Following the US election, we're sharing some initial thoughts on the implications of the election results for climate policy and corporate sustainability.

We’ll also host a series of virtual events to go deeper on these topics. On November 13, we’re hosting a virtual conversation with California State Senator Scott Wiener, architect of California’s Climate Corporate Data Accountability Act (CCDAA), which mandates carbon disclosure for large US companies. Join Senator Wiener for a conversation on what to expect from the CCDAA, and the trajectory of California climate policies in a Trump administration. Sign up here.

In the meantime, here are three key observations for corporate sustainability leaders:

Corporate climate disclosure is mandated for large global companies, regardless of who is in the White House

Mandatory climate disclosure is locked in for most large U.S. firms, independent of U.S. federal policy. Regulatory pressure is global, and increasingly a condition of market access:

- California’s disclosure law, the CCDAA, is signed, fully funded, and in the process of being implemented. Disclosures of scope 1 and 2 emissions begin in 2026 on 2025 data; scope 3 reporting begins in 2027. In practice, its impact is national, covering thousands of US firms doing business in California. Senator Wiener will share more at our event next week.

- US federal policy is not currently a driver of climate disclosure: the SEC’s proposed rule has been frozen in a court challenge and is unlikely to be implemented. California’s CCDAA applies to more U.S. companies with more stringent expectations (e.g., scope 3) than the SEC proposal.

- The EU’s Corporate Sustainability Directive (CSRD) captures over fifty thousand companies, including thousands in the U.S. that do business in the EU. The first wave of reporting begins in 2025. More on getting ready for the CSRD here.

- Globally, the ISSB’s disclosure standards are being implemented as mandatory requirements in over 20 countries, covering 55% of the world’s GDP. Those include the UK, Canada, Australia, Japan, China and Brazil. Many U.S. firms with a global footprint will be caught by those rules.

All eyes are on the IRA, where the outlook is unclear

The Inflation Reduction Act (IRA) was the Biden administration’s signature climate policy, injecting hundreds of billions of dollars into private sector deployment of clean energy and low-carbon industry and manufacturing. See here for a summary of the IRA’s impact over the last two years and here for a tracker of clean energy investment by quarter.

President Trump has opposed the IRA, and all eyes are now on whether his administration will slow or stop IRA funding. This will be a key lever for the impact of federal policy on total U.S. carbon emissions. One thing of note: 18 House Republicans have already advocated for maintaining IRA investments, citing job creation from energy tax credits.

We’ll keep you posted as discussions about the future of the IRA unfold next year.

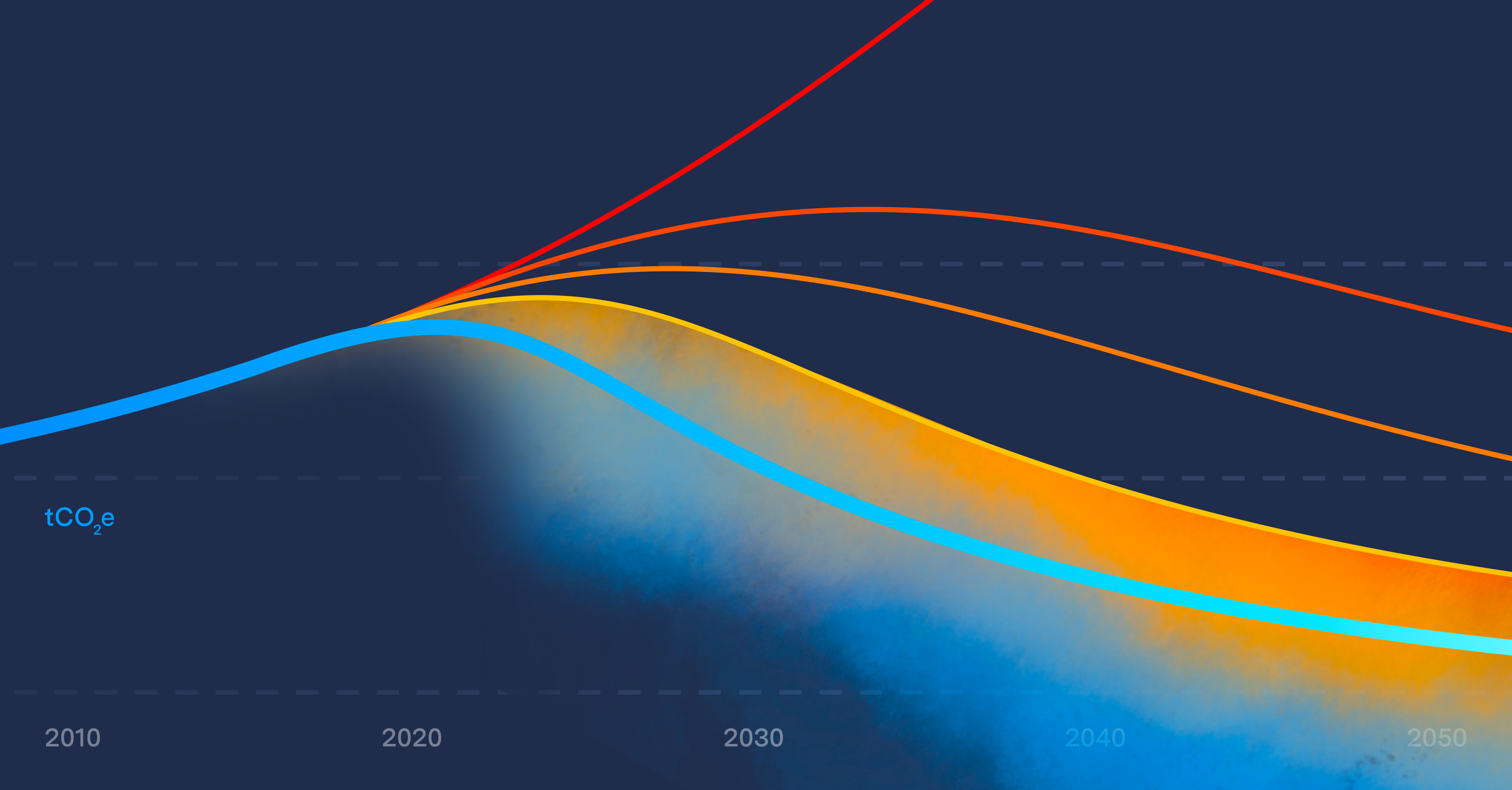

The underlying economics of the transition to net zero will continue to drive corporate action on sustainability

Beyond regulation, economic incentives—from cheap clean energy, customers, and investors—are motivating corporate action on climate. We expect this to continue to accelerate. Specifically:

- Clean energy is now cheaper than fossil fuel energy. For example, in the U.S., the Levelized Cost of Electricity (LCOE) for utility solar and onshore wind are now cheaper than natural gas and coal—even without incentives from the IRA. (See this excellent analysis from Lazard.) 91% of new electricity deployed in 2023 was from renewables, propelled by record purchases from corporate buyers.

- Over six thousand businesses have set Science Based Targets that have been validated by SBTi; these companies are requiring their suppliers to do the same. 21,000 companies reported to CDP in 2023, up 24% from the year before.

- Investors that steward over $130 trillion in capital have committed to funding the transition to net zero.