Global regulators are converging on shared goals for climate disclosure. Publicly reporting greenhouse gas emissions and climate risks is now the baseline, and the next step for many companies will be to develop and publicly disclose a transition plan to explain how they will achieve their decarbonisation targets. Transition plans are required in current and upcoming climate regulation in the EU, UK, and US.

In the UK, the government created a transition plan taskforce (TPT) to develop their own framework for transition plans. The framework launched in early October 2023, and is broadly expected to be adopted into UK climate regulations as part of the upcoming transition to ISSB in the summer of 2024. This framework was formally announced on Monday, October 9, at the London Stock Exchange.

In the EU, transition plans are included under the CSRD (the Corporate Sustainability Reporting Directive) and the proposed CSDDD (the Corporate Sustainability Due Diligence Directive). The US SEC rules additionally include their own provision for transition plans, and some voluntary frameworks, such as the ISSB, also include transition plan requirements.

Transition plans, and the specific criteria under both EU and UK regulatory frameworks, will be a new concept for many organisations that previously only disclosed high-level decarbonisation targets or climate commitments. Organisations in scope will need to begin building their transition plans now in order to be prepared for upcoming regulations.

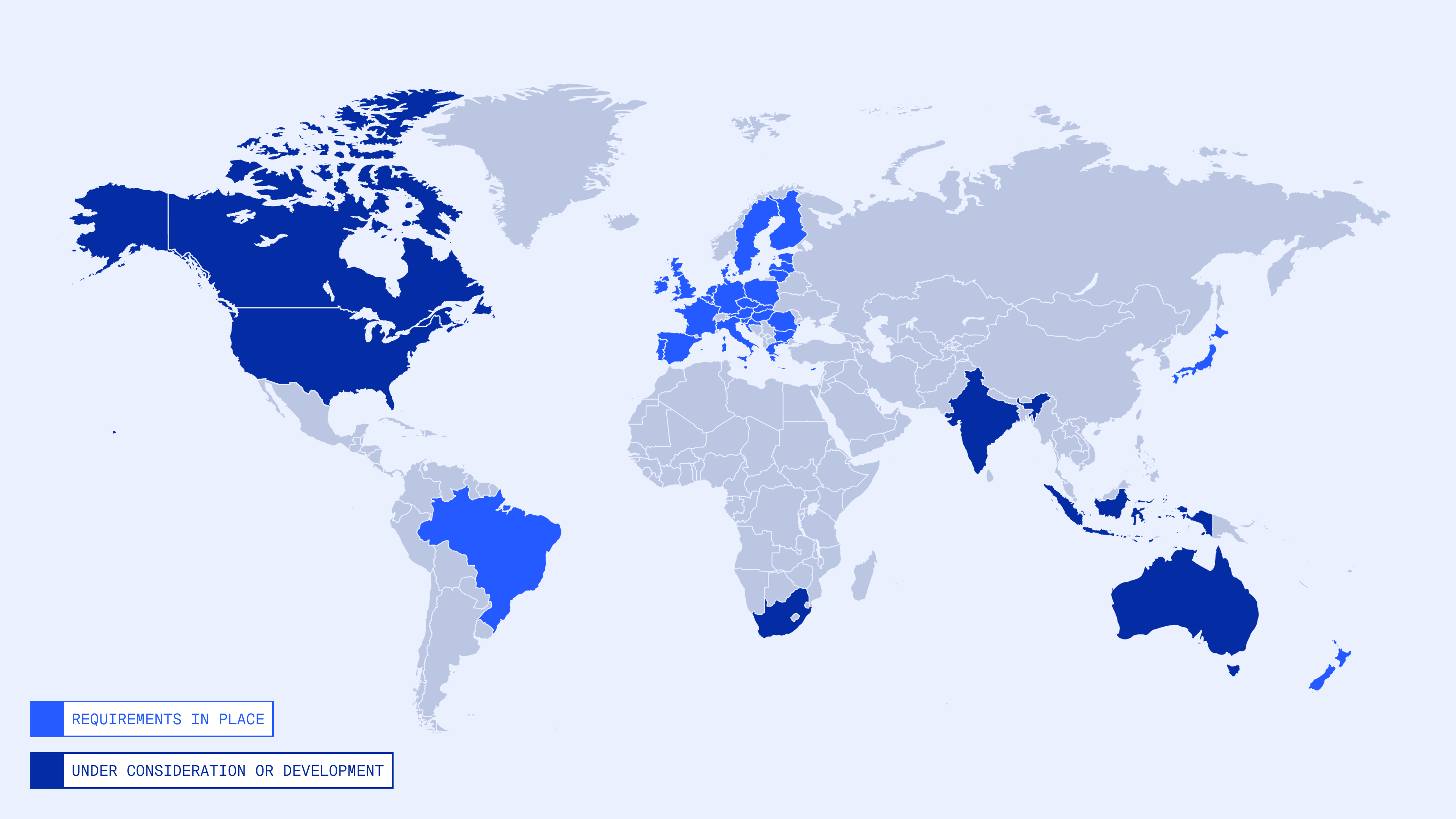

Requirements in place | Under consideration or development | |||

|---|---|---|---|---|

UK | European Union | Brazil | USA | Australia |

The UK Transition Plan Taskforce framework requiring transition plans has formally been adopted for listed firms. | New requirements to develop and/or disclose climate mitigation transition plans are being proposed under the Corporate Sustainability Reporting Directive (CSRD). | Current resolutions mandate that financial institutions should establish a Social, Environement and Climate Responsibility Policy, which must includ actions to transition to a low-carbon economy. | Draft US SEC rule proposes public firms include their transition plan in disclosures where voluntarily adopted as part of the firm’s climate-related risk management strategy. | The Treasury recently consulted on climate-related disclosures for large entities, including a proposal for transition plan disclosure requirements. |

