Watershed Finance

The complete ESG solution for financial institutions

Leading financial institutions use Watershed Finance to consolidate all their ESG data in one place for more efficient and reliable reporting.

Watershed works with financial institutions managing $14T in assets, including:

Explore interactive product tours

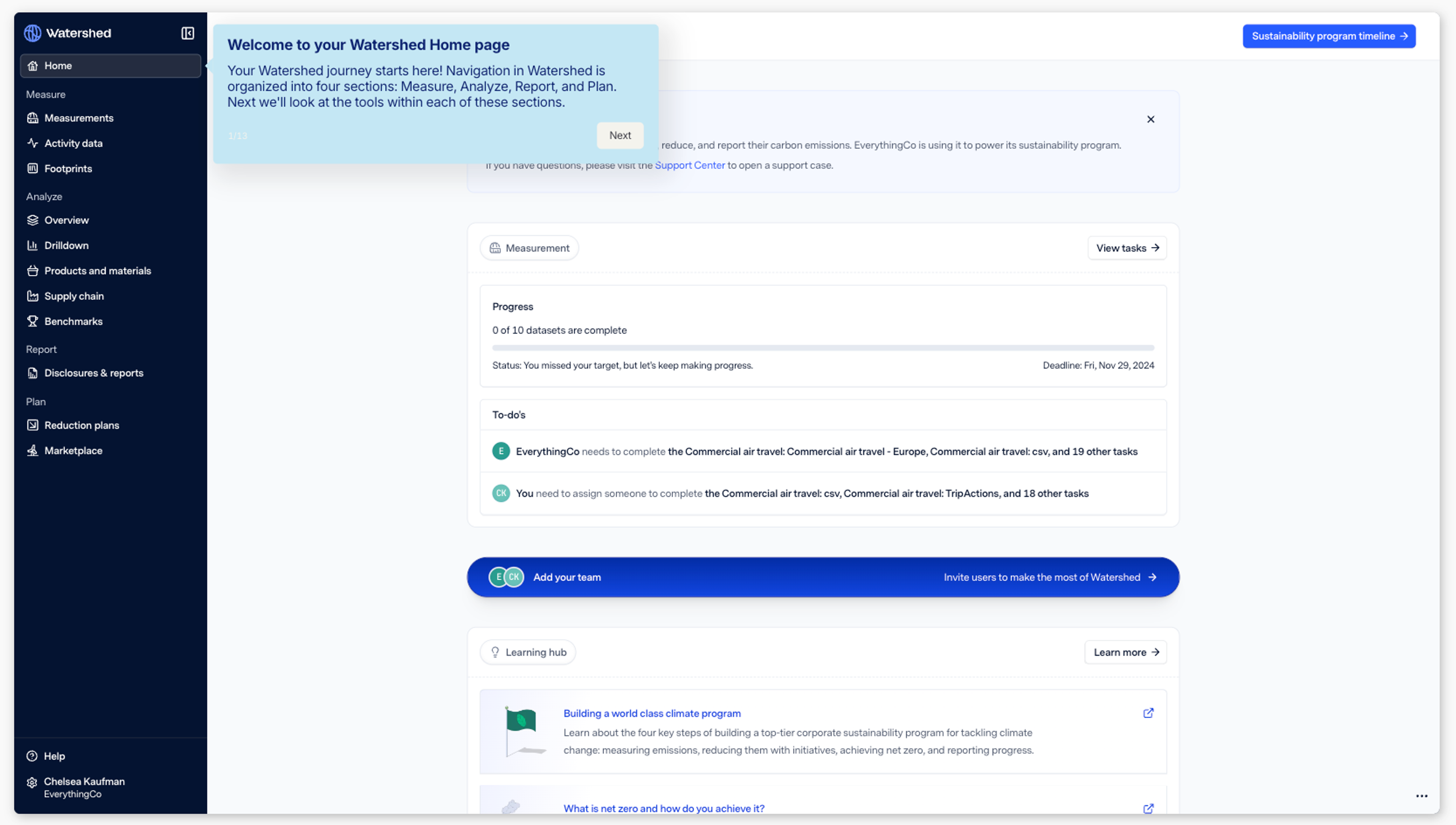

Click around interactive product tours to see the Watershed platform in action.

Consolidate all your data in one place

Get a complete and auditable view

Collect, estimate and aggregate carbon data from your core business and any assets in one place, reducing your costs and giving you sharper insights into your levers for progress.

