The EU has replaced their legacy ESG reporting programme—the NFRD—with the Corporate Sustainability Reporting Directive (CSRD). The CSRD will cover over 50,000 organisations, including an estimated 10,000 non-EU companies. It’s a big milestone for sustainability reporting: under the CSRD, ESG disclosures will be held to the same assurance bar as financial reporting. This means companies will now need to treat sustainability data with the same level of rigour as their finances.

The CSRD raises the bar for breadth and robustness in sustainability reporting, covering categories beyond carbon emissions, including pollution, water, waste, and biodiversity. It covers ten sustainability topics each in its own “standard.” Disclosures on each standard are only required if deemed “material,” i.e., posing a significant risk to that company’s operations or society.

The EU Commission singled out the climate change standard for extra scrutiny: if any company deems climate as immaterial, it requires a detailed explanation of why not (and a description of what could make climate material in the future).

The materiality assessment process—as well as the disclosures for any material topical standard itself—will need to gain assurance before disclosure.

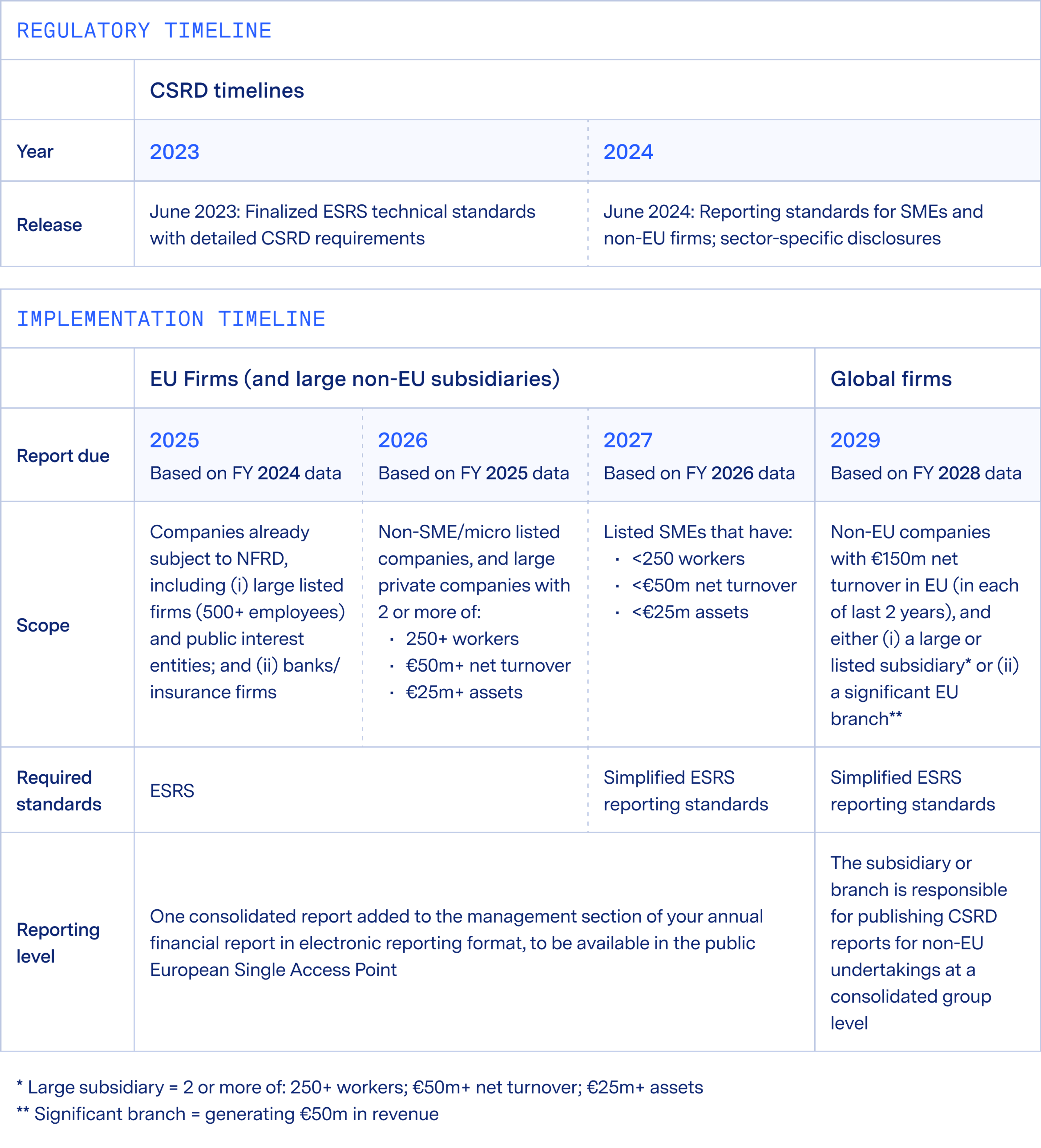

CSRD reporting requirements will be phased in waves, but the first reporting group (composed of more than 11,000 large companies) will need to begin reporting in 2025 on 2024 data.

It’s crucial that companies prepare by understanding how the CSRD applies to them, setting clear climate goals and building out audit-ready reporting infrastructure.

This guide covers five essential steps to start preparing for CSRD disclosure:

1. Understand your timeline & reporting level(s).

Implementation of the CSRD will roll out in four phases, starting in 2025 with companies already subject to NFRD reporting. The full sequence and details on the level of reporting required is laid out below, with EU firms' reporting timeline depending on their size:

While companies have the option to submit reports by entity to different member states, most companies are either consolidating across the EU into one report covering all of Europe, or—for some—reporting from the start at the global consolidated level. Beginning in 2029, all companies will need to report at the global consolidated level.

Most companies (49K+) begin reporting in 2025 and 2026.

2. Assess what your company is required to report on.

The details of what the organisations covered by the CSRD need to report on are laid out in the recently-finalised European Sustainability Reporting Standards (ESRS). These standards are grouped into ten different sustainability topics, and specify the detailed technical reporting requirements for each.

