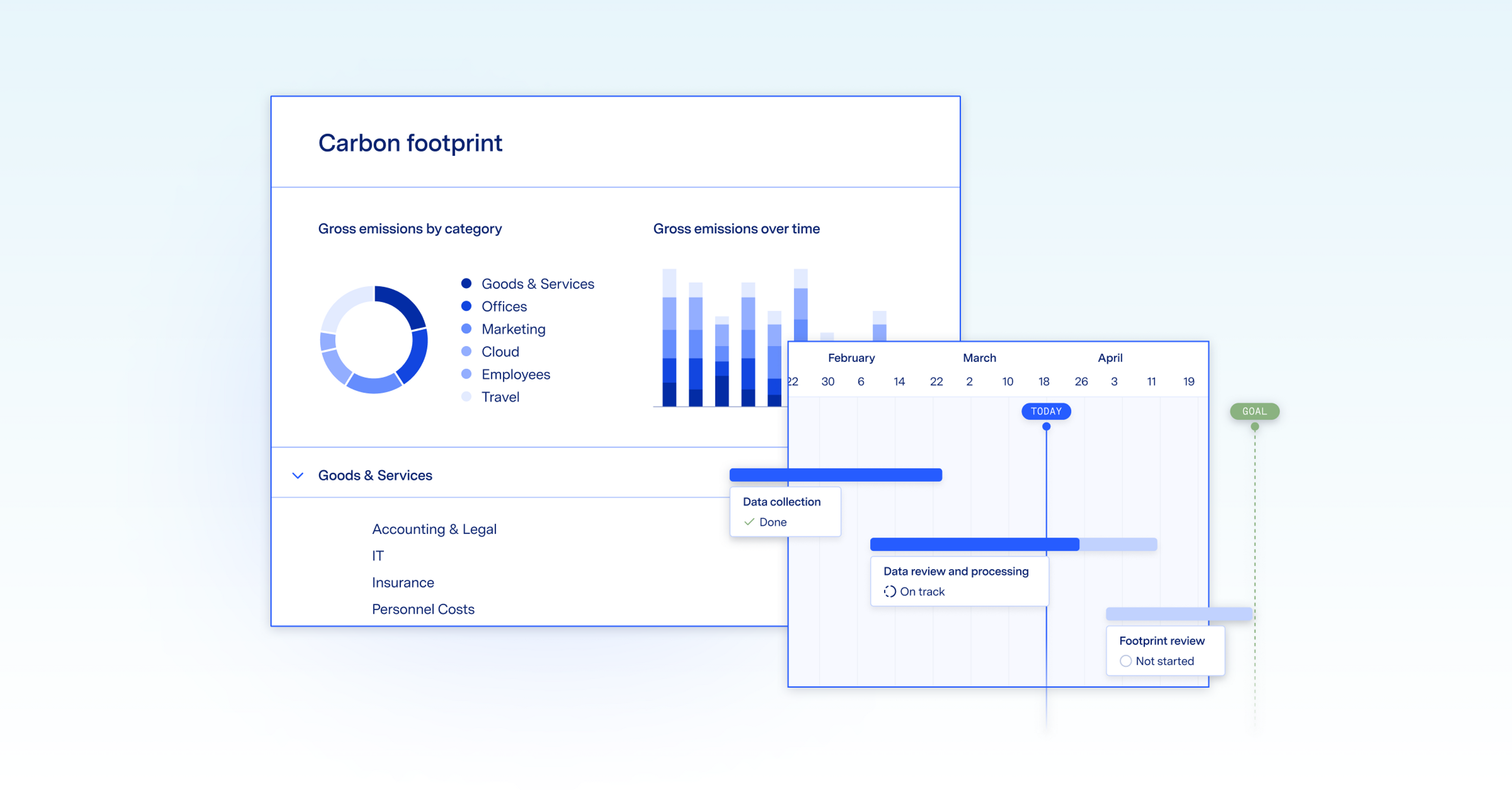

Sample data | Transition risks ⚖️ Policy & legal risks (e.g. enhanced emissions reporting obligations) 🌱 Technology risks (e.g. cost of transitioning to lower-emissions technology) 📈 Market risks (e.g. increasing cost of raw materials) 💬 Reputational risks (e.g. shifts in consumer preferences) Physical risks 🌪️ Acute risks (e.g. extreme weather events) 🌊 Chronic risks (e.g. rising sea levels) Climate-related opportunities ⚡️ Resource efficiency opportunities (e.g. reduced water use) 🔋 Energy source opportunities (e.g. clean power) 📊 Product & services opportunities (e.g. product diversification) 💸 Market opportunities (e.g. climate-related incentives) ♻️ Resilience opportunities (e.g. resource diversification) | ✅ Scope 1 emissions, or emissions from a company’s owned operations (e.g. coal-fired burners at a company factory), measured in MT CO2e ✅ Scope 2 emissions, or emissions from an organisation’s purchase of indirect services (e.g. emissions from electricity used in the company’s offices) ✅ Scope 3 emissions, or indirect emissions from a company’s value chain (e.g. emissions from an OEM’s manufacture of a part purchased by a company)

| ||

Climate targets

Organisations should describe their key climate-related targets such as those related to GHG emissions, water usage, energy usage, etc. Other goals may include efficiency or financial goals, financial loss tolerances, avoided GHG emissions through the entire product life cycle, or net revenue goals for products and services designed for a low-carbon economy.

In describing their targets, organizations should consider including the following:

- Whether the target is absolute or intensity based

- Time frames over which the target applies

- Base year from which progress is measured

- Key performance indicators used to assess progress against targets

Organisations disclosing medium-term or long-term targets should also disclose associated interim targets in aggregate or by business line, where available. Where not apparent, organisations should provide a description of the methodologies used to calculate targets and measures.

Not sure what data you need to disclose?

Take our 8-question assessment to understand your sustainability reporting obligations.

Timeline: TCFD, ISSB, and global climate disclosures

