Stay ahead of disclosure requirements

Get ahead of sustainability disclosures with everything you need for investor-grade, audit-ready ESG and climate reporting.

Expert guidance from our in-house policy team

Build on a transparent platform for audit-ready reports

With Watershed, companies can now take control over sprawling data collection, de-risk third-party assurance, and leverage Watershed's world-class network of partners, scientists, and policy experts to navigate reporting complexity—all in one complete platform. 100% of Watershed footprints, when audited have passed.

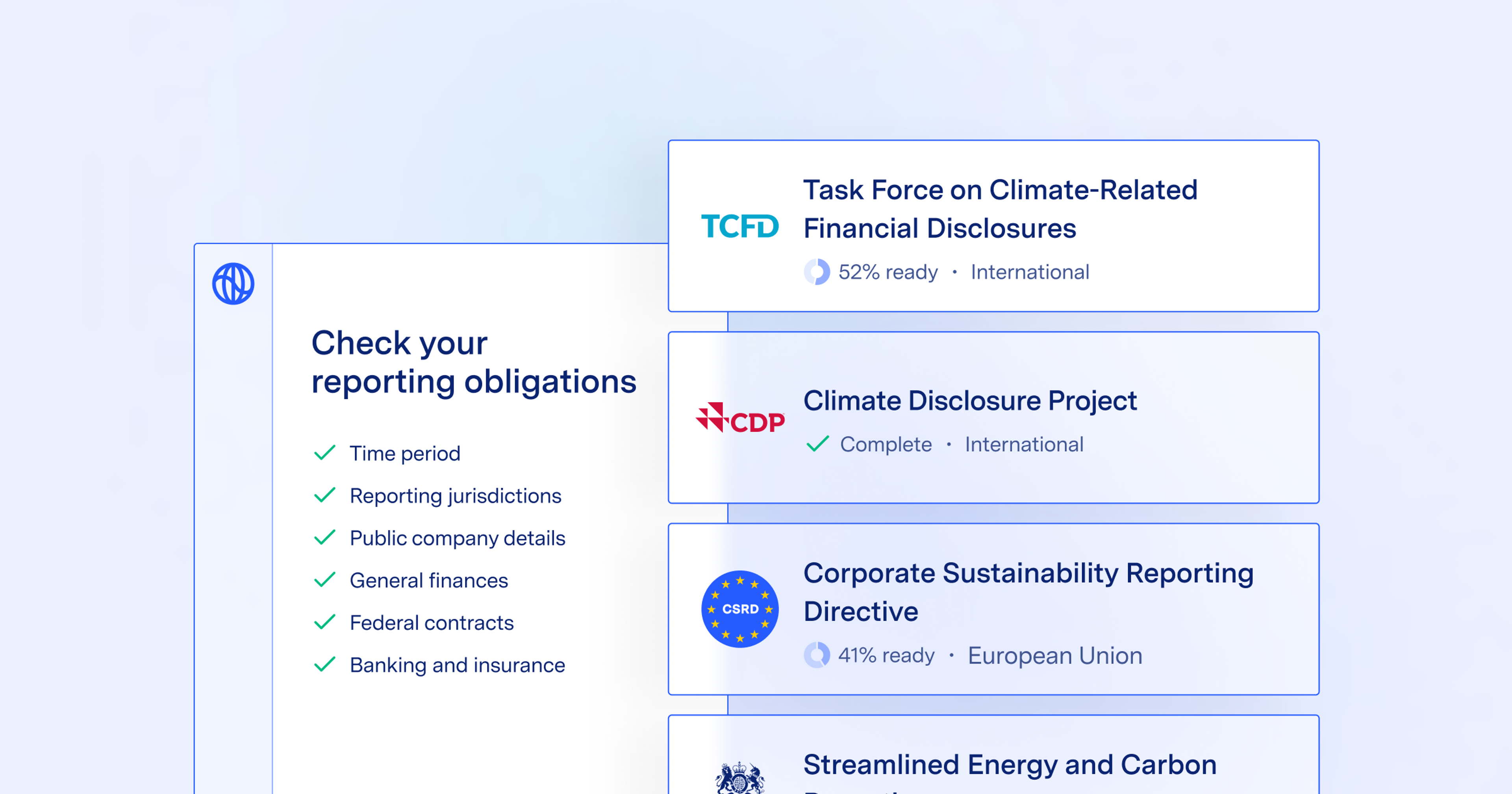

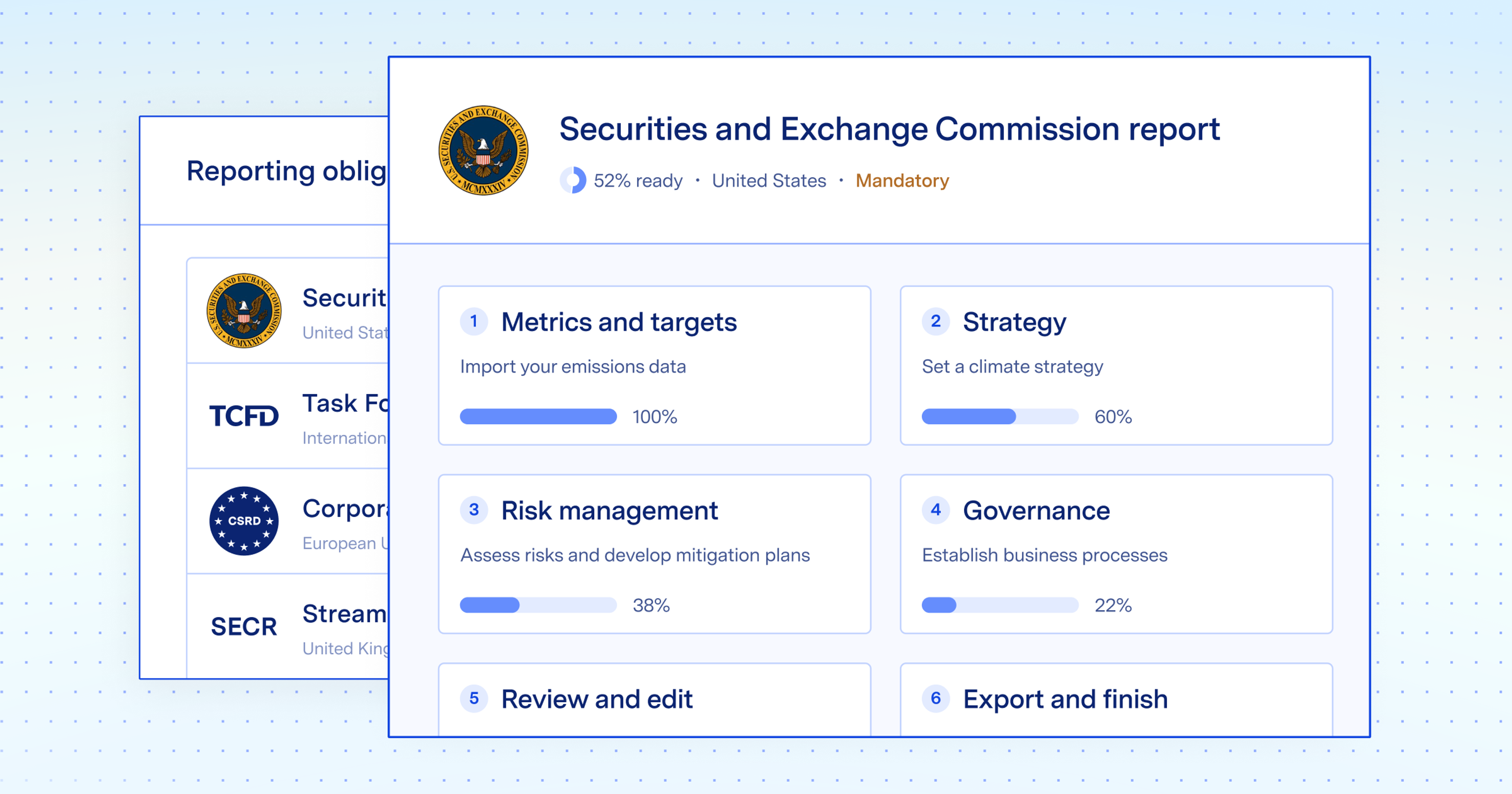

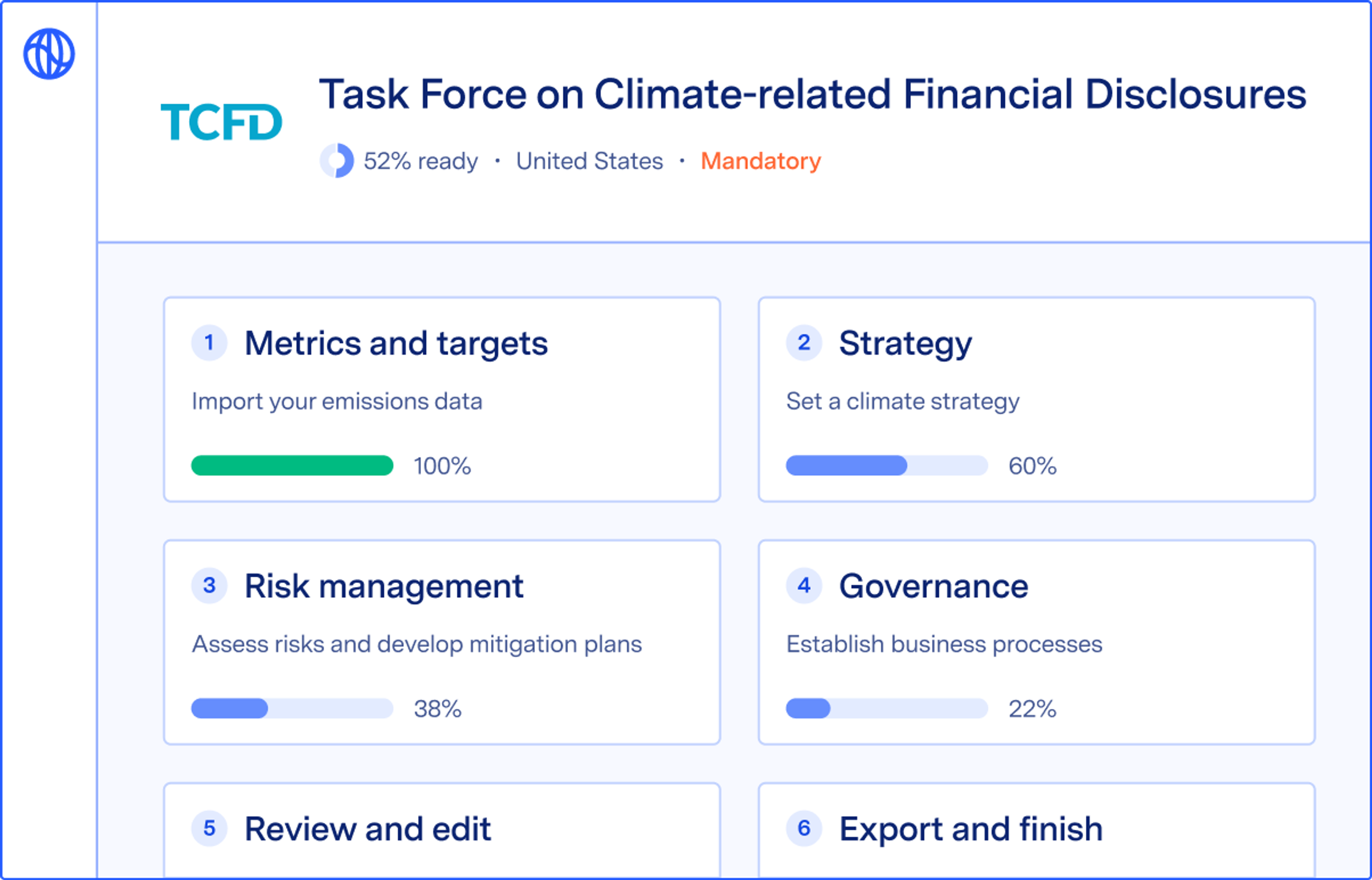

Streamline your reporting process

Use smart workflows to create disclosures that meet reporting requirements for CCDAA, CDP, CSRD, ISSB, TCFD, and more. Leverage past measurements, targets, and reduction plans to auto-populate multiple reports at once.

Benefit from in-app guidance and peer benchmarks

Review publicly available peer responses and high-quality disclosure examples, section by section. Include relevant climate risks from a proprietary risks and opportunities library.

