Fashion is in the climate spotlight. Apparel is responsible for as much as 10% of global carbon emissions, leading regulators in the EU and UK to target this high-impact sector with new measures meant to limit greenwashing, improve sustainability, and accelerate the adoption of circular economy principles. Apparel companies will soon be required to label their products with unprecedented climate clarity—covering raw materials all the way through final disposal.

Governments have increasingly taken the view that consumer demand is difficult to change and too valuable to lose. So rather than focusing only on shopping frequency, they’re now also focused on ensuring that sustainability information is so accurate and accessible that shoppers can factor the climate impact of a new pair of jeans just as easily as they can its fit or price.

“Apparel companies will soon be required to label their products with unprecedented climate clarity—covering raw materials all the way through final disposal.”

In this guide we highlight the main programmes set to affect apparel companies in the EU and UK in 2023 and beyond—grouped by policy category. Rather than covering the dozens of proposed rules at exhaustive depth, our goal here is giving a clear sense of what kinds of climate data they ask for and why and how to act ahead of them.

Circular Economy Package (CEP)

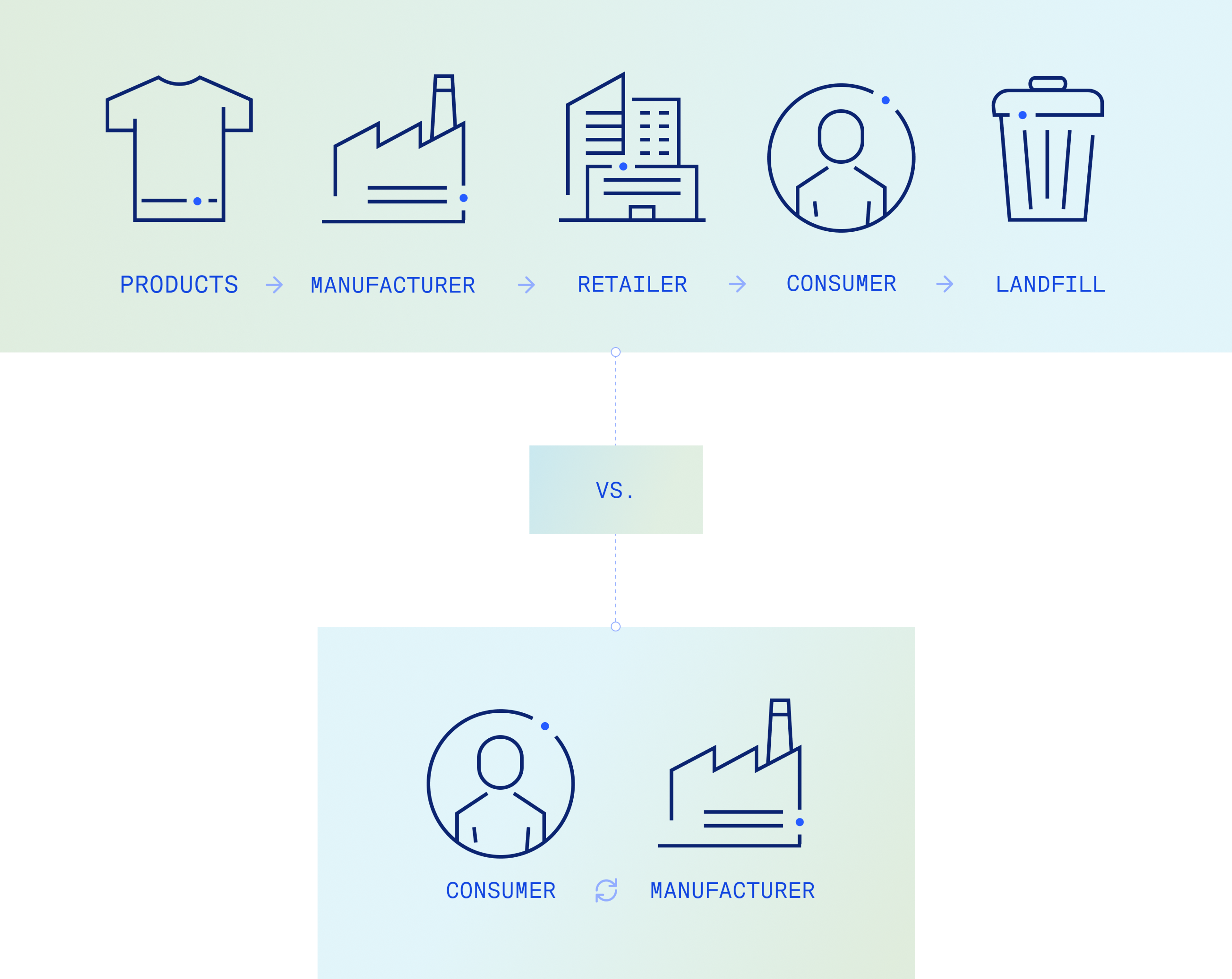

The EU’s Circular Economy Package (CEP) spans multiple pieces of legislation, collectively meant to nudge supply chains towards reduced waste, improved transparency, and more “circularity by design”—where care must be given to how goods are ultimately disposed of. The first proposals were released in March 2022, with the last four now expected in 2023.