Established in 2015, the TCFD laid the groundwork for global sustainability disclosures. It first released climate-related financial disclosure recommendations in 2017, which served as the backbone of many subsequent mandatory and voluntary reporting frameworks. In 2023, the International Sustainability Standards Board (ISSB) published a new global standard for climate disclosures, building on the TCFD’s recommendations.

Year | Evolution of global climate disclosures | ||

|---|---|---|---|

2015 | The Financial Standards Board (FSB), an international body responsible for global financial policy, creates the Task Force on Climate-related Financial Disclosures (TCFD) to develop recommendations for climate-related financial disclosure standards | ||

2017 | TCFD releases its disclosure recommendations, which include the 4-pillar framework with 11 questions companies are expected to answer within their disclosures | ||

2019 | The Non-Financial Reporting Directive (NFRD), the EU’s ESG disclosures programme, is revised to include TCFD questions | ||

2021 | At COP26, the International Financial Reporting Standards (IFRS) Foundation, creates the International Sustainability Standards Board (ISSB) to develop a comprehensive baseline for global sustainability disclosures, focused on the needs of investors and financial markets | ||

2023 | The ISSB publishes its inaugural set of standards, which fully incorporate TCFD’s recommendations, known as IFRS 1 and IFRS 2 | ||

2024 | Organisations may begin reporting under the new ISSB framework beginning in 2024. ISSB will take over monitoring of TCFD reporting | ||

From TCFD to ISSB: a new global standard

The International Sustainability Standards Board (ISSB) published new climate-related financial disclosure standards in June 2023. These standards—named IFRS after the International Financial Reporting Standards, ISSB’s parent organisation—include guidelines for broader sustainability reporting (IFRS “S1”) and for climate reporting specifically (IFRS “S2”). These standards aim to be the new global baseline for sustainability disclosures, with companies free to report against them as soon as 2024.

The standards are:

- General sustainability disclosures (S1), which apply the TCFD approach to non-climate-related sustainability issues.

- Climate disclosure standards (S2), which apply the TCFD approach to climate-related considerations like physical and transition risks, climate resilience, and GHG emissions.

The standards align to TCFD’s four pillars, with additional rigour around the metrics and targets companies must disclose. For a detailed explanation of the ISSB standards, read our guide.