California Climate Rules

Streamline SB 253 GHG measurement, understand your SB 261 climate risks and leverage embedded expertise across California reporting.

Read moreCDP

CDP reporting for climate, forest, and water with a direct API sync to CDP to reduce errors from copy and paste. Plus, you'll get question guidance, peer benchmarks and reusable answers from prior years for climate.

Read moreCSRD

Intelligent data collection, audit-ready measurement, collaborative report authoring and de-risked assurance for CSRD disclosures.

Read moreISSB

A comprehensive report builder for ISSB disclosures, focused on IFRS S2 requirements for climate.

Read moreSECR

Large UK companies need to report their climate impact to comply with Streamlined Energy and Carbon Reporting (SECR). Watershed’s all-in-one software makes it, well, streamlined.

Read moreTCFD

Watershed offers build-in support for TCFD, one of the universal frameworks for climate disclosures.

Read moreCustom reports and more

Create custom reports using metrics inside Watershed and access additional frameworks for things like BCorp, UK Tender, SASB for energy and more.

Request a demo

Watershed helped us understand the requirements, pull in all of our data seamlessly, and develop responses we’re confident in. Watershed makes reporting far easier.

Watershed supports a wide array of major voluntary and mandatory reporting frameworks such as those required for:

- CDP

- CSRD

- ISSB

- California climate laws

- SECR

- UK Tender

- TCFD

To get a full list and details on the coverage, it's best to talk with a Watershed representative.

The platform enables businesses to understand, report, and reduce their carbon footprints and produce audit-grade reports. Watershed's intelligent reporting system measures once and scales to all reports, taking the pain out of sustainability reporting with easily repurposable data, a guided report builder, and embedded benchmarks and expertise.

The platform also gives you a data foundation that can be packaged to fit nearly every major reporting requirement and adapted for specific customer or investor requests.