Over the last decade, the environment in which businesses operate has been upended. Regulation, science, and ultimately a cultural shift have put climate action at the center of corporate responsibility.

Through international agreements and national regulations, efforts led by governments and NGOs to combat climate change have expanded meaningfully—but success depends on the private sector, which is responsible for the vast majority of global carbon emissions. As pressure mounts from investors, consumers, and regulators, a world-class climate program is no longer a ‘nice-to-have’—it is a business imperative that’s critical to financial success.

The good news? Prioritizing sustainability helps you win as a business. Here's some of the data behind why climate programs are good for business.

1. Get investor premiums and better access to capital

Investors and corporate lenders are increasingly assessing corporate climate programs as a contributing factor in their business decisions; climate risk is investment risk. Suppose you operate an emissions-intensive business in a country that will soon require climate disclosure, or have business partners and consumers who increasingly make decisions based on a company's climate performance. These concerns can have a significant impact on your bottom line—and, as such, are top of mind for investors as they consider long-term viability. Today’s investors expect companies to not only understand the climate concerns facing their business, but to disclose them—and have a plan for mitigation.

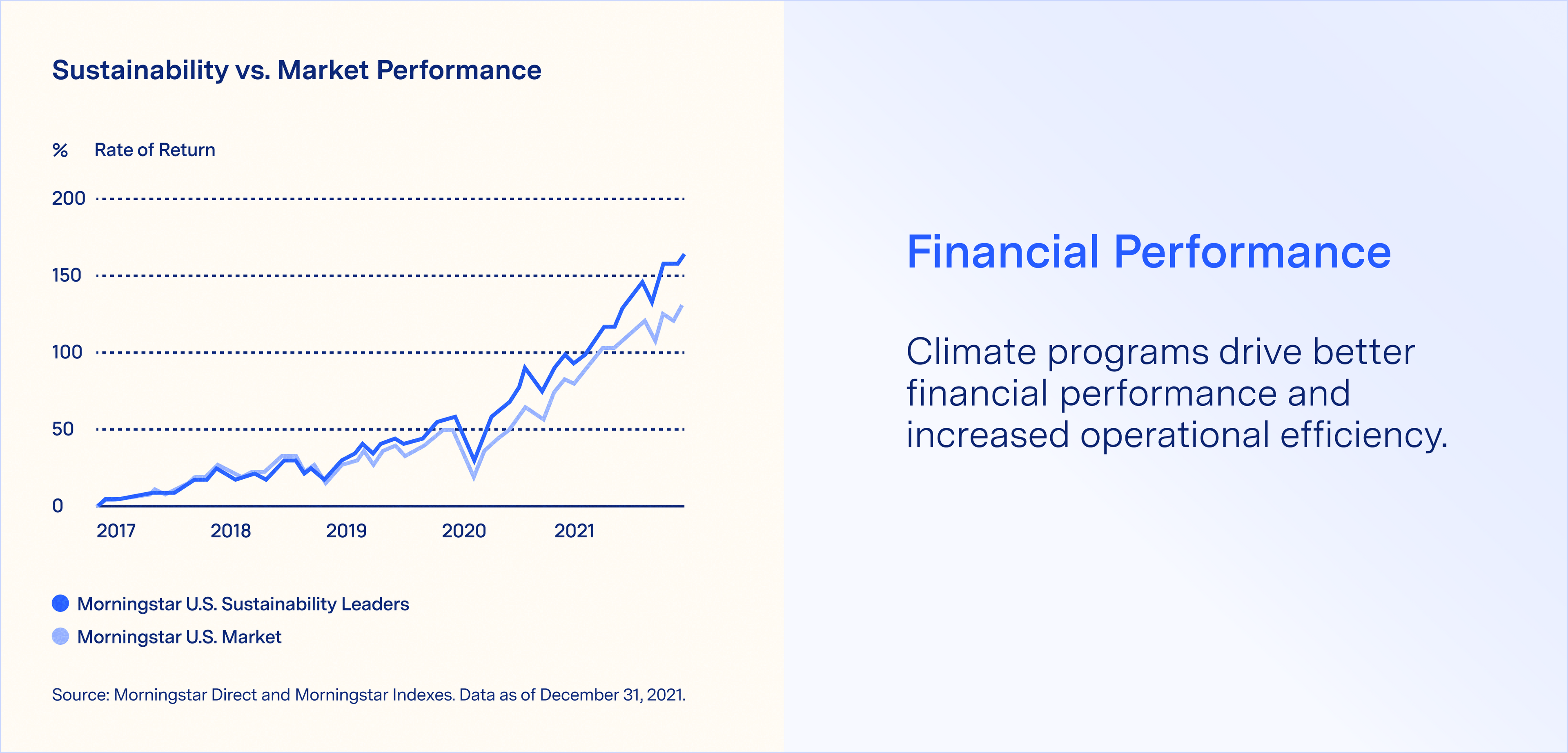

