In the aftermath of the US election, many sustainability leaders are examining whether the new administration will impact their corporate strategies and how to communicate these changes internally. To get a good perspective, it helps to start with where we've been and the potential impact of changes in US policy.

What did the Biden administration accomplish on climate?

Let’s start with where things stand today based on the policies enacted during the Biden administration. The Biden administration focused on a series of ambitious climate and renewable energy policies aimed at steering the US toward a low-carbon economy. Key actions included:

- Advancing renewables: The Biden administration’s primary climate policy was passing the Inflation Reduction Act (IRA), which allocated nearly $370 billion in tax credits, grants, and incentives for clean energy, aiming to reduce US emissions by up to 40% by 2030. This legislation has accelerated investments in wind, solar, EVs, and other renewable technologies, significantly boosting domestic clean energy production.

- Setting ambitious targets: In April 2021, President Biden set a new national goal to reduce emissions by 50% to 52% from 2005 levels by 2030. This was formalized in a nationally determined contribution (NDC) under the Paris Agreement.

- International reengagement on climate: The administration re-joined the Paris Agreement and worked closely with the EU and other countries on climate initiatives, reasserting US leadership in global climate efforts.

- Methane emission regulations: The administration implemented tighter regulations on methane emissions from oil and gas operations, which account for a substantial portion of US greenhouse gas emissions.

For corporate sustainability programs, these policies accelerated incentives to transition to clean energy, helping bring down costs over the last few years.

However, due to an increasing imbalance between supply and demand, clean power prices and forecast renewable energy credit (REC) prices increased in the months prior to the election after years of decline. Corporate demand for clean power has accelerated as more companies make climate commitments. At the same time, the average US clean power project now takes close to 5 years to complete (compared to 17 months before 2015). As a result, PPA prices increased to unprecedented highs in 2024, and 2028 REC futures—the REC price traders forecast in 2028—jumped to 3x today’s prices.

How might the new administration impact the energy transition?

