As we enter the fifth year of this crucial decade in the climate fight, we’re also entering a new regulatory era. Most industrialized countries have now passed at least draft rules on how companies and financial firms need to measure and disclose their carbon emissions.

Consolidation between the reporting rules in different regions is ongoing, but far from finalized. This has made it difficult for many global organizations to understand exactly what to disclose—and where, and when.

“Most industrialized countries have now passed at least draft rules on how companies and financial firms need to measure and disclose their carbon emissions.”

To take the pain out of disclosure, we’ve put together guides for all the most common voluntary and mandatory reporting programs. In this post we cover each of these programs at a glance to help you easily determine which apply to you.

We’ve also included programs that aren’t expected to go live until 2024 or later, but that are expected to ask for 2023 data—which all companies should begin collecting ASAP.

The US

The SEC’s climate disclosure proposal

While the SEC hasn’t released their final rule yet (expected April 2023), their draft proposal called for full transparency on both carbon emissions and climate risks. Companies will need to disclose comprehensive data—along with their climate action plans and their performance against those plans—starting as early as 2024, on 2023 data.

While private companies are exempt, companies on a path to going public will likely be asked by investors to begin reporting this data at least internally in 2023.

The SEC’s fund-labeling proposals

The first proposal covers fund categorization. Its core idea is that the more central that ESG is to the public objectives of a fund, the stronger its disclosures should be. Funds that consider greenhouse gas emissions in their selection criteria will have much more robust reporting requirements—potentially including Scope 3 “financed emissions” from their investments.

The second proposal covers fund naming. Any fund that includes a specific type of investment in its name—like “ESG”—would need to allocate at least 80% of the fund’s value accordingly, and would need to clarify the criteria used to make that determination.

Both proposals went to final comment in August 2022, and are expected to be released in final form in October 2023.

The new climate disclosure proposal for US federal contractors

Significant contractors will need to begin disclosing limited emissions each year, while major contractors will need to both publish comprehensive disclosures and file science-based targets—likely beginning in 2024.

The EU

Corporate Sustainability Reporting Directive (CSRD)

The CSRD sets a new standard for depth and rigor across multiple Environmental, Social, and Governance topics. An overhaul of the Non-Financial Reporting Directive (NFRD) regime, the CSRD obligates more than 50,000 companies—both based in Europe and based elsewhere with business in Europe—to disclose detailed information on ESG impacts, policies, processes, and risks.

While first filing dates won’t be until 2025 (on 2024 data), we encourage new filers to begin building out their reporting infrastructure, and get in at least one full year of voluntary TCFD disclosure prior to CSRD disclosure. Given much of the CSRD’s climate change standard is based on TCFD, this will help identify data gaps and establish good processes.

New SFDR rules for financial firms and advisors

New SFDR rules have been released that affect June 2023 filings, including a new requirement to include detailed emissions data from all portfolio companies. Our guide breaks down all the new obligations, and includes disclosure templates.

The UK

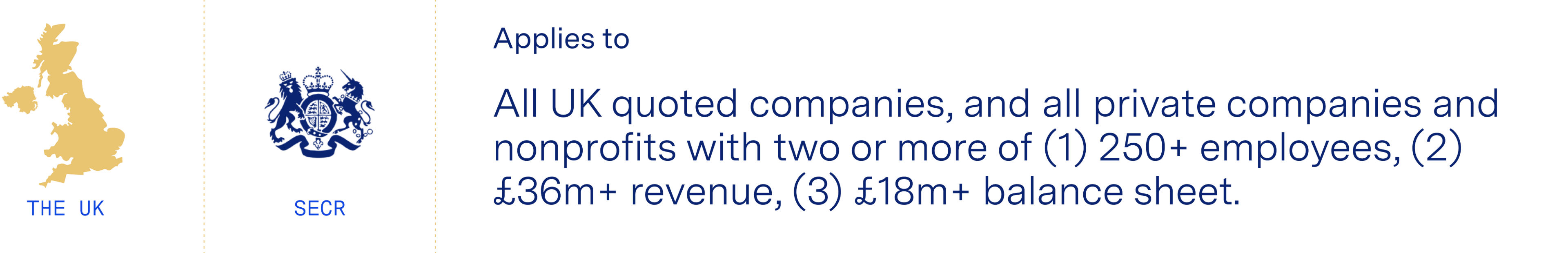

SECR carbon reporting

SECR mandates disclosure of three energy and emissions metrics along with commentary on actions taken and methodology used. These disclosures must be included within—or in some cases alongside—2022 financial results reported in 2023.