As a result, investors are funneling capital to the companies that will thrive in the transition to a zero-carbon economy. For example, 450 financial institutions have joined the Glasgow Financial Alliance for Net Zero (GFANZ), representing 40% of the world’s capital—indicating their commitment to fund and support companies with net-zero targets. And for companies that have invested in climate programs—increasingly a linchpin of larger environmental, social, and governance (ESG) initiatives—the payoffs are clear:

- In 2021, ESG leaders saw 8% higher returns than the broader U.S. market (Morningstar), while in 2020 ESG leaders beat laggards by 23.4% (Fidelity)

- Additionally, a survey of C-suite executives and investors revealed willingness to pay a median 10% premium to acquire a company with a positive record on ESG with 25% of respondents saying they would pay 20%+ (McKinsey)

- Companies with high ESG scores receive discounts on cost of capital, 10% on average vs. those with low ESG scores, as the risks that affect your business are reduced (MSCI, McKinsey, and Said Business School at Oxford).

2. Gain a competitive advantage amongst business partners and consumers

With investors, businesses, and consumers increasingly paying attention to, and making decisions based on climate considerations, corporate climate programs have begun offering a new axis on which to differentiate. Strong sustainability programs, whether driven by ambitious commitments, emissions reduction targets, or flagship sustainability initiatives, enable companies to differentiate in competitive markets.

