In late 2022, the UK government released its first set of proposals for its new Sustainable Disclosure Requirements (SDR) regime, starting with a suite of five proposed rules for UK-regulated asset managers. Taken together, these proposals require all UK financial products marketed with words like “sustainable” to be backed by real action. Those actions must be summarised for consumers via consistent, easily-parsed, easily-located disclosures.

Crucially, this means that the firms creating financial products will soon be approaching the companies that make up their portfolios and asking for their climate and sustainability data.

These proposals are just the first wave of a larger push to minimise greenwashing and promote meaningful sustainability across the British economy. Future waves are expected to strengthen these requirements, and to include rules for UK companies more broadly, as SDR begins to slowly consolidate most existing UK sustainability disclosures initiatives.

This post covers the main points that asset managers need to know: which financial firms and products are covered, what they need to disclose, and key programme timelines.

“These proposals are just the first wave of a larger push to minimise greenwashing and promote meaningful sustainability across the British economy. ”

Global context: How SDR fits

Many global financial firms will soon have multiple sustainability disclosure regimes to report into—including SDR in the UK, SFDR in the EU, and upcoming SEC rules in the US. While these programmes are meant to align on key points—particularly through the ISSB’s efforts to harmonise ESG disclosures globally*—that harmonisation is still in its early days. Notably, several of the SDR’s suggested rules were written to shore up perceived weaknesses with the EU’s equivalents. We cover the most essential differences below.

*The UK's Financial Conduct Authority is already working to align with ISSB. Further detail on UK-ISSB alignment will be released via the UK’s updated Green Finance Strategy, due March 2023.

What companies does the SDR apply to?

The proposed rules cover all investment funds administered by UK-regulated asset managers and distributors of financial products. Unlike similar programmes, these proposals apply to all covered firms regardless of size—-with one limited exception in Proposal #3 below.

The UK government has also announced its intent to gradually expand the SDR regime to include pension products, listed issuers, and overseas products marketed into the UK.

