Switching to zero-carbon electricity is one of the most powerful steps a company can take to reduce its carbon emissions. But this seemingly simple act—purchasing clean power—masks what in reality is a very complex task.

In a perfect world, every company that wanted to reduce emissions from its electricity would connect solar panels or wind turbines to each of its factories, offices, stores, and warehouses. In reality, that’s not feasible. Most businesses rely on indirect methods to clean up their power sources. These methods vary significantly in impact, price, and complexity, which can be difficult for buyers to navigate.

This guide will cover two of the most common strategies—buying RECs, and participating in a VPPA—as well as the fixed-price VPPA, a brand new product available to Watershed customers.

What are Energy Attribute Certificates (EACs) and Renewable Energy Certificates (RECs)?

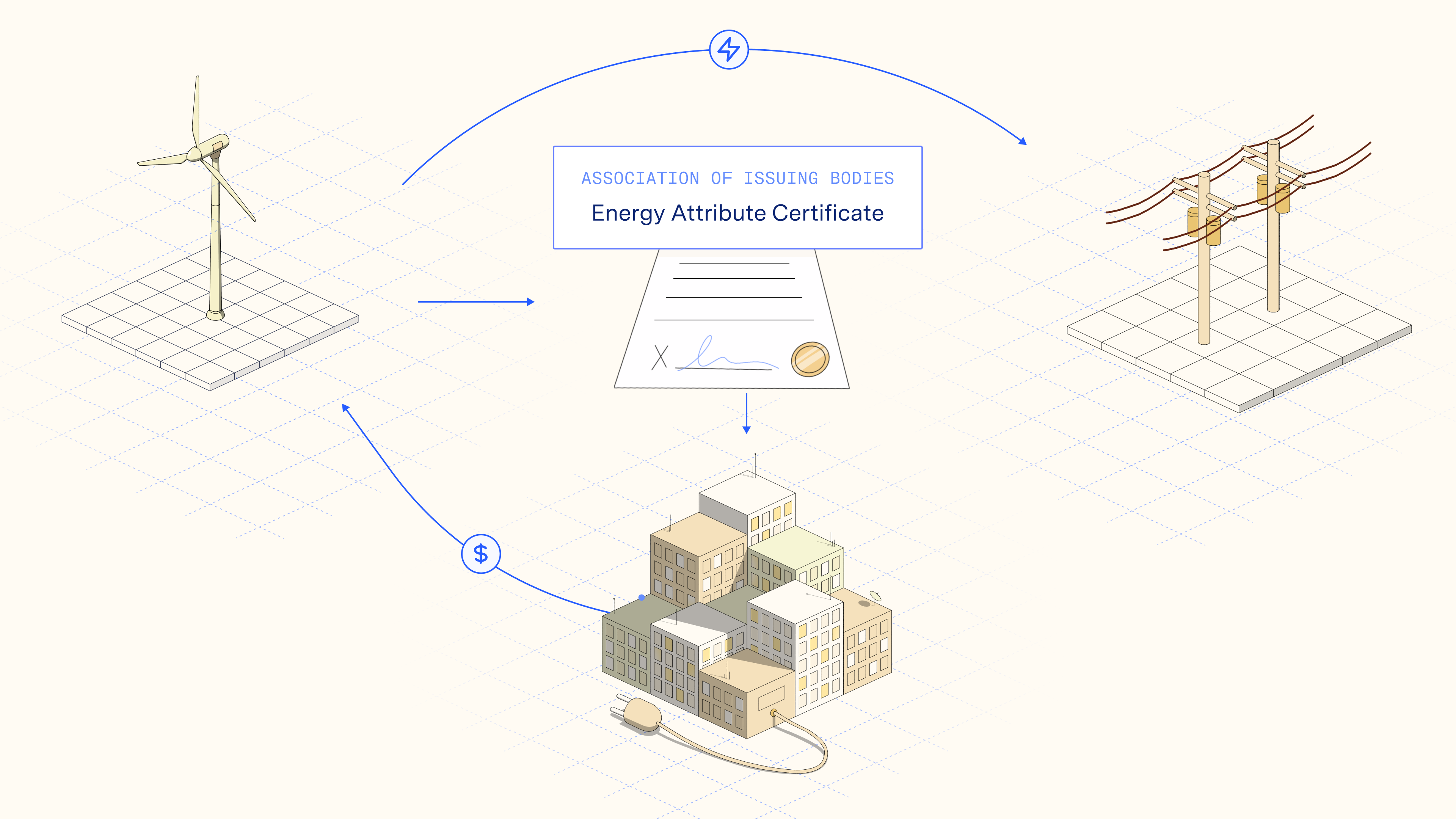

When a renewable energy source generates power, it is actually generating two products that it can sell: (1) the electricity and (2) the “credit” for the creation of this renewable electricity. The credit is formalized as an Energy Attribution Certificate (EAC), or Renewable Energy Certificate (REC) as they are known in the US.

These certificates are sold by power developers or utilities. Businesses buy them because they can be used towards reductions in their carbon footprint. This helps support a healthy marketplace for renewable energy, and allows companies to invest in clean power even if they don’t have the physical space, or logistical manpower to build their own solar plants or wind farms.

But it can be difficult for a buyer to discern the quality of each REC. Many RECs are associated with power that would have been generated anyway, so the associated reductions have low “additionality,” a measure of reduction impact. Most RECs are not associated with bringing new power onto the grid.

What is a Virtual Power Purchase Agreement (VPPA)?

A higher-impact, higher-complexity way for companies to reduce their emissions is through a virtual power agreement, or a VPPA. A VPPA is a financial contract between a buyer—usually a business—and a renewable energy project.