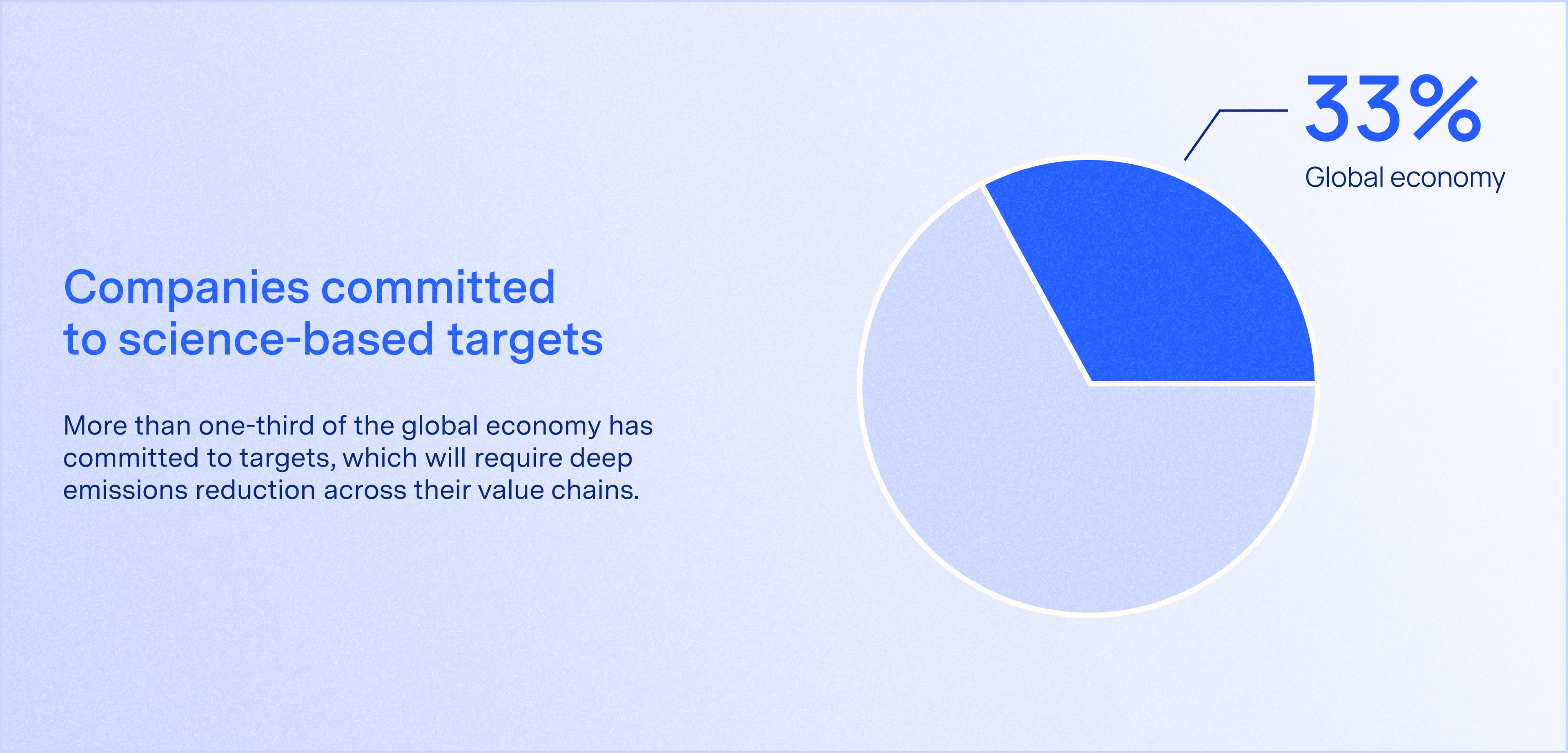

Business partners

With more than one-third of the global economy committed to science-based targets—including global leaders like Apple, Amazon, Walmart, Visa, and Volvo (SBTI)—entire supply chains and vendor ecosystems will be expected to follow suit. Winning the next RFP will require increasingly meaningful climate action from suppliers whose direct emissions make up these companies’ Scope 3 emissions.