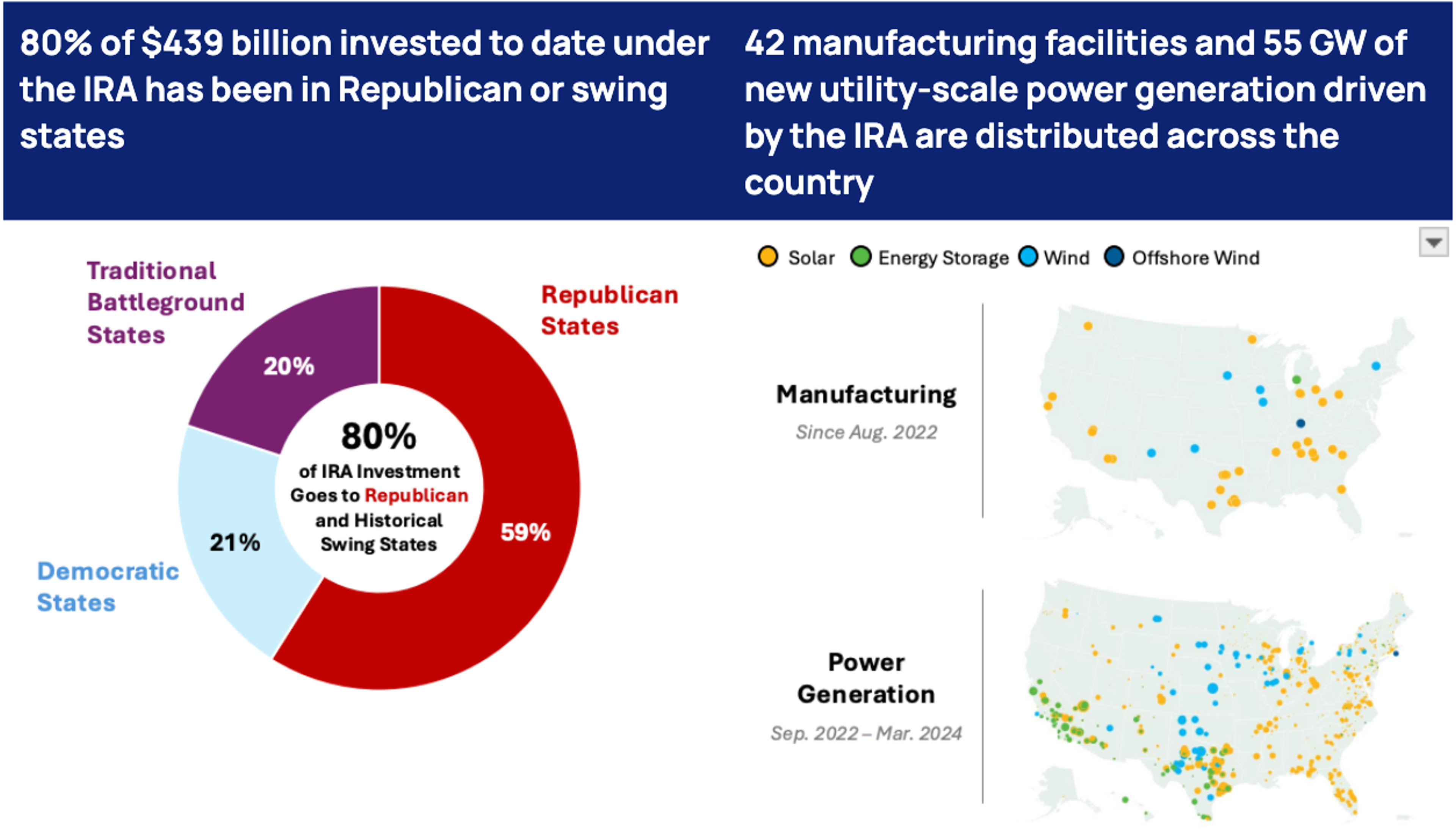

While the transition to renewable energy may slow under the new administration, it is unlikely to reverse course entirely. The key reason: the IRA may be difficult to roll back given its success at driving investment and job growth, especially in Republican states (the DOE estimated the IRA would lead to 1.5 million jobs created by 2030; most in "red" states). While Republicans may support the IRA, it still remains to be seen how President-elect Trump will approach the law, given his past statements in favor of repealing it.

Here are a few possible scenarios for how the next four years could play out:

- Renewable energy will continue to be a smart economic choice: Despite recent increases, clean energy is still cheaper than fossil fuel energy. In the US, the Levelized Cost of Electricity (LCOE) for new renewable projects is cheaper than the LCOE of 99% of operating coal plants.

- Renewable energy will continue creating jobs in America: Nearly 3.5 million people in the US work in the clean energy industry and last year, the IRA created 150,000 clean energy jobs.

- Renewable development will face investment uncertainty: Reduced federal support could diminish private sector confidence in renewable energy investments, especially in sectors heavily reliant on tax incentives and grants. Lack of clarity is already impacting clean power investments; post-election uncertainty caused a drop in clean energy stocks.

- Tariffs may slow the energy transition: If the new administration imposes tariffs on goods from countries like China, the cost of renewables components will increase, slowing growth. Chinese exports currently make up more than 80% of solar panel manufacturing.

What role will the private sector play in the energy transition?

While federal policy may shift, the forces driving clean energy adoption are more significant than any one administration. The private sector is likely to make progress regardless of federal government action, compelled by the following factors:

- Competitive pricing: Renewable energy is now cheaper than alternatives. According to Lazard, utility-scale solar and wind are now half the cost of gas and coal. But, it’s important to note that the supply crunch in recent months may intensify due to political uncertainty, which could pressure pricing.

- State-level support is accelerating: More than 30 states have renewable portfolio standards or clean energy targets, ensuring continued support for wind, solar, and battery storage. States including California, Michigan, Minnesota, and New York remain committed to ambitious climate goals, with state-level legislation that sustains demand for renewables.

- Private investors are the main source of capital: During Trump’s last presidency, before the IRA provided government support for renewables, the private sector contributed ~$600 billion to clean power development, significantly more than public funding. Private spending on renewables has since grown more rapidly than public spending.

- Global demand is reshaping the market: Investments in clean energy globally surpassed $1.7 trillion in 2023. US companies, particularly those with international operations, face growing pressure to meet clean energy targets abroad. Major companies are demanding action from their customers on scope 2 and 3 emissions, driving sustained demand for renewable power domestically.

How should companies prepare for a new clean power landscape under Trump?

Under the new administration, corporate leaders should prepare for a range of scenarios. Here are four steps sustainability leaders can take:

- Engage CFOs on budget planning: Clean power price volatility is likely to increase under the new administration. Communicate transparently with finance counterparts to hedge against unpredictable pricing.

- Accelerate timelines on scope 2 action: There will be increased competition for renewable projects, PPAs, and RECs as companies seek to secure project access against short and medium-term uncertainty. Acting in the near-term will help avoid longer-term instability.

- Diversify funding sources for renewables: For long-term PPAs, explore state, local, and private financing options to mitigate federal funding uncertainty.

- Strengthen resilience and adaptability: Consider investments in energy efficiency and on-site renewable generation to minimize dependency on federal incentives.

While federal action on clean power is uncertain, there is strong economic momentum for renewables. Companies that act quickly and decisively can seize opportunities to lock in favorable prices, bolster resilience, and reduce emissions.