Firms falling under CSRD will need to assess which of the 10 sustainability topics are material to their business. Where those topics are material, the ESRS set out precisely what firms need to assess, measure and disclose, including relevant metrics and targets.

If a topic is deemed immaterial it is optional for companies to explain why–except in the case of climate, in which case every business is required to explain why it is not material. This communicates the EU’s expectation that climate change will be material for most businesses.

Understanding which standards are material for your business via a double materiality assessment is a critical step that defines what you will need to report on.

3. Assemble the team.

The scope of disclosures that the CSRD requires is unprecedented, covering everything from greenhouse gas emissions to the welfare of the workers in your supply chain. The broad scope means compliance will require tight project management and collaboration between multiple teams.

Align on the individuals and teams owning CSRD reporting, and notify teams who might need to be involved for data collection / sharing (e.g., HR, facilities, procurement). Many European companies are hiring or designating project managers specifically to focus on CSRD compliance.

4. Identify data gaps.

The CSRD’s standards require companies to share qualitative and quantitative data that may or may not be collected already. It’s important to ensure your company understands options for collecting data and builds a robust mechanism to collect, store, and update this data from the tonnage of hazardous waste produced to the number of bribery incidents reported last year.

Assessing the data requirements for each standard will highlight any gaps where your business might not have a process for data collection, or may not have answers (e.g., policies related to water, or to prevent bribery). The sooner your organisation identifies these gaps, the more time you will have to remedy them.

5. Go deep on climate.

The climate standard is one of the few standards that will be deemed material for most companies.

The CSRD climate disclosures require companies to not only report their full carbon footprint (Scopes 1 to 3) but also to share the risks climate poses to their business. Companies also need to disclose their transition plan—that is, a plan to align with a world where global warming is limited to 1.5 °C. Successful climate disclosure will require companies to work several muscles: collecting complex data, understanding climate science, and planning for long-term scenarios.

The climate standards are substantially aligned with TCFD (Task Force on Climate-related Financial Disclosures) reporting requirements, so companies that already prepare TCFD disclosures will have a head start. For any organisation that hasn’t disclosed climate data in the past, preparing a Scope 1-3 measurement, a Transition Plan, and a TCFD report are the best places to start.