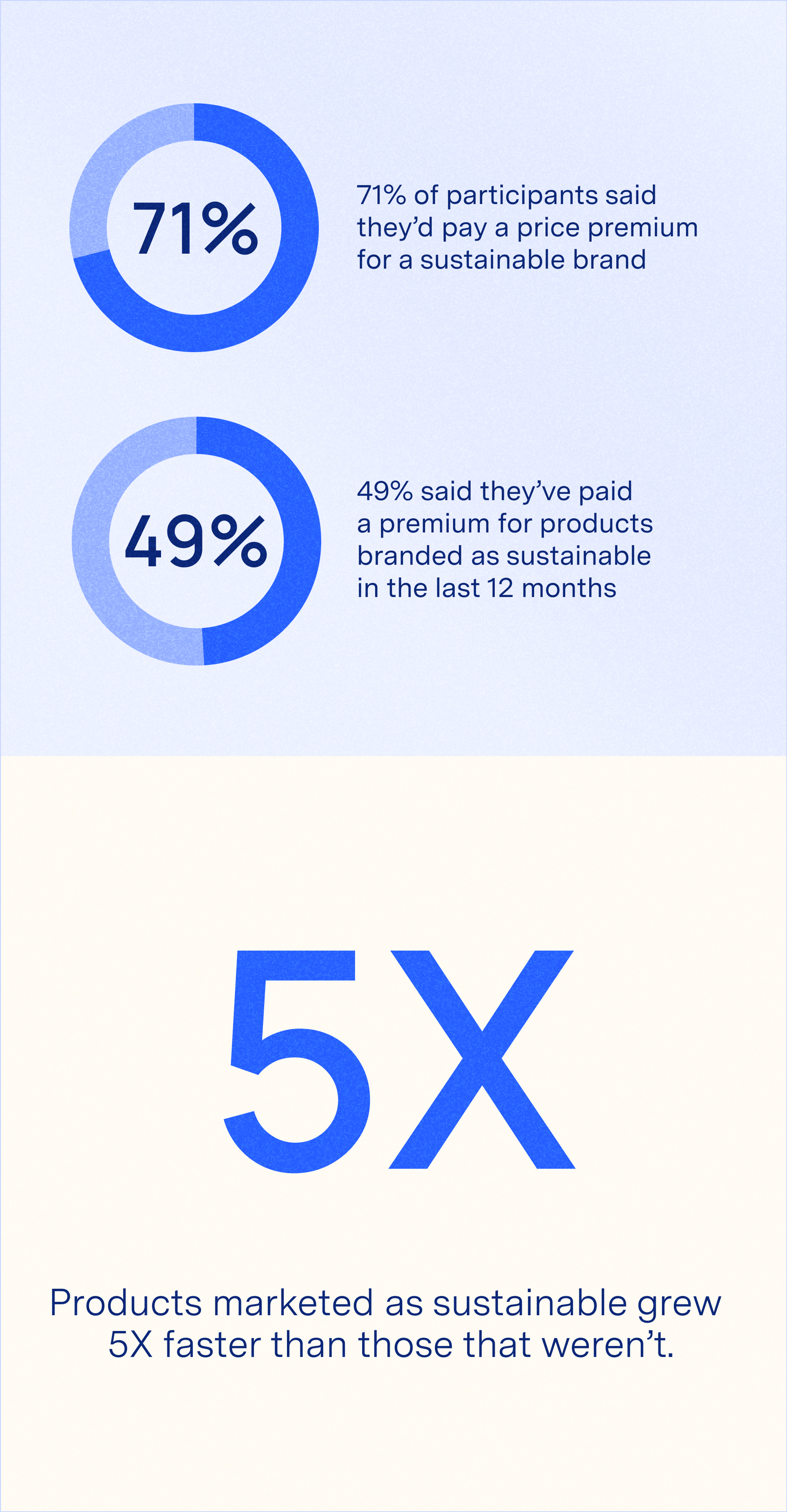

Consumers

In a recent consumer survey, 71% of participants said they’d pay a price premium for a sustainable brand, and 49% said they’ve paid a premium for products branded as sustainable in the last 12 months (IBM and the National Retail Federation). Moreover, between 2013–2019, products marketed as sustainable grew 5X faster than those that weren’t (HBS).

Consumers are voicing their preferences clearly: sustainability is an important factor in purchasing decisions, and is only growing in importance.

3. Cut operational costs and mitigate risk

Beyond investment outcomes, measuring and reducing carbon emissions can improve operational efficiency by helping companies identify areas to trim waste or rethink legacy processes. In our experience, there are a host of operational initiatives that drive emissions reductions and can generate positive ROI, many of them are validated by other industry experts like McKinsey:

- Lower travel and expense costs due to reduced business travel

- Lower power costs due to increased energy efficiency in buildings and industrial processes

- Optimized supply chain routing and logistics

- Improved product composition and packaging

- Reduced inventory waste

Studies by the NYU Stern School of Business and Harvard Business School also found that, in addition to direct cost savings, sustainability initiatives appear to drive better overall financial performance due to mediating factors such as improved risk management and greater innovation. For instance, if you’re opening a new facility, weather patterns and susceptibility to natural disasters may play a greater role in deciding where to locate.

4. Attract and retain talent

Today’s workers are paying closer attention to the purpose and values of their employer.

As a result, companies with sustainability programs have 40% higher employee retention (Deloitte), and 55% better employee morale (HBR). And in a recent survey, three-quarters of millennials—a group that surpassed Boomers and Gen Xers to become the largest generation in the U.S. workforce in 2016 (Pew Research)—said they would take a pay cut to work at an environmentally responsible company (Fast Company).

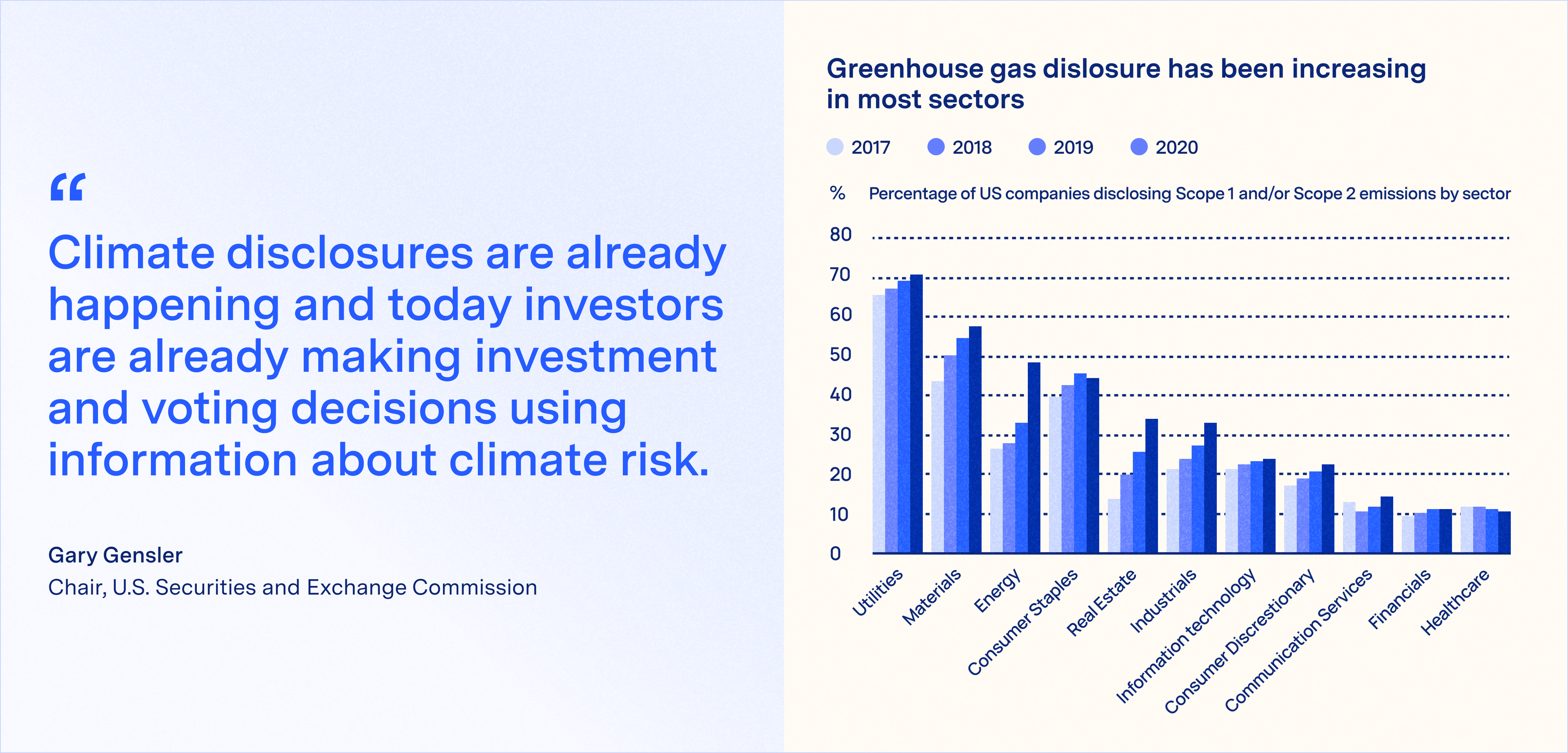

5. Meet mounting social and regulatory pressure

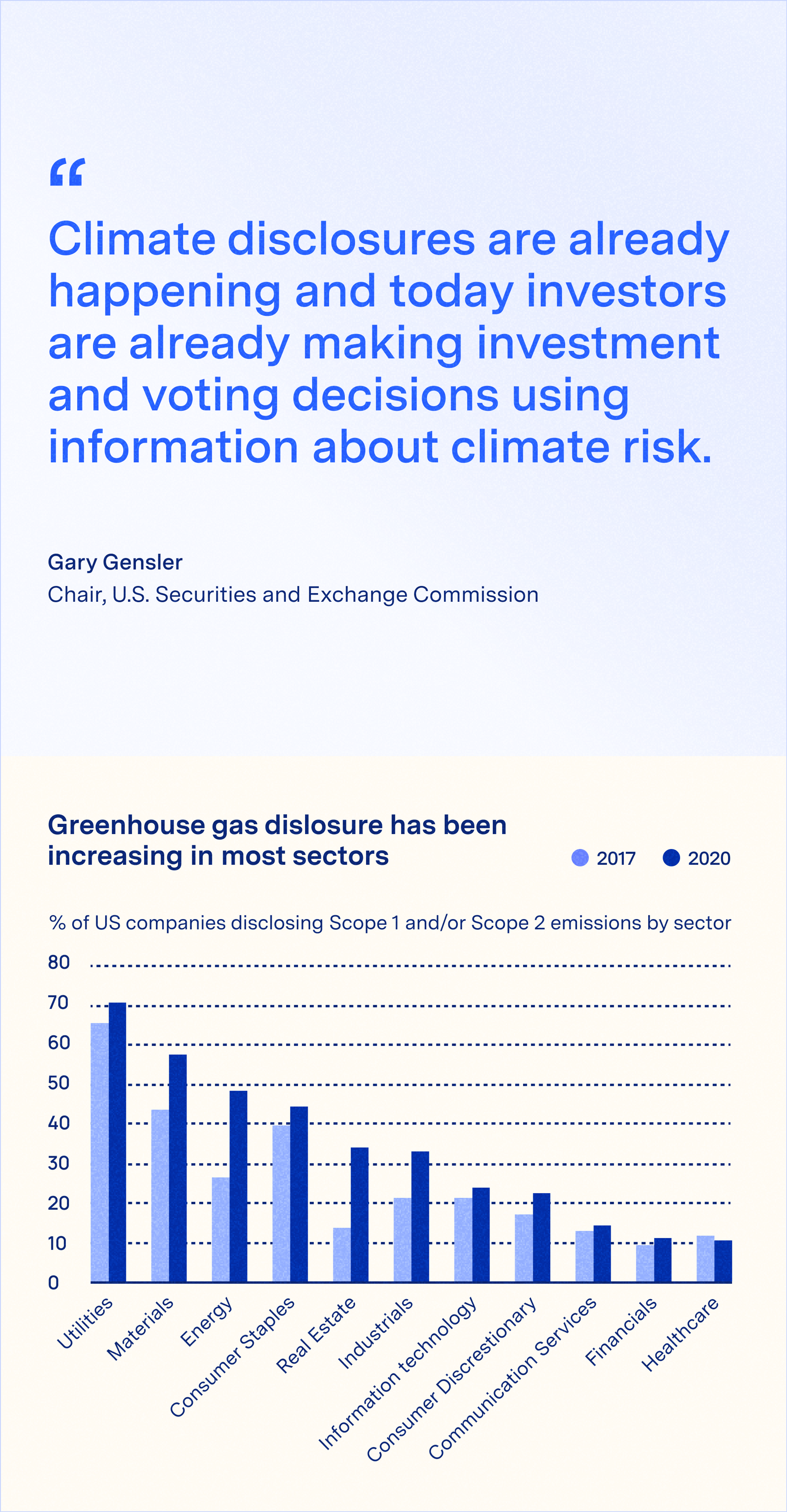

Regulators across the globe are increasingly mandating climate disclosure, and companies with established climate programs will be best-prepared to meet these demands. Already, Brazil, the European Union, Hong Kong, Japan, New Zealand, Singapore, Switzerland, and the United Kingdom have announced requirements for climate disclosure, and the U.S. and Canada have similar proposals under consideration. Developing a climate program now will help companies stay ahead of regulation, avoiding disruption and lost opportunity cost from last-minute focus shifting.

Beyond the internal benefits, high-impact climate programs can also alleviate external pressure from other stakeholders. According to Neilsen, 65% of consumers in North America & Europe expect companies to care about the environment (Neilsen), with 51% of survey of respondents stating environmental sustainability is more important to them today than it was 12 months ago (IBM). Companies like Microsoft, Meta, Salesforce, Apple and others are increasingly requiring their vendors not only to report climate data, but to agree to a plan to reduce their emissions by a target year.

How to build a climate program that captures these advantages

Building a high-impact climate program now gives you immediate financial and competitive advantages, and sets you up to tackle regulatory standards with ease as they arrive.

- Accurately measure your emissions. This means measuring across your entire value chain, from the heating and electricity in your buildings to your capital goods and IT purchases. Precise measurement is key, so working with data analytics and the most up-to-date methodology will ensure the most accurate and audit-ready measurements.

- Report your emissions. Whether reporting is required or voluntary, sharing your company’s climate ambitions and progress with stakeholders ensures the business advantages laid out above are captured. Furthermore, it's critical to stay up to date on current climate disclosure regulations (e.g., EU and UK), and proposals (e.g., SEC proposal on climate disclosure in the U.S.) to avoid penalties or blowback from key stakeholders.

- Act on your insights. This can take many forms, such as setting a climate target, switching to clean power, reducing emissions within your operations and supply chains, or balancing out emissions by investing in high-quality carbon offsets and removals. Regardless, taking action is critical to reducing your emissions over time and delivering on the purpose of your climate program.

To get started today, request a demo.