The five proposed rules

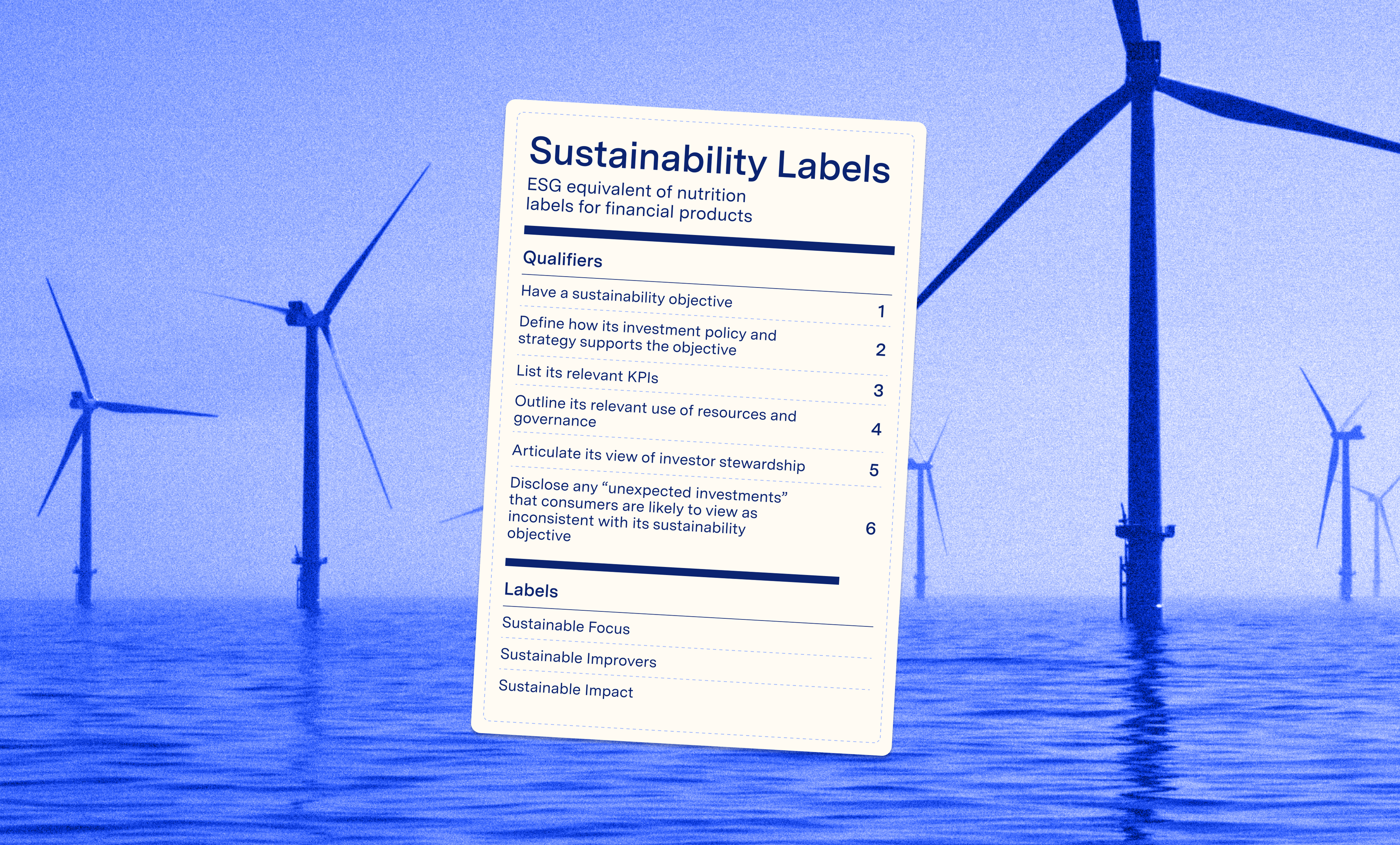

Sustainability labels

The core idea here is creating the ESG equivalent of nutrition labels for financial products, giving potential buyers granular context on whether and how the underlying investments actually promote greater sustainability. While the EU’s SFDR regime does something similar, one of its most popular labels (“Article 8”) has been criticised for loose criteria that make impact vague. The UK has opted towards making sure buyers can shop by the aspects of sustainability that are important to them, backed by clear objectives and meaningful data.

To qualify for any of the three available SDR labels, a financial product must (1) have a sustainability objective, (2) define how its investment policy and strategy supports the objective, (3) list its relevant KPIs, (4) outline its relevant use of resources and governance, (5) articulate its view of investor stewardship, and (6) disclose any “unexpected investments” that consumers are likely to view as inconsistent with its sustainability objective.

- Label 1: “sustainable focus”. Products where at least 70% of underlying investments meet “credible” ESG standards. The UK’s Green Taxonomy, once finished, is likely to be one such standard. Alternative standards are also still being discussed.

- Label 2: “sustainable improvers”. Investments that may not meet credible ESG standards today, but that are on a clear course towards greater sustainability. 100% of included investments must have a demonstrable pathway there, including KPIs and a progress tracker. Each covered product must also disclose its “escalation triggers”, or the steps it will take if progress doesn’t come—all the way up to potential divestment.

- Label 3: “sustainable impact”. These products must have an objective that contributes towards solving an environmental or social problem—ie, a sustainability ambition that’s clearly significant. These products must also have a divestment plan for any assets that fail that ambition.

While products aren’t required to have a label, all will still be subject to Proposal #4 below, which restricts them from otherwise suggesting sustainability in their names or marketing.

Customer-facing disclosures

While financial products may be sold without an SDR label, all products—regardless of whether they’re marketed as sustainable—will need to come with easily-understood disclosures that outline: (1) the product’s sustainability objective, if it has one, (2) how it performs against that objective, (3) how its asset selection factors sustainability, if it does.

While the requirements will be softer at first for products that don’t have an SDR label, this is likely to change over time.

Detailed disclosures

As the disclosures from Proposal #2 are intended to be parsed at a glance, the UK also requires more comprehensive disclosures to be made available covering additional details like how firms are managing sustainability-related risks and opportunities.

The more advanced disclosures fall into three categories, the second and third of which only apply to financial products that have SDR labels.

Category #1: entity-level reports

Covered firms must publish a report covering the firm as a whole, using an extended version of TCFD that covers broader sustainability-related disclosures. (The ISSB’s new standards will likely supplant TCFD as the basis here.) This report must also cover the firm’s “financed emissions”—ie. their fair share of emissions from portfolio companies.

This requirement applies regardless of whether a firm applies for SDR labels for their products. However, firms with under £5B in AUM (calculated on a three-year rolling basis) are currently exempt—the only threshold-based exemption in these new rules. Firms that offer at least one product with an SDR label must also disclose additional information on governance and resource allocation.

Category #2: pre-contractual product reports

Before selling a financial product, firms are required to provide potential investors with a disclosure that covers key sustainability information in detail—ie. a more fleshed-out version of the glossier summary required in Proposal #2.

This requirement only applies to products that use an SDR label, or that otherwise advertise having a sustainable investment strategy.

