Check if you have any corporate entities which are “doing business” in California. If their revenue is above $500M, you’re in scope for SB 261; if it’s above $1B you’re in scope for both. Subsidiaries can report at the parent level, but fees apply to each entity.

Watershed for California climate disclosures

Streamline SB 253 and SB 261 reporting

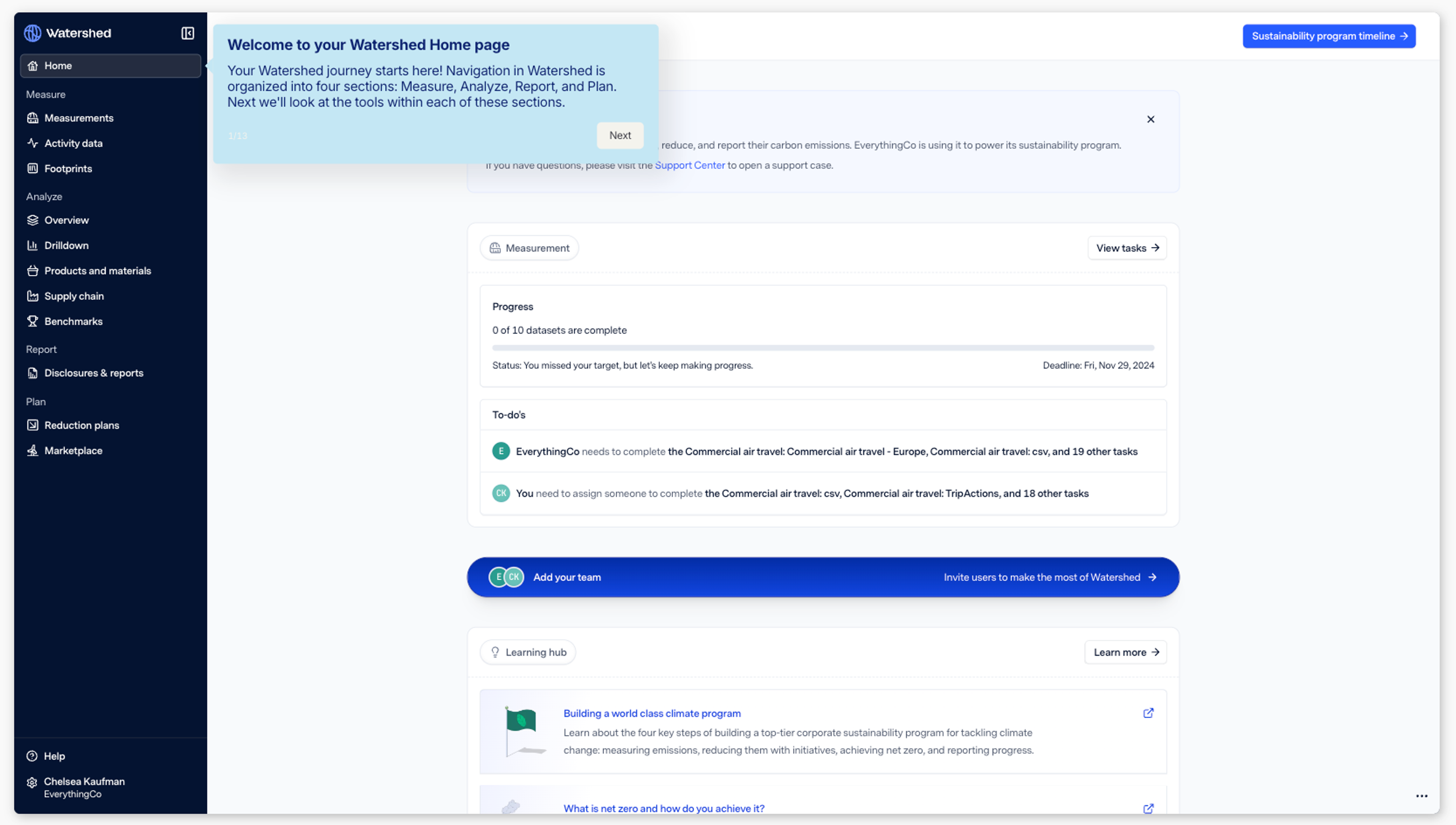

Measure emissions, assess climate risk, and publish your disclosure – all in one place. With software, AI, and expert guidance trusted by the world’s largest companies.

