Zero-carbon electricity is our best existing tool against climate change—the low-hanging fruit of decarbonization. Wind, solar, and other clean power sources are now cost-competitive with coal and natural gas, and are still getting cheaper. But we need to switch over faster: electricity usage is responsible for a quarter of US greenhouse gas emissions, and renewable sources still make up only 20% of this consumption.

Companies can play a pivotal role here. Businesses have added nearly 40 GW of clean energy to American grids over the past decade by purchasing clean power. But doing this right is tricky: most renewable purchases don’t create new clean power, and the most effective tactics have long been reserved for massive corporations with huge teams.

In this guide we’re sharing our playbook for how companies of all sizes can add clean power to the grid.

Renewable Energy Certificates

Where does your electricity come from? With modern electricity grids, you can’t choose which specific electrons power your building. But companies care a lot about whether their electricity bill supports solar panels or coal plants.

To give companies more optionality, the industry created the Renewable Energy Certificate (REC), a transferable credit awarded to energy suppliers for every MWh of clean power produced. Suppliers then sell these RECs at a premium to companies that want to fund clean energy while reducing their net carbon emissions. If your company uses 1 MWh of power in a given year, buying 1 MWh of RECs fully accounts for that consumption.

(These credits vary in naming across markets. You may see companies talk about Energy Attribute Certificates, Renewable Energy Guarantees of Origin, and so on.)

But there’s a problem: additionality

How can you be sure that a REC purchase is adding new clean power to the grid and not just bidding up the cost of clean power that already existed? In the climate lexicon, this is the “additionality” problem. And it’s particularly acute here, because RECs are awarded for every MWh of clean power—whether it comes from a hydro plant built decades ago or a brand-new solar array.

Companies that lead on climate optimize for additionality, ensuring that every dollar spent on clean power results in new zero-carbon electricity sources. But doing so requires buying with care—and a plan.

What are the green energy options for businesses?

Companies can pick from a menu of ways to buy clean power. Here’s a brief overview of the most popular options, in increasing order of impact and additionality:

Buy generic unbundled RECs (low impact)

The most basic version of the REC is the “unbundled” credit, purchased separately from the associated power—often from an anonymous supplier through an open market. For example, a company uses 10 MWh of electricity, buys any 10 MWh of RECs created that year, then declares zero emissions for their electricity consumption.

This is better than nothing: all REC purchases create extra demand for renewables in general. But this approach rates low on additionality. When you don’t know where your REC comes from, you can’t be confident your purchase is driving new clean power.

Buy high-impact unbundled RECs (medium impact)

Discerning buyers—of even modest amounts of energy—can purchase RECs that reliably add new clean power to the grid. These RECs typically come in three categories:

- They’re issued by active developers who’ve explicitly (and sometimes legally!) committed to using their REC revenues to finance new clean power projects.

- They’re attached to recently-built, high-transparency projects where the purchase of those RECs will motivate builders to continue adding new clean supply.

- They’re issued by suppliers in high-impact geographies—either located near the end user (i.e., not distant sources where clean power is easier to produce) or within a carbon-intensive grid (where new units of clean power have the largest marginal climate impact).

At Watershed, we vet projects to identify RECs that fit these criteria. For example, many of our customers have purchased RECs from new solar arrays built on family farms in North Carolina. These developers are using those revenues to fund additional buildouts, helping solar to displace high-carbon energy sources like coal across the region.

Buy into a pay-as-you-go utility clean power program (medium impact)

Some local utilities make it easy for customers by offering a bundled program (i.e., power + RECs) that ensures at least some of the bill is supporting clean energy.