Which regulations are set to affect the apparel industry?

One of the passed proposals—the Ecodesign for Sustainable Products Regulation, finalized at the end of 2023—calls for setting minimum criteria for circularity, energy efficiency, and carbon footprint reduction. Its rules will apply by product group, covering at least textiles, footwear, and common chemicals used in apparel manufacturing. Taken together with related initiatives, apparel companies will need to present retail consumers with a “Digital Product Passport” covering key sustainability details—likely including a materials overview, recycling information, and the product’s carbon footprint.

Similar digital labelling requirements are being considered by the UK as part of its own circular economy regime. While this planning is still in relative infancy, it’s expected to target the textiles industry with a “polluter pays” extended producer responsibility (EPR) scheme—where apparel companies will assume the financial burden of waste disposal.

Anti-greenwashing

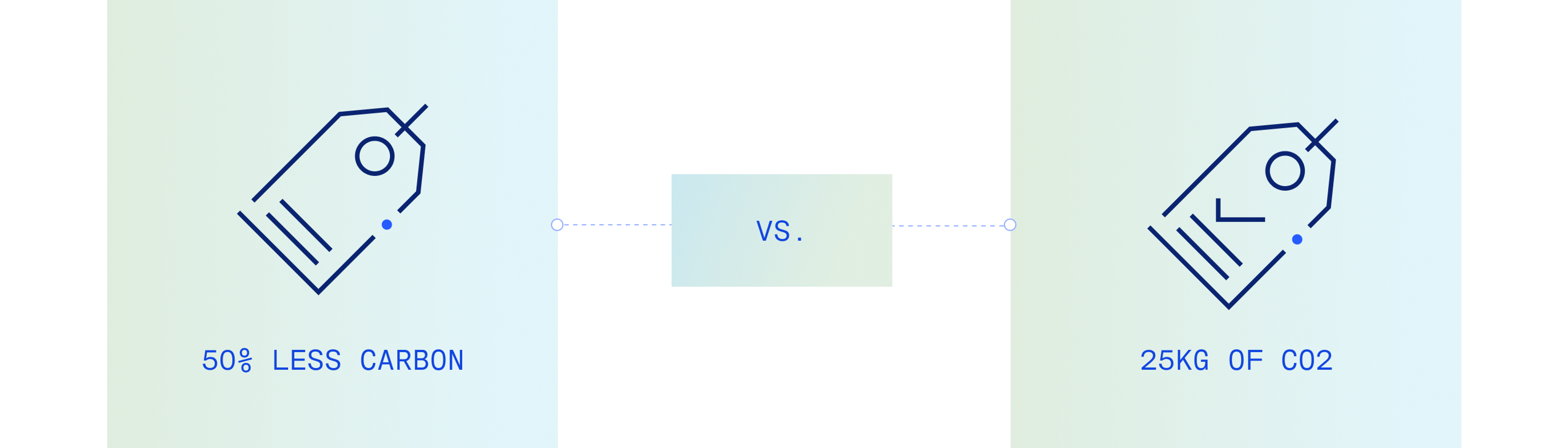

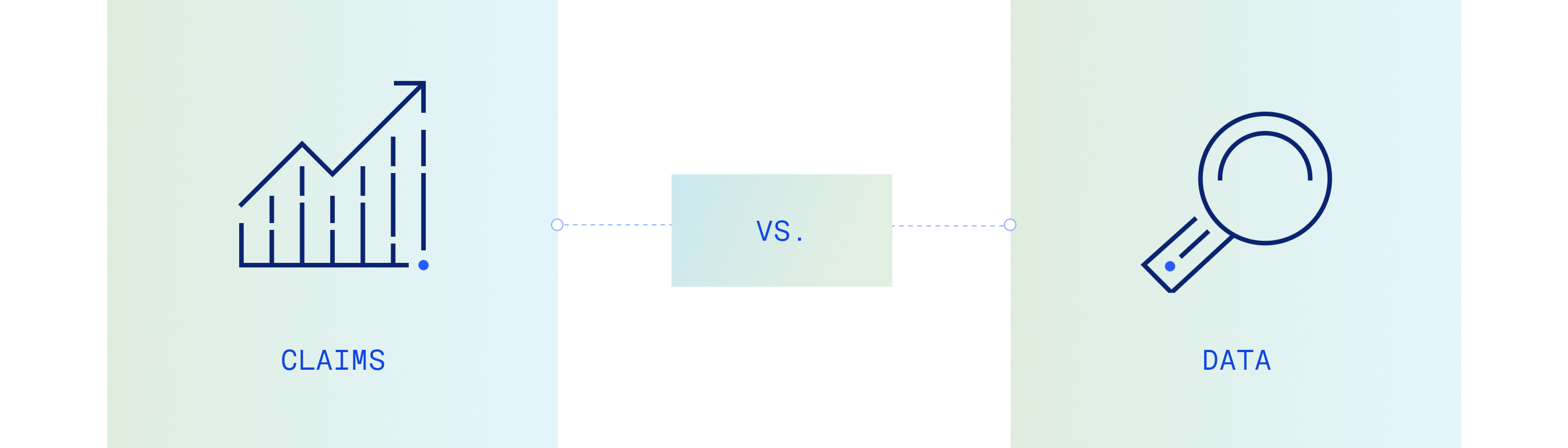

Regulators—on behalf of both consumers and investors—are increasingly asking companies to measure and publish the real climate impacts of their products, including emissions from their supply chains. Vague claims are out; increasingly precise disclosures are in. Companies will soon be judged by consumers on their actual climate impacts today, not their far-off plans.

To this end, the UK Competition and Markets Authority (CMA) published its Green Claims Code in 2021. Its six key principles include that all environmental claims be truthful, unambiguous, and substantiated. While the UK’s underlying regulatory approach is still being developed, the endgame is clear: companies that claim greenness need to back it up with hard data.

The EU has adopted a more forceful approach through its Proposal on the Substantiation of Green Claims. This proposal, which was formally adopted in March 2023, builds on existing measures to mandate that marketing claims like “net zero”, “planet neutral”, or “50% lower emissions” will only be allowed when substantiated by formal Product Environmental Footprint methodology—ie. when accompanied by rigorous life cycle assessments covering 16 sustainability impact categories including climate change.

Supply chain due diligence

It will no longer be enough to ask suppliers if they’re doing enough to curb harms. New regulations will soon require gathering and verifying hard data, especially around carbon. Pending final negotiations in Spring 2023, the EU’s Corporate Sustainability Due Diligence Directive (CSDDD) is set to apply to roughly 17,000 firms. While the textiles industry has already been identified as a high-impact sector, a wider scope of apparel companies will also be caught based on the anticipated business size thresholds.