The two parties enter a long-term financial agreement in which the buyer agrees to ensure the project earns a fixed price when the electricity is sold in a wholesale market. This fixed number, called the “strike price,” is agreed to for a certain period of time, often around 15 years.

This guaranteed revenue is necessary for the project developer to secure financing needed to build a new, clean energy project. The buyer also receives all the RECs associated with this energy, which count as reductions toward their overall carbon emissions. The buyer doesn’t actually use the physical electricity. Instead, it continues to rely on its local power, and settles with the project to ensure it is earning the agreed strike price for the VPPA’s renewable energy.

But the buyer is now exposed to some financial risk—and potential upside. If the market price of power goes below the strike price, the buyer pays the difference to the project. If the price goes above the strike price, the buyer reaps the profit.

This financial risk is a barrier for many companies, along with the long time commitment. Placing a good bet on the right strike price for a particular project requires complex forecasting and deep knowledge of the energy markets. Typically only the biggest, most profitable companies have the resources to do this, and that’s reflected in the numbers: in 2021, more than 300,000 companies bought RECs while only around 600 participated in VPPAs or PPAs (PPAs are similar to VPPAs, but in a PPA, the buyer does buy the physical electricity).

Fixed-price VPPA: how is Watershed’s VPPA different?

Watershed—in collaboration with our financial partners—has introduced a new fixed-price VPPA that makes clean energy more accessible and affordable to more companies.

The “fixed price” in this case refers to the RECs. In our model, the buyer does not participate in the sale of electricity from the VPPA, meaning they do not need to make any predictions or long-term commitments based on the price of power. Instead, the project sells the electricity to the grid.

The buyers only buy the RECs, at a fixed price that does not fluctuate. This allows them to lock in years of high-quality reductions to their carbon footprint at a predictable cost, and provides the project developer with the guaranteed revenue needed to finance construction. The time commitment for the buyers is only five years, much shorter than a traditional VPPA agreement.