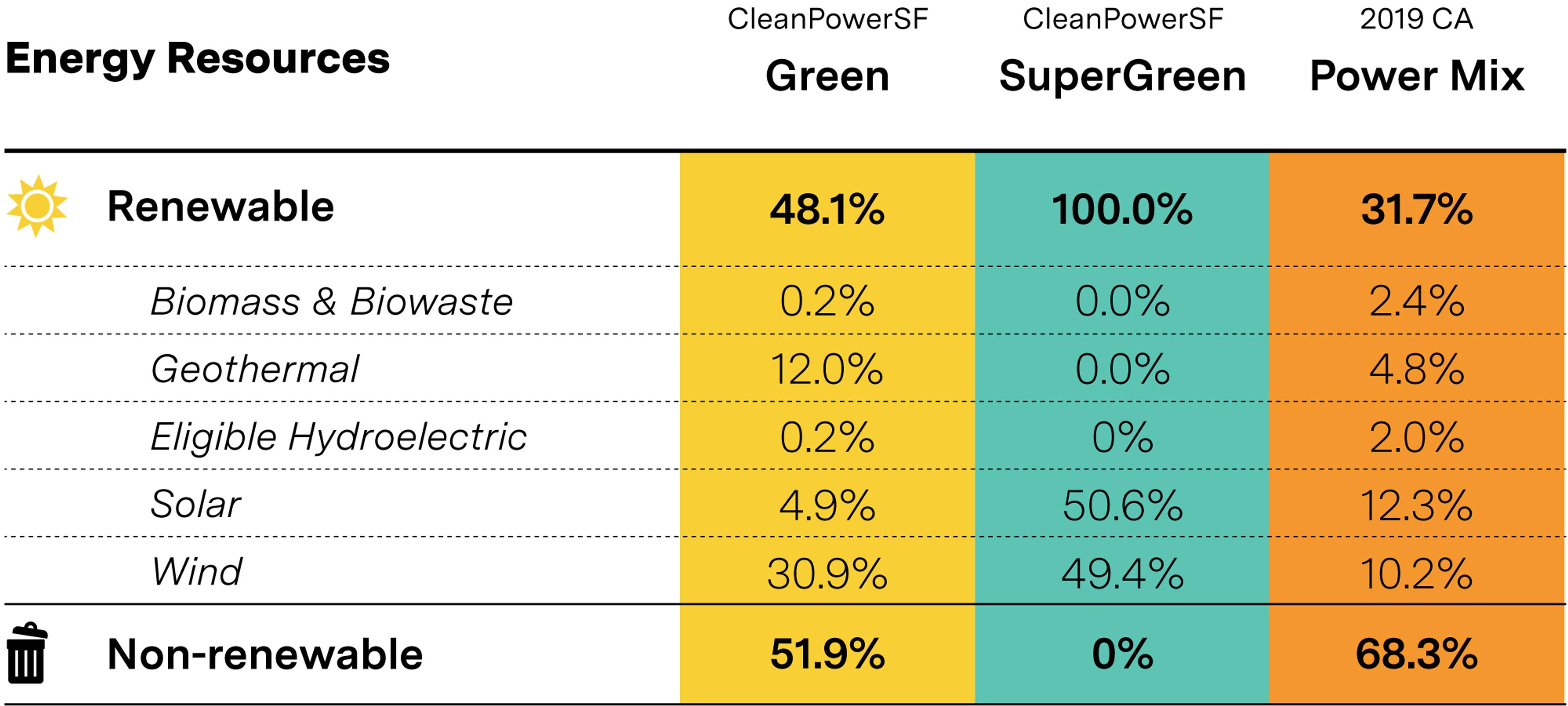

The impact of these programs can vary though. In some cases the utility is just purchasing low-cost RECs on the market and packaging them with mostly dirty local power, making expected additionality quite low. Stronger programs, like CleanPowerSF’s, use their buying power to fund new local infrastructure while providing clearly-labelled purchasing options:

Sometimes these programs are structured as Utility Clean Tariffs, which tend to come with minimum spending levels across terms of up to a few years. This makes it easier for the utility to either build or commission the clean energy projects that the power will come from.

Buy long-term offtake from local utilities and/or suppliers (high impact)

Larger companies can use their cashflow and purchasing power to pre-order energy and REC bundles for extended periods (often 10 years) at a fixed rate. Developers then quite literally take these revenue commitments to the bank as collateral for the capital they need to build out the new solar and wind farms.

Though these deals come in a few flavors, the basic structure is referred to as a Power Purchase Agreement (PPA). They’re considered the gold standard for corporate clean power additionality, and are widely used by climate-leading companies like Google, Apple, and Facebook.

Build your own clean energy installations (high impact)

Sometimes the best path is the most direct one: if you own your office’s roof, or if your data center is in an area with cheap adjacent land, you may be able to install solar and/or wind capacity on site to supply some or all of your power needs.

It’s also possible in many states to pay upfront for a share of a community solar facility shared between local buyers. While most members draw from that energy directly, others resell their share to other local companies, often making a small profit while helping to drive down the cost of future development.

The Watershed playbook on clean power

We’ve helped some of the fastest-growing companies become more effective power purchasers. In doing so, we’ve developed our playbook of quick actions that can ensure your dollars have maximum impact:

- Start by purchasing bundled RECs from utility green programs where they’re available with high additionality.

- Buy high-impact unbundled RECs for any remaining consumption.

- Build as much local / on-site capacity as space and finances allow.

- As your energy load increases and your budget allows for multi-year commitments, consider long-term offtake agreements.

(Watershed makes executing this playbook easy for clients. If we can help, please get in touch.)

Funding the future of clean energy, today

For the largest companies with the most spending power, there are three other strategies that can bring the future forward even faster.

Fund clean power for your suppliers

Indirect emissions from up and down your supply chain can often equal 80% or more of the total emissions created by your product or service. Making it easier for your suppliers to purchase clean energy is both high-leverage in the climate fight and a strong way to future-proof your business as regulators continue to mandate lower total emission levels.

Apple alone has induced 4 GW of new clean energy into their supply chain since 2015, and is well on their way to being carbon-neutral by 2030. Co-investing with your business partners on PPAs and community solar facilities can have outsized impact.

Fund next-generation firm power

“Firm power” is the base supply for every grid, which often comes from on-demand sources like coal and natural gas. Even companies matching 100% of their monthly electricity usage with high-impact RECs are often still contributing to this demand, as the economy is 24/7 while wind and solar generation largely aren’t. Companies like Google have begun matching their usage on an hour-by-hour basis, which gives a truer picture of dirty fuel dependency. To avoid what happened in Texas during their 2021 icestorm, grids need clean power that can be relied on regardless of the weather or time-of-day. Advances to promising options like geothermal will drop in price faster as those who can afford it buy this power early.

Fund long-duration energy storage

Because of how weather-dependent wind and solar are, companies like Form Energy are working to reform grids around inexpensive, long-duration storage. Pre-ordering today can rapidly advance R&D work that will be fundamental to both getting off fossil fuels and getting maximum efficiency from our lowest-cost clean sources.

(Curious to learn more about these options? Let us know.)