In 2028, approximately 600 UK-listed companies will be required to report their FY 2027 climate data in alignment with the UK Sustainability Reporting Standards (UK SRS). This post includes everything you need to know about the status of the current standards and how to prepare for reporting.

What’s happening?

- On February 25, 2026, the UK government formally adopted the UK SRS, disclosure standards aligned with ISSB. These standards will eventually replace all existing TCFD-aligned disclosure requirements.

- On January 30, 2026, the Financial Conduct Authority (the primary regulator for listed companies in) launched a consultation for mandatory UK SRS disclosure for listed companies.

- The UK government is expected to launch a consultation for mandatory UK SRS disclosure for unlisted companies in H1 2026.

What are the UK SRS?

The UK SRS are ISSB-aligned sustainability disclosure requirements that cover what a company must include in its sustainability report. There are two components:

- UK SRS S1 (general sustainability requirements)

- UK SRS S2 (climate-specific requirements)

The UK SRS themselves do not cover which companies are in-scope or when companies have to start disclosing. These issues are addressed separately by the FCA for listed companies, and by legislative acts by the UK Government for unlisted companies.

Who is currently in scope in the FCA’s draft proposal?

There are 2 categories of companies in the FCA’s proposal with different requirements:

- Full UK SRS compliance required. UK-incorporated companies listed on the London Stock Exchange must fully comply with the UK SRS (an estimated 515 companies).

- Transparency-only requirements. Non-UK companies with secondary listings or depositary receipts on LSE must disclose which climate/sustainability standards they follow in their home jurisdiction and where those disclosures are located, or state if none apply (an estimated 85 companies).

Closed-ended investment funds, open-ended investment companies, shell companies, debt securities, securitized derivatives, and warrants/options are not in scope.

When do in-scope companies need to report?