Built-in data on 30m companies

Data from PCAF scores

External report databases like CDP

Survey data from your assets

CEDA global database of 60K EFs

Cover a wide range of asset classes

Scale your sustainability reporting using a growing number of asset classes covered within Watershed Finance including:

- Listed equity & corporate bonds

- Unlisted equity & business loans

- Commercial lines of insurance

- Sovereign debt

- Mortgages, and more.

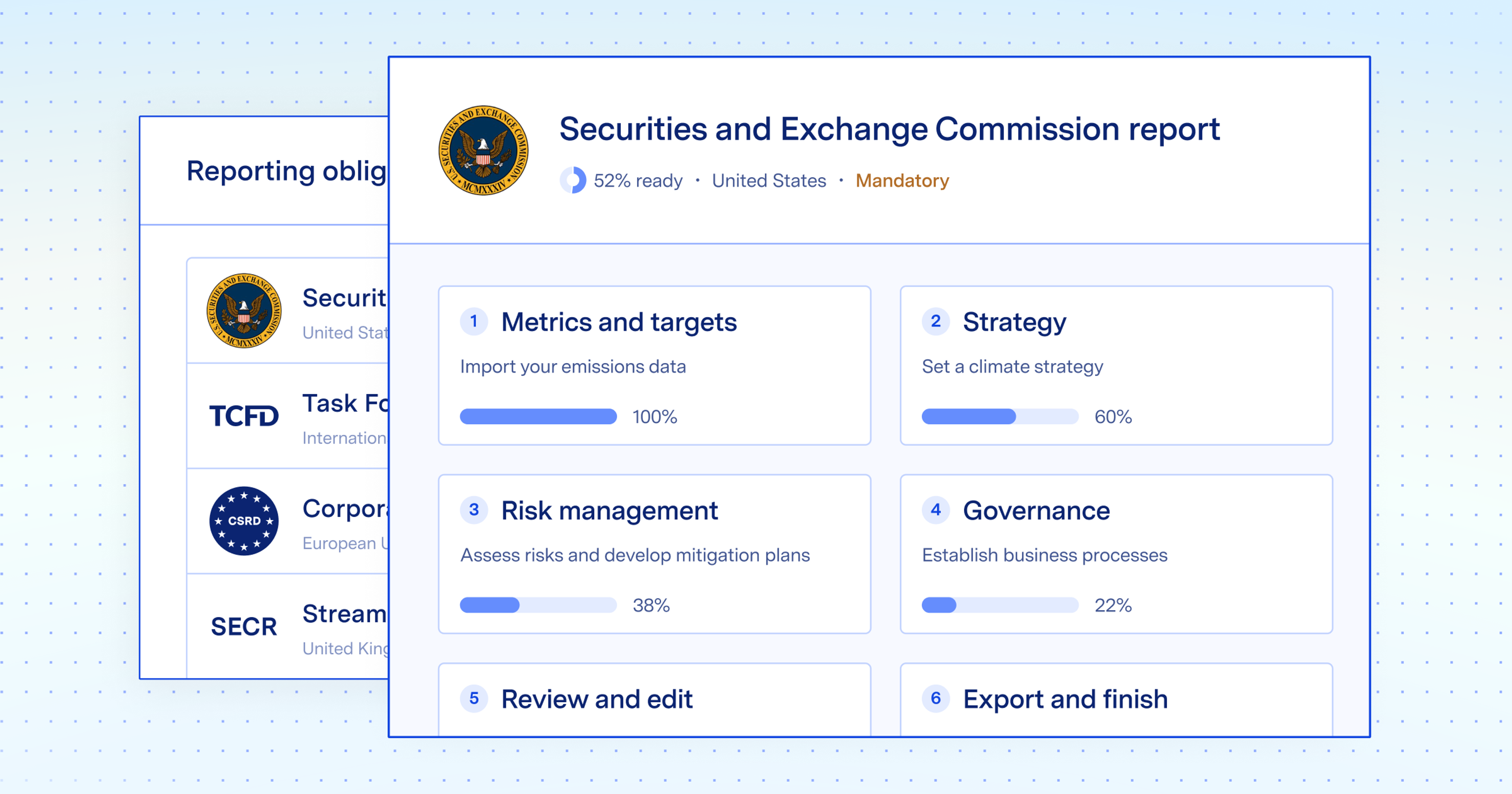

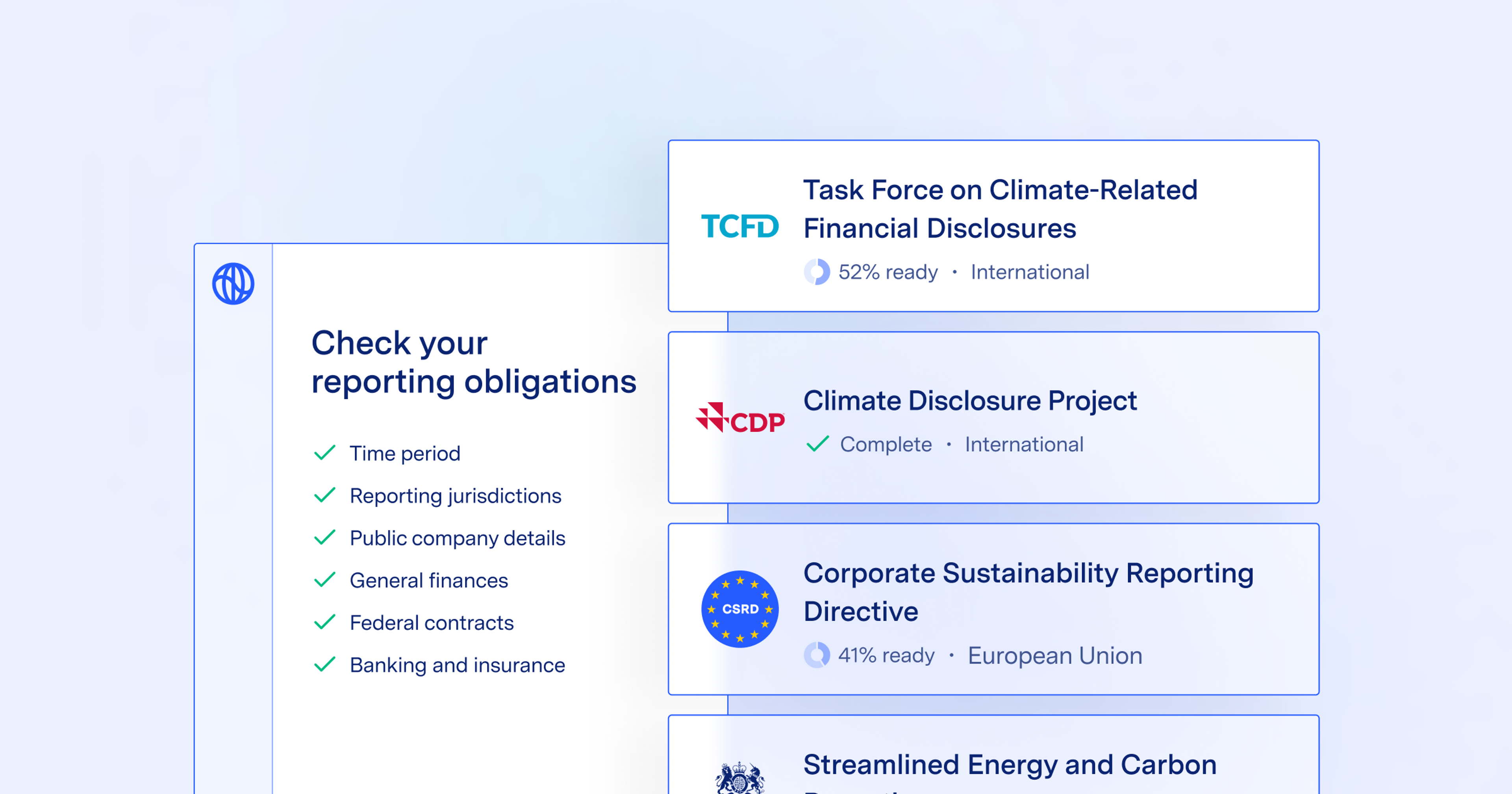

Power reports and business decisions

Better data leads to better outcomes

Watershed Finance enables you to harness advanced BI tools, peer benchmarking, and extensive in-house expertise in science and policy. This combination allows you to create comprehensive reports for LPs or regulatory bodies and make informed decisions with confidence.

PCAF expertise

Peer benchmarks

Rigorous estimation engine