Trusted by 200 leading companies reporting to California

California's climate disclosure rules

SB 253: Companies with >$1B in global revenue must report their Scope 1 & 2 emissions with limited assurance; Scope 3 emissions in 2027. | SB 261: Companies with >$500M in global revenue must file a climate risk report. |

Streamline disclosure with Watershed

AI-accelerated climate-risk reporting

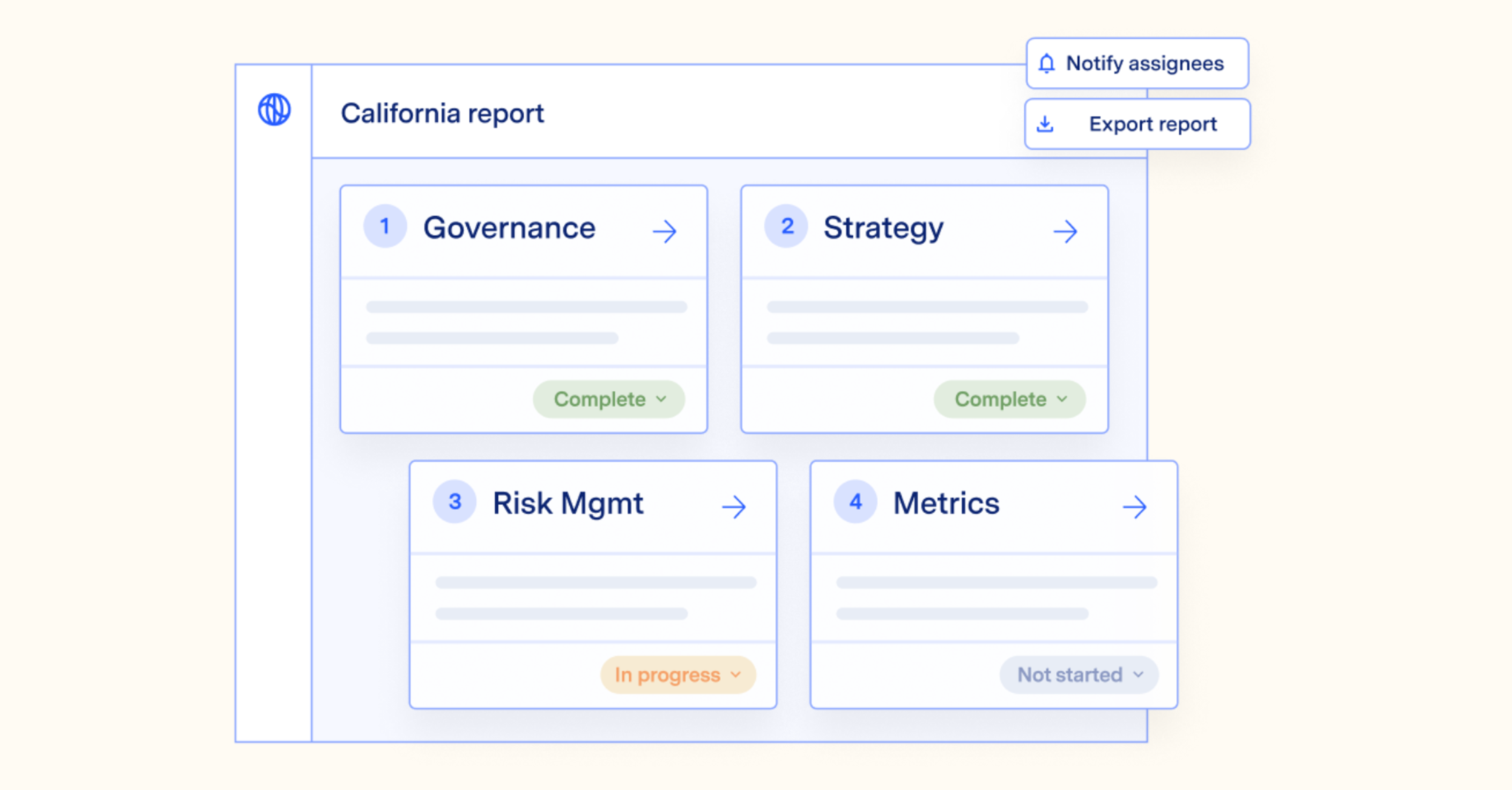

Move from data to disclosure faster with Watershed’s AI-accelerated reporting for SB 261. Generate a first draft aligned to the latest CARB templates, review guidance and peer examples, and refine with expert support. Built-in validation, citations, and real-time feedback ensure accurate, regulator-ready reporting in days, not weeks.

Audit-ready emissions measurement

Watershed combines audit-ready data, transparent calculations, and expert support to ensure your SB 253 emissions reporting passes third-party verification. Our guided report builder streamlines every step of preparing your disclosure, helping you submit with confidence.

Guaranteed Assurance program

When you sign up for our Guaranteed Assurance program, a Watershed expert will work with you and your auditor until you pass assurance for SB 253. If you don’t pass, we’ll waive fees for the following year, up to $250,000. Available to customers who use our standard methodologies and Verification Support package. See FAQ below for important terms and limitations.

Built-in expertise and support

Behind every report is Watershed’s team of policy, climate, and assurance experts. Our guidance reflects the latest updates from California regulators, ensuring your disclosures are accurate and defensible. Whether you’re developing your first report or refining an established program, you’ll have expert partners at every step.

Future-proof for what’s next

With Watershed as your end-to-end sustainability data platform, you can easily repurpose data for other reporting frameworks, such as CDP, ISSB, CSRD, and more. And with accurate data as your starting point, you can take informed steps to achieve real progress.

Explore our California climate disclosure solution

Click around our interactive product tours to see the Watershed platform in action.