Category #3: progress product reports

To ensure that investors can access up-to-date information on how well financial products are performing against their sustainability objectives, firms must compile and publish progress reports on at least an annual basis—building on the information disclosed in the pre-contractual reports, detailed in a way that meets TCFD (and eventually ISSB) disclosure minimums.

This requirement only applies to products that use an SDR label.

Naming and marketing rules

To prevent firms from opting against the rigour of qualifying for an SDR label while still trying to convince customers that its financial products are sustainable, SDR will restrict the language that firms can use in naming and marketing their products.

Products without an SDR label will be prohibited from using the word “sustainability” or any equivalent that implies sustainability characteristics—including at least “ESG”, “environmental”, “climate”, “green”, “net zero”, “impact”, “responsible”, “SDG”, and “Paris-aligned”.

In addition, a companion anti-greenwashing rule will require all sustainability claims to be “clear, fair, and not misleading”. This rule will take effect immediately once SDR is finalised, and is likely to be the basis of swift enforcement action.

Requirements for distributors

While most of these rules are focused on the firms that create financial products, SDR will also require the firms that distribute these products to display labels prominently and make all consumer-facing disclosures available to potential buyers. If you’re buying a financial product in the UK—no matter from whom—the same data should be readily available in a prominent way.

What is the timeline of the SDR regime?

