As part of its push towards greater climate action, the UK government has mandated that large UK organisations must disclose their electricity usage and greenhouse gas emissions alongside their annual financial reports. This requirement is now live for 11,900 firms across the UK, most of which are reporting their emissions for the first time.

What is SECR?

This new programme—Streamlined Energy and Carbon Reporting (SECR)—replaces the now-defunct Carbon Reduction Commitment (CRC) Energy Efficiency Scheme. It continues the same mission of encouraging more efficient operations, while expanding the reporting scope to ensure companies are taking real action on carbon.

We’re sharing here the basics of what you need to know: whom the SECR programme applies to, what it asks for, and how and where to file the resulting report.

Which businesses have to comply with SECR?

The new obligations cover all UK quoted companies. They also cover private companies and nonprofits that have two or more of:

- 250+ employees

- £36M+ annual turnover

- £18M+ balance sheet

What are the requirements of SECR carbon reporting?

SECR requires companies to disclose three metrics and two pieces of commentary:

- Total energy consumption - Most organisations can calculate this by adding their gas and electricity bills. Unquoted organisations and LLPs must also include fuel purchased for all business travel beginning and ending in the UK.

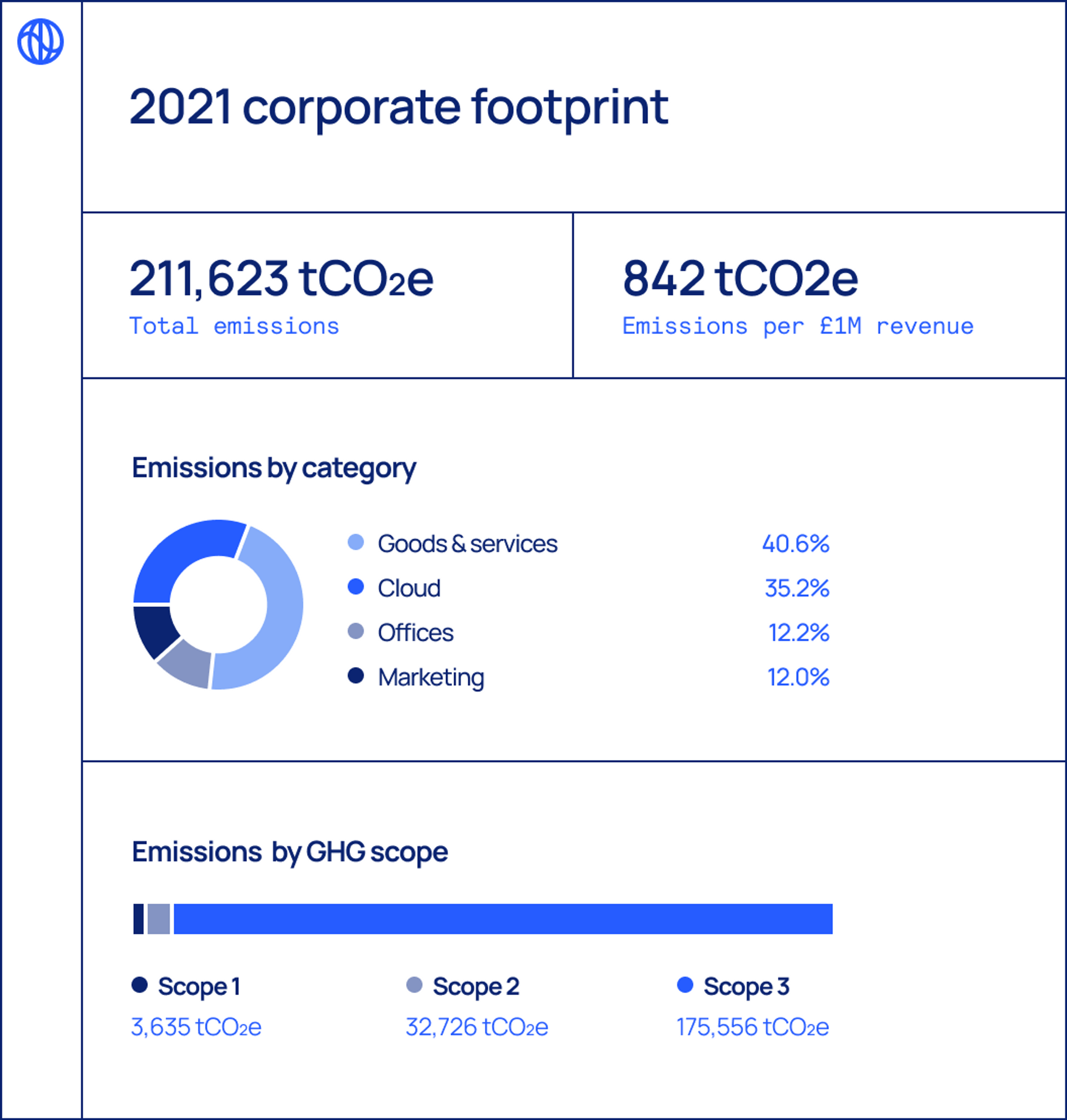

- Scope 1 and 2 greenhouse gas (GHG) emissions - Using the Greenhouse Gas Protocol’s framework, Scope 1 covers direct emissions from company-controlled infrastructure, whilst Scope 2 covers emissions associated with the purchase of electricity, steam, heat, and cooling. These are expressed in carbon dioxide equivalents (CO2e) to normalise emissions of non-carbon greenhouse gases.

- An emissions intensity ratio - To put your emissions in context, they must also be expressed relative to some business activity—eg. tonnes of CO2e per dollar of turnover. The chosen ratio (see options in Annex F) must be considered “most appropriate” for your core business activity.

- Brief commentary on actions taken - You must list all actions taken in the past year to improve energy efficiency across your infrastructure and operations.

- Notes on methodology - You must make it clear how you calculated your consumption, emissions, and intensity ratio.

Metrics 1 and 2 must also include annual totals for the prior reporting year for reference. Companies must disclose metrics 1-3 for their entire global footprints, broken out between UK and non-UK totals.

How do I report?

Under the SECR guidelines, the UK government provides a suggested template on pg 51 for quoted and unquoted organisations to follow.Filing requirements are based on organisation type:

- For quoted companies, the required information must be included in their annual Director’s Report to Companies House. Though if the details are considered of strategic importance, this filing can be included in their Strategic Report instead.

- LLPs must prepare a standalone “Energy and Carbon Report” covering this information, then have it approved by all members and signed by a designated member before submitting it to Companies House.

- For charitable companies, this information should be included in their Directors’ and Trustees’ Annual Report.

How can Watershed help with the SECR report?

Watershed helps UK companies like Monzo, Wise, and Kainos measure and manage their emissions—including generating the quantitative part of their SECR report with just the click of a button, using methodologies already verified by the most exacting auditors.

If we can help with measurement or any other compliance reporting, please get in touch.