SDR disclosures for UK asset managers

A set of five initial proposals for the UK’s new Sustainable Disclosure Requirements (SDR) regime, that taken together will soon require all UK financial products marketed as sustainable to be backed by real action—where those actions must be summarized via both new labels and a suite of detailed, easily-parsed, easily-located disclosures. The core idea here is creating the ESG equivalent of nutrition labels for financial products, giving potential buyers real context on whether and how the underlying investments actually promote greater sustainability.

Crucially, this means that the firms creating these products will soon be approaching the companies that make up their portfolios to pass on their climate and sustainability data.

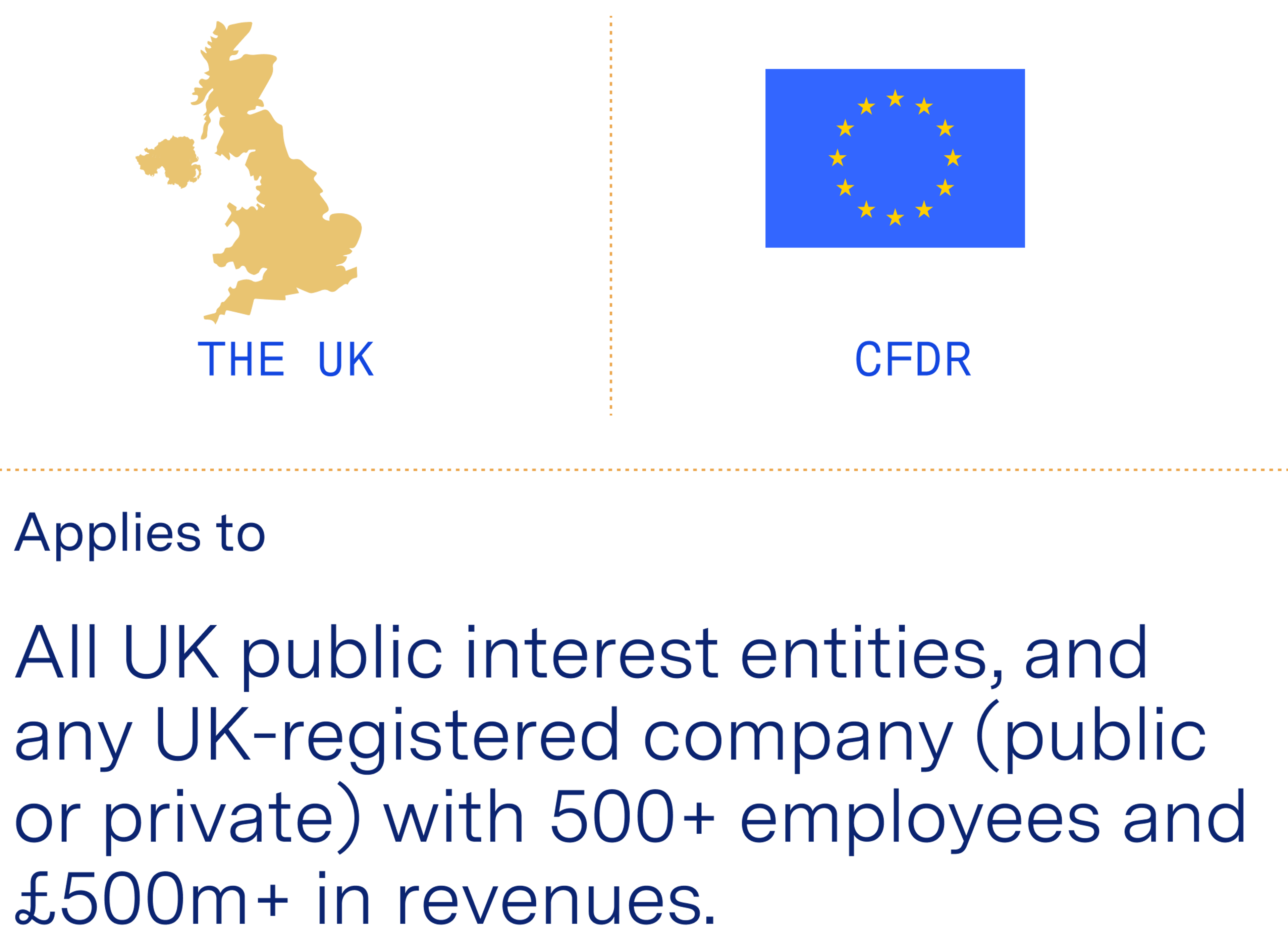

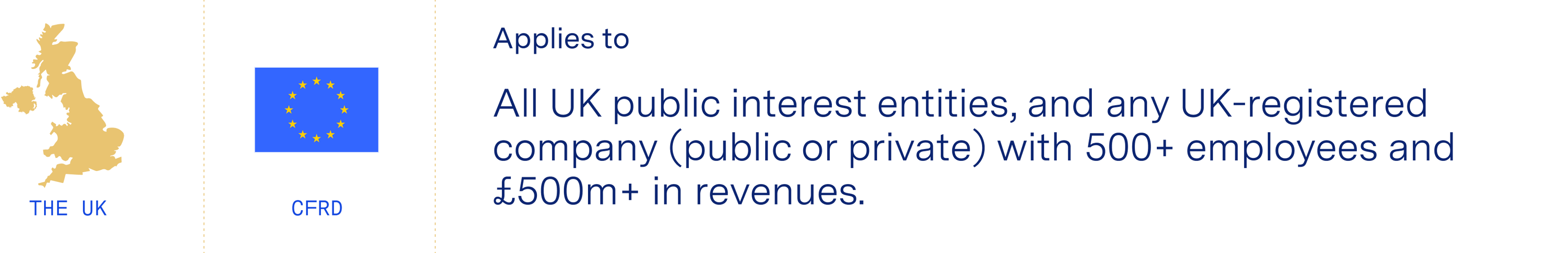

Climate Related Financial Disclosures (aka BEIS)

Formerly referred to as BEIS (after the now-restructured Department of Business, Energy, and Industrial Strategy), this reporting regime requires covered organizations to include eight sustainability-related disclosures in their annual filings each year—starting in 2023. This program is based heavily on TCFD.