In-scope companies will need to carry out specific steps to identify, prevent, mitigate, and bring an end to adverse human rights and environmental impacts throughout their supply chains. This includes adopting a plan demonstrating that strategy across the value chain is aligned with limiting global warming to a 1.5°C trajectory. Plans should identify the extent to which climate change is a risk for, or an impact on, the company’s operations. Where climate change is identified as a risk, they will need to include emissions reduction goals as part of their climate change plan.

Given widespread investor appetite for this data, non-EU jurisdictions including the UK are likely to follow on with similar proposals.

Sustainability reporting

European policymakers significantly raised the bar for robustness in ESG reporting with their CSRD regime, which sets out new and heightened reporting standards for sustainability information. While its number of total disclosures was reduced in later negotiations, many of the cut disclosures are expected to be re-introduced in the sector-specific standards now being developed—which will include apparel companies as a high priority. While these rules are being passed at the speed of bloc politics, some individual member states are acting with greater urgency. Germany’s “Green Button” framework has required detailed disclosures from apparel companies since 2019, and is likely to influence final EU standards.

At a global level, ISSB—the body responsible for creating a harmonised international baselines for this sort of sustainability reporting—is also determining which industries to identify as priority sectors. If textiles is included, as it has been elsewhere, this is likely to trickle down to national-level programmes globally, including the UK’s SDR.

While these new requirements impose significant and demanding expectations, they’ll also drive significant revenues to companies that act decisively on decarbonisation. As consumers gain the ability to shop on climate impact, companies that can tell the best story—using real data, not PR messaging—will see new sales follow.

Watershed helps leading retailers like KEEN Footwear, SKIMS, and Warby Parker measure, report, and act on their emissions. Watershed Supply Chain allows consumer goods companies to visualise and quantify the impact of their materials, manufacturing, transportation, and packaging options—arming decision-makers with real, science-backed numbers to guide them.

If we can help with any of this, please get in touch with our London HQ.