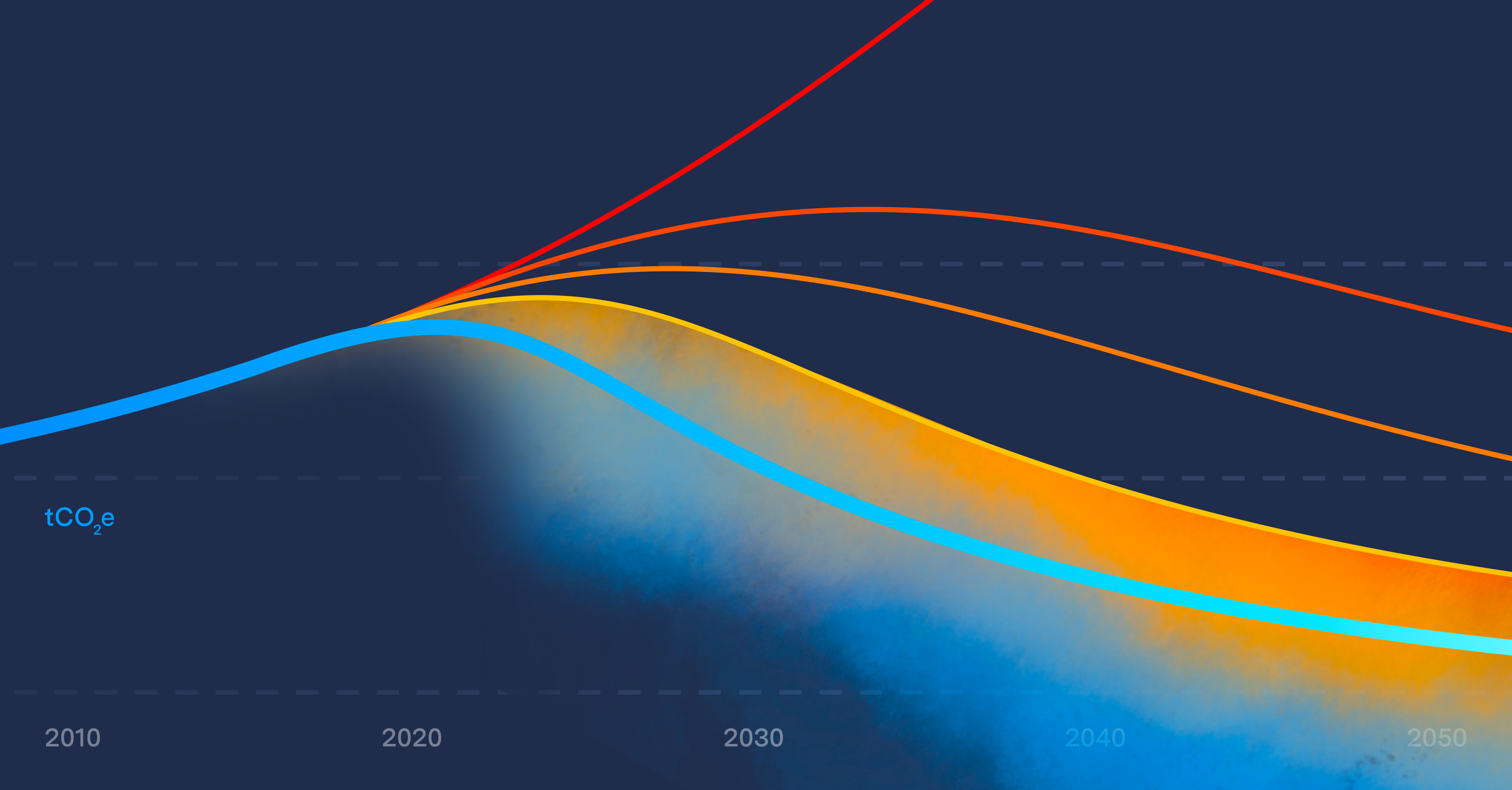

Clean power is the linchpin of solving climate change. Electricity generation is responsible for 25% of U.S. greenhouse gas emissions, and solar and wind are now cost-competitive with natural gas and coal. The oft-repeated mantra for cutting emissions is "electrify everything, and then green the grid!" But we need to move faster: 60% of U.S. electricity still comes from fossil fuels.

Businesses are key to accelerating this transition. Corporate purchases have financed more than 50 gigawatts of new clean power in the US, and renewable electricity purchasing is rightly the first step for most corporate climate programs.

But there’s a catch. How companies buy clean power really matters. Many well-meaning dollars go to renewable electricity that would have been generated anyway. The most effective procurement approaches have historically been so complex that they require huge budgets and dedicated energy purchasing teams.

We’ve been working hard to change that. Today, we’re announcing that Watershed customers can use a new type of virtual power purchasing agreement (VPPA) to directly add newly-built clean power projects to the grid. Stripe, Samsara, and TaskUs are among the first to participate, and Ever.green is facilitating the project.

I’ve been working on clean power financing for fifteen years, and I’ve been frustrated that companies have traditionally faced a difficult choice between two options for their clean power programs:

Most companies reduce reported emissions by buying Energy Attribute Certificates (EACs)—known as Renewable Energy Credits (RECs) in the US—to match each MWh of electricity consumption with a MWh generated from a clean source. These certificates are relatively easy to buy, and provide a price premium to clean power developers. But it’s hard to know the impact of each EAC. The market is fragmented, and it's difficult for companies to vet credits on their own: are you paying for electricity that would have been generated anyway, or helping to support a project that’s new to the grid? This is the question of “additionality.”

A more impactful approach is to enter into a Power Purchase Agreement (PPA) or Virtual Power Purchase Agreement (VPPA) directly with a clean power developer. Developers can take these purchases to the bank—literally—to finance new projects and build them from scratch. This has a very high impact. But the impact comes with complexity: PPAs involve convoluted, multi-decade contracts that expose purchasers to the swings in electricity prices. Because of this risk and complexity, they’ve been the province of a small group of massive corporations. In 2021, 309,000 companies bought REC while only about 600 entered into PPAs.

We’re now helping companies take a third path, one that strikes a balance of maximizing impact and minimizing complexity. We’re partnering with Ever.green to offer a new type of VPPA to Watershed customers. It’s designed to reduce the hurdles that have made VPPAs prohibitive for most companies, with a fixed price, shorter term, and lower minimum volume. This last point is critical: we’re excited to drive collective action, making the impact of the Watershed network greater than the sum of its parts.

And here’s the part that really matters: Watershed customers including Stripe, Samsara, and TaskUs are using this VPPA to support the construction of a brand new solar plant in Laredo, Texas. The plant will avoid 13,000 tonnes of CO2, equivalent to taking nearly 3,000 gas-powered cars off the road each year. This is a small first step. We’re already working on the next project (get in touch if you’d like to join!) and are excited for many more to come.