What is a climate transition plan?

A climate transition plan asks companies to define how they will achieve their decarbonisation goals and prepare for the transition to a lower-carbon economy. Defining this plan will be a cross functional effort. Organisations will need to work across teams to embed their climate transition plan into their business strategy, as they would to implement any other sweeping shifts to the business model.

While the specific details of transition plans vary based on the regulation, there are a few key elements they all include:

- Quantified decarbonisation levers.

- Specific initiatives to achieve those levers.

- Clear governance and executive sign off of the plans.

- The potential financial effects of the transition plan.

- The impact of climate-related risk to the plan and strategy to mitigate this risk moving forward.

The UK Transition Plan Taskforce Framework

The transition plan taskforce has developed their framework to serve as the best-in-class standard for building and disclosing transition plans. While the framework is aligned with TCFD and ISSB, the Transition Plan Taskforce framework goes a step further in creating transparency in corporate climate disclosures by challenging companies to clearly define how they plan to achieve their decarbonisation targets, manage climate-related risks, and contribute to the economy-wide climate transition.

Companies will ultimately be required to disclose this framework as a standalone report. In the interim before this requirement takes effect, the process of transition planning is a useful tool for companies developing their climate objectives.

This process should not be viewed as a once and done exercise; the aim is to have a process and framework in place that companies can revisit and adjust as their plans and business evolve.

What are the transition plan requirements of the UK TPT framework?

The UK TPT framework closely aligns with existing global reporting frameworks, and in particular with TCFD and ISSB. In addition to this, as part of the development of this framework, the taskforce worked to ensure the interoperability of these requirements with existing regulations in the EU, as well as the ISSB standards released by the IFRS.