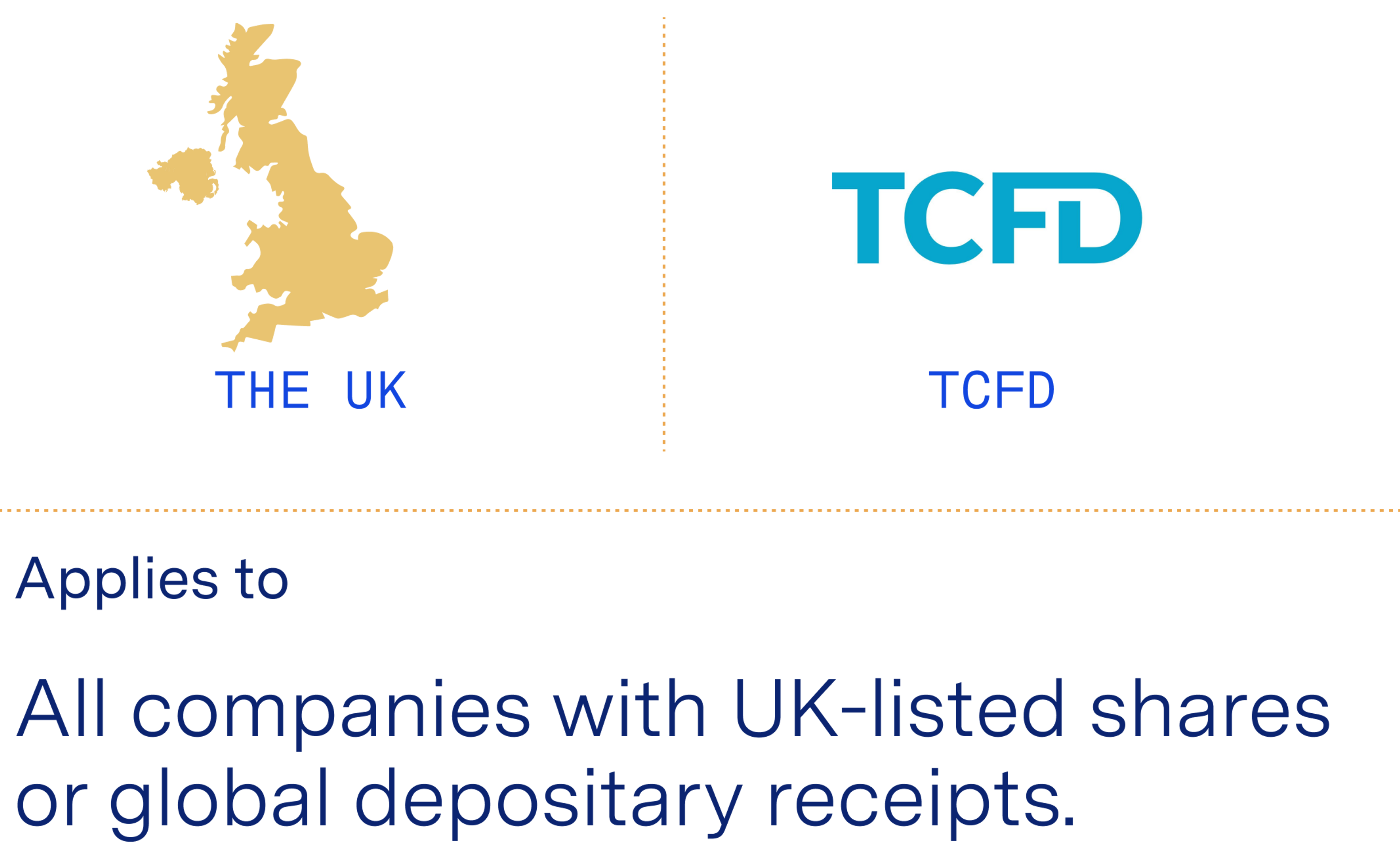

FCA’s TCFD requirement for listed firms

The Financial Conduct Authority (FCA) requires filers to include a standard TCFD report each year, inclusive of Scope 3 emissions from supply chains. While this rule was originally limited to premium listed firms, the program was extended to include standard listed firms for accounting periods beginning on or after January 1st, 2022—ie, for all reports in 2023.

All FCA filers should also note the FCA’s latest guidance on expectations for robust reporting.

DWP’s disclosure rules for pension funds

The Department for Work and Pensions (DWP) requires filers to include a slightly modified TCFD report each year on a free-to-access website within seven months of their year end. The main modification is that filers must include the “financed emissions” of their fund—ie. their proportional share of the emissions from the companies and assets they’ve invested in.

ESOS energy audits in 2023

The Energy Savings Opportunity Scheme (ESOS) is a legacy program inherited from the EU that requires an energy audit every four years. While there were proposals to revamp ESOS ahead of its next deadline (Dec 5th, 2023), it’s now expected to stay as-is for this cycle.

Covered organizations must measure and document their total energy consumption across their buildings, industrial processes, and transportation use—alongside commentary on planned reductions and how their report was reviewed.

Global

ISSB disclosure standards: what companies need to know for 2023

While our main focus is on programs in the US, UK, and EU, operations elsewhere still have reporting obligations to prepare for. In particular, the International Sustainability Standards Board (ISSB) has finalised a new global baseline for sustainability disclosures—which will largely replace TCFD as a meatier alternative that covers more sustainability categories.

ISSB’s final standards will be available June 2023 (for voluntary use 2024 in preparation for 2025 filings), and will be integrated by regulators across the world into their mandatory reporting program—possibly as soon as 2024 filings on 2023 data.

Getting more granular, existing disclosure programs are going to either:

- Direct filers to do an annual ISSB submission instead of a TCFD report (eg. many FCA-mandated programs in the UK, CSRD in the EU)

- Fully merge with ISSB (eg, IRF, SASB, and CDSB; see joint progress update here)

- Align with ISSB so that overlapping disclosures should ask for similar data in a similar way (eg, GRI, CDP, and most mandatory national programs)

While companies already reporting into the above programs should keep doing so for their 2023 filings, those that haven’t begun formal reporting should begin preparing well in advance of any new deadlines. For guidance on how to start, see our guide to voluntary reporting.