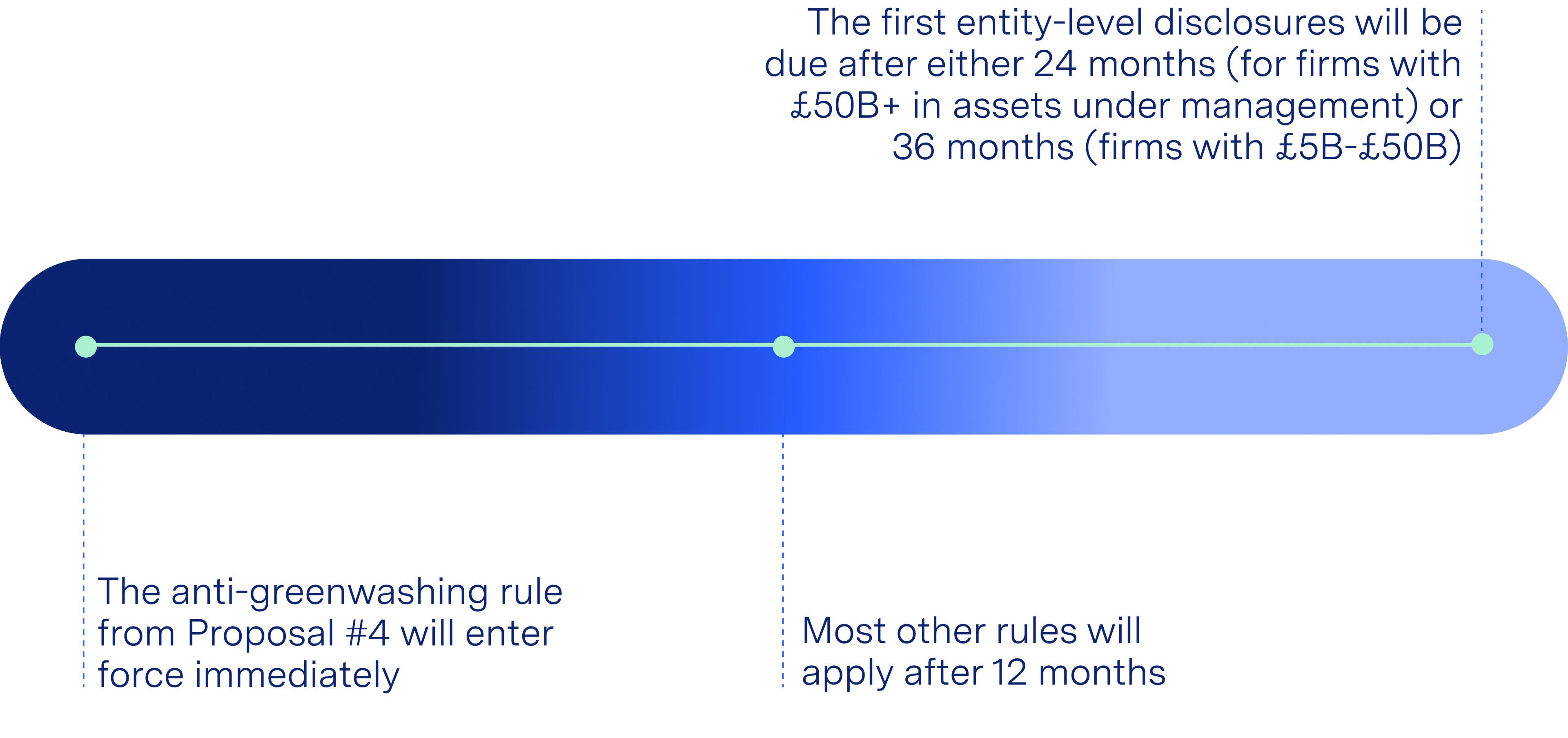

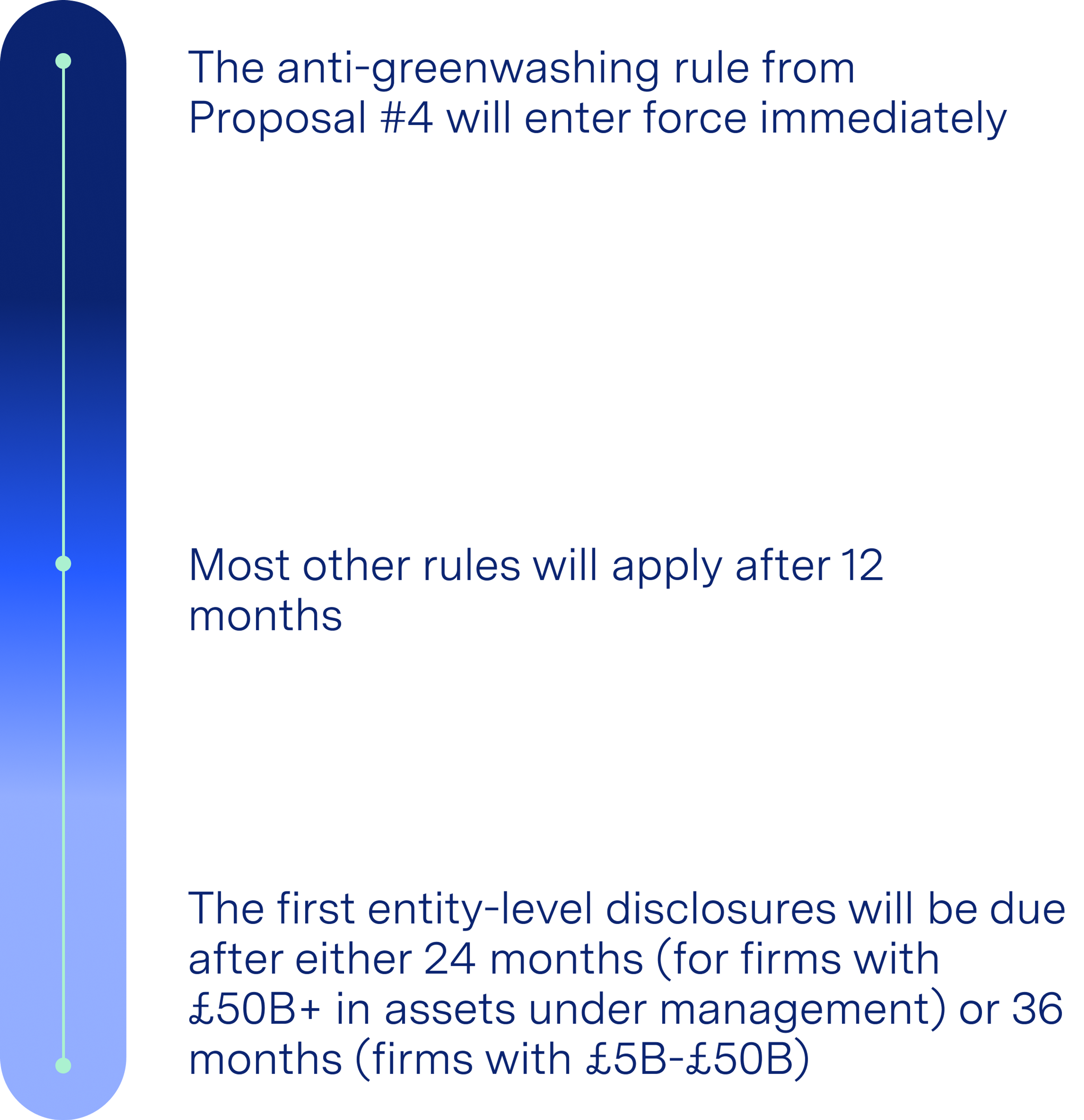

The new rules are expected to be finalised by July 2023, and to be phased in as follows:

Watershed helps leading financial firms like Carlyle, Oakley, and Bain Capital measure, manage, and report their emissions—including their financed emissions from their portfolio companies. If we can help you prepare for these requirements, please get in touch.