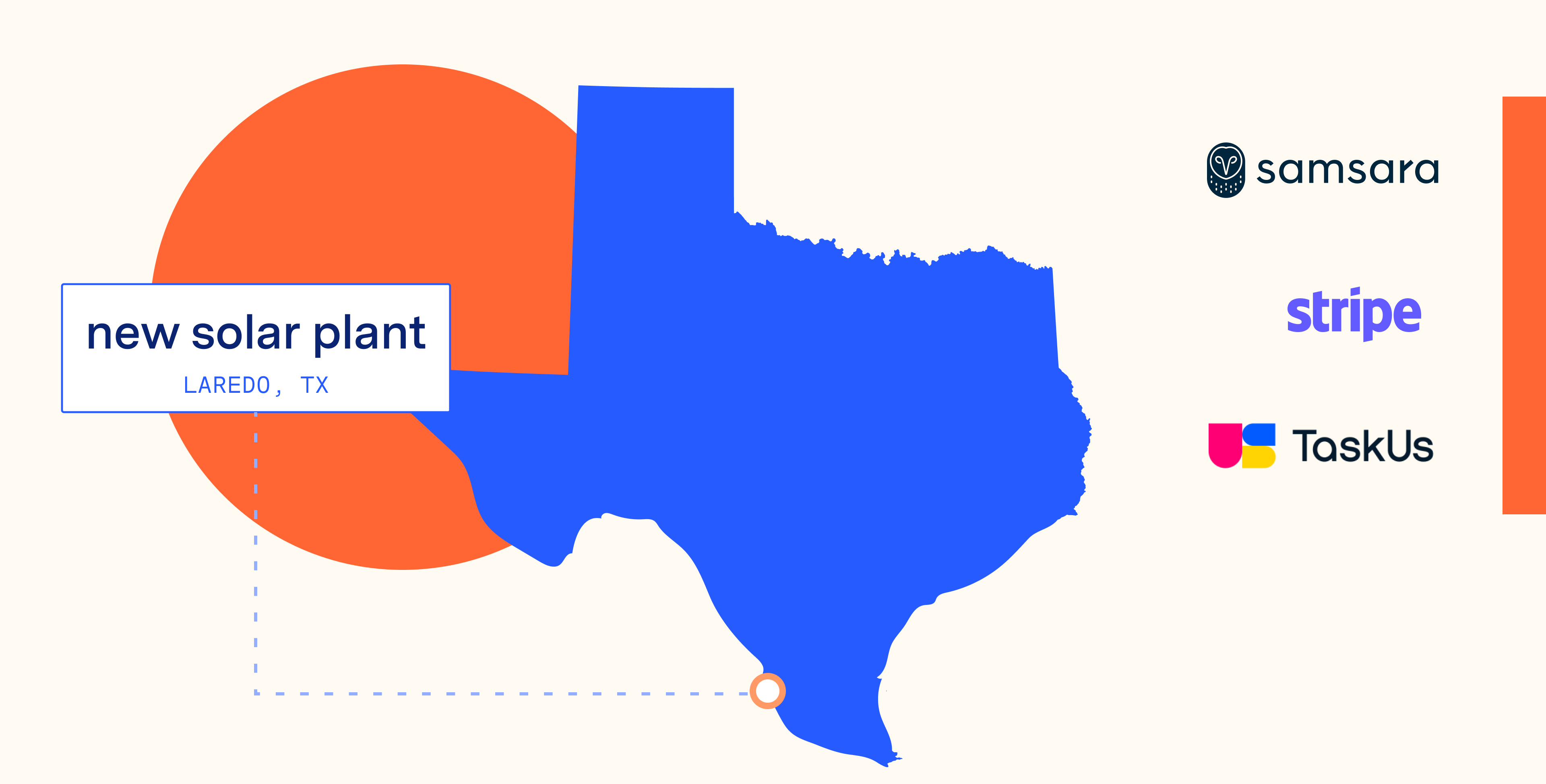

Watershed’s first fixed-price VPPA, created in partnership with Ever.green, is supporting the construction of a new solar plant in Laredo, Texas. The buyers include Watershed customers Stripe, Samsara, and TaskUs. By aggregating several companies together, we enabled them to support something bigger than any of them would have done on their own.

The plant will avoid 13,000 tons of CO2 emissions every year, equivalent to taking nearly 3,000 gas-powered cars off the road each year. About two-thirds of all electricity in Texas comes from coal or natural gas, so bringing new renewables onto this fossil fuel heavy grid is especially impactful.

This is just one of many fixed-price VPPAs Watershed is offering. Want to learn more? Get in touch!