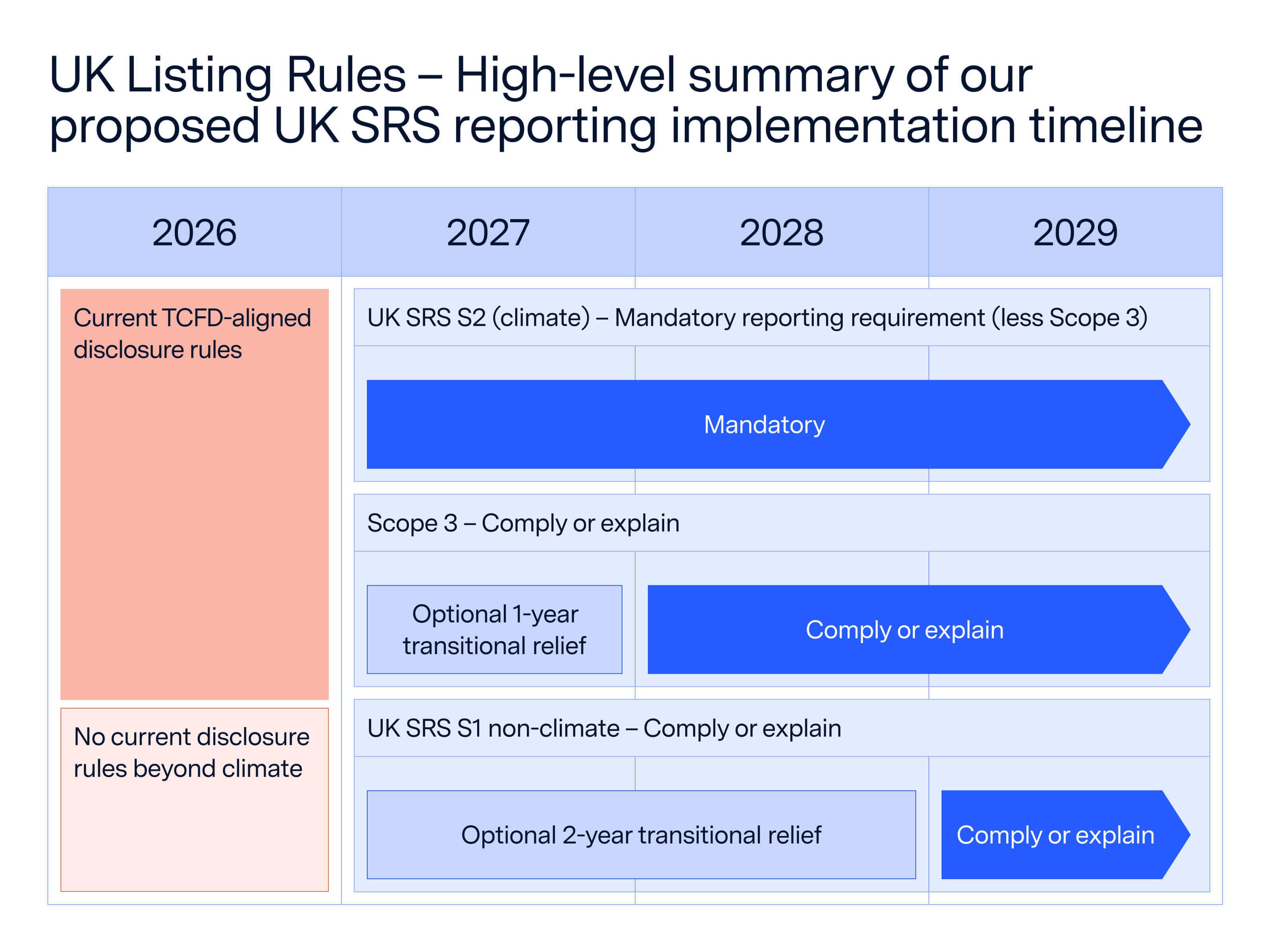

The first UK SRS-aligned sustainability reports are due in 2028 on FY2027 data.

Based on the FCA’s proposal, what do full-compliance companies need to report?

The FCA has proposed the following sections for reporting:

- Mandatory basis:

- UK SRS S2 climate disclosures including Scope 1 and 2 emissions

- Relevant portions of UK SRS S1 that support climate reporting. These primarily cover explaining and defining the conceptual foundations, judgements, uncertainties and errors used in the climate disclosure.

- "Comply or explain" basis (either disclose, or state why you haven’t):

- Scope 3 emissions

- UK SRS S1 non-climate sustainability disclosures

- Transition plan disclosure (must state whether they have one and where it's published, or why not)

- Third-party assurance disclosure (must state whether obtained and provide details)

- Note: the UK government is expected to adopt transition reliefs for Scope 3 and non-climate disclosures. Likely, companies will get 1-2 years before they have to comply or explain.

Are unlisted companies in-scope for mandatory disclosure?

Not currently. However, the UK government is expected to launch a consultation on what ‘economically significant’ entities should be in-scope for mandatory UK SRS. The definition is expected to be similar to the existing reporting requirements for Climate-related Financial Disclosures (revenue and/or headcount thresholds).

When will the FCA proposal be finalized?

The FCA has stated that it intends to publish the final Listing Rules (i.e. requirements for listed companies) for UK SRS usage in autumn 2026.

Is assurance of UK SRS reports required?

Not currently, but the UK government is conducting a consultation on creating an oversight regime for sustainability assurance. This is viewed as a precursor to eventually mandating some form of assurance over sustainability disclosures.

If my company’s financial year starts before 1 January 2027 and we are already disclosing using the TCFD-aligned rules, what should I do?

Companies with financial years starting before the first application date of the UK SRS have two options:

- Continue using TCFD-aligned rules and guidance OR

- Voluntarily adopt the new UK SRS requirements early (note that transitional reliefs won't be available if this option is selected)

How are the UK SRS different from the existing TCFD rules?

The UK SRS S1 is not covered by the existing TCFD rules, and is a new reporting requirement. The structure and requirements of the UK SRS S2 are broadly aligned with TCFD rules, with a few notable exceptions:

- Strategy. UK SRS S2 does not specify particular scenarios for companies to use in their scenario-analyses. By contrast, the TCFD rules require considering a 2 degree or lower scenario.

- Risk Management. UK SRS S2 requires companies to consider climate-related opportunities as well as risks. By contrast, the TCFD rules require companies to only consider climate-related risks.

- Metrics and targets. UK SRS S2 requires the usage of the latest IPCC assessment reports where possible. TCFD does not mandate any such specific methodology.

Do the UK SRS offer any reliefs or phase-in provisions?

The UK government provides the following reliefs in its adoption of the UK SRS.

- Climate vs. non-climate metrics (transition relief). A 2-year gap is permitted between disclosing climate and non-climate metrics.

- Financed emissions disclosure flexibility. UK SRS allows financial firms flexibility in the industry classification system used in disaggregating their financed emissions, rather than mandating the use of the Global Industrial Classification System (GICS).

- Industry-specific disclosures. Industry-specific disclosure requirements (such as the SASB metrics) are optional, while ISSB considers them mandatory.

- Transition relief start date. Transition reliefs for the UK SRS apply from the date of mandatory disclosure so as not to penalize early voluntary adopters of the UK SRS.