The framework has 3 key pillars

Ambition | Action | Accountability | ||

|---|---|---|---|---|

Foundation | Implementation strategy | Engagement strategy | Metrics & targets | Governance |

Clear strategic ambition, business model and value chain implications, key assumptions and external factors. | Implications for business planning, operations, including financial cost assessment | Strategy for engaging with the value chain, and, if relevant, government or industry groups | Key metrics and targets across emission tracking, governance, and carbon credit usage | Board oversight and reporting, culture, incentive and renumeration, skills competencies and training |

How to prepare for the TPT’s framework

Whether you’re just beginning your transition planning process, or already have a preliminary draft to build off, it’s important to recognise that you’re not going to have all the answers immediately—and that’s okay. Transition planning is a multi-year process as you improve data, build better governance structures, and design implementation strategies—all the while being prepared to iterate on your plan as it develops.

Above all else, the foundation of a transition plan is your company’s overarching decarbonisation ambition.

You can get started building this foundation by:

- Defining emissions hotspots and identifying key reduction initiatives.

- Building out actions and policies to support the implementation strategy.

- Identifying key stakeholders and executive engagement who can support a strong governance structure.

Start sooner rather than later in building your transition plan to meet the UK Transition Plan Taskforce Disclosure Framework requirements. Publicly disclosing any business strategy—let alone a climate-related strategy—can take time to align on internally.

Utilise the TPT’s framework and resources not only to prepare for regulations, but also to help develop the plan itself. This framework is a valuable tool in giving companies a blueprint to begin developing their transition plans, and cut through the uncertainty in building a comprehensive climate strategy today.

Which companies will be covered by the TPT framework?

Currently, in the UK, listed issuers, asset managers and asset owners in scope of the UK Financial Conduct Authority’s (FCA) climate-related disclosure rules are already expected to describe their plans for transitioning to a low-carbon economy.

The FCA intends to strengthen its expectations for transition plan disclosures, drawing on the TPT Disclosure Framework. As a first step, on 10 August 2023, the FCA signalled its intention to consult on transition plan disclosures by listed companies in line with the TPT Disclosure Framework, alongside its consultation on implementing UK-endorsed ISSB Standards.

These new requirements are anticipated to come into force for accounting periods from January 2025. The first reporting would begin from 2026. The UK government will also consult on requirements for the UK’s largest public and private companies to disclose transition plans if they have them.

What does the CSRD require as part of its transition plan?

The EU’s Corporate Sustainability Reporting Directive (CSRD) includes a wide range of sustainability reporting requirements, and one of these requirements is a transition plan.

As part of the CSRD transition plan, companies will need to disclose a similar set of requirements as outlined above. CSRD goes one step further, however, and prescribes that companies disclose targets—and a plan to achieve them— that are aligned with 1.5C, the warming trajectory agreed under the Paris Agreement.

The most common way to satisfy this criteria is by setting Science-Based Targets and developing a detailed strategy to achieve the required annual reduction.

CSRD Transition Plan Requirements:

As part of the Climate Change Standard, companies should disclose:

- A GHG emissions plan, benchmarked against a 1.5C pathway (e.g. Science-Based Targets).

- Clear mitigation actions and decarbonisation levers to achieve the GHG emissions plan.

- Explanation and quantification of the financial implementation of the plan.

- An assessment of locked-in GHG emissions, and how they drive transition risks as well as jeopardize the achievement of emissions reductions targets.

- An explanation of how the transition plan is embedded in the business strategy & financial planning.

- Demonstrated approval of the plan by administrative management and supervisory bodies.

- Reported progress in implementing the transition plan and against targets.

If relevant, alignment with the EU Taxonomy, a disclosure of significant CapEx amounts invested during the reporting period related to coal, oil and gas-related economic activities, and a disclosure on whether or not the undertaking is excluded from the EU Paris-aligned Benchmarks.

Which companies will need to provide transition plans under the CSRD and the CSDDD?

As part of the Climate Change standard, CSRD requires all companies to disclose transition plans if they have one, or if not, explain why they don't, and when they plan to build one.

In addition to the CSRD, the proposed Corporate Sustainability Due Diligence Directive (CSDDD) will enforce mandatory disclosure of transition plans for a subset of companies already captured by CSRD.

To learn more about the CSRD and determine if this is relevant for